Vancouver's most high-profile receivership case, that of the 55-storey tower planned for 1045 Haro Street, has now progressed to the sale stage, according to an official sales brochure obtained by STOREYS.

The 1045 Haro Street property is being listed by Tony Quattrin, Jim Szabo, and Carter Kerzner of CBRE Vancouver without an asking price. As of writing, the listing is not publicly available.

Although there is no asking price, there are a few existing numbers that could potentially serve as points of comparison.

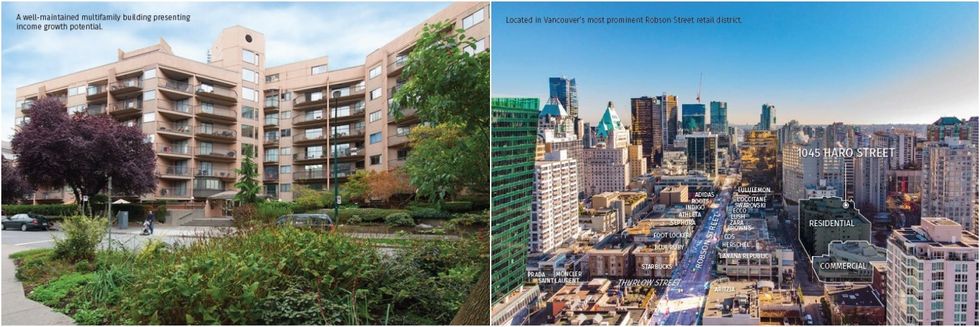

In August 2018, the developers acquired the site for $172,750,000. Now, however, BC Assessment values the property at $98,077,000. The site is currently occupied by a seven-storey rental building with 160 units that were originally constructed in 1980 and a three-storey commercial building. According to CBRE, the property currently carries a net operating income of $1,770,000.

Additionally, after the developers came to the realization that they would not be able to move the project forward, an attempt was made last year to try to sell the property. Then, CBRE was also retained, and one of the offers it received was from Chard Development for $93M.

One final number to consider is the amount of debt, as the primary goal of court-ordered sales processes is to recover the amount owned to creditors. The receivership against the developer was initiated by the Bank of Montreal with a claim of an $82.2M debt, but a later analysis conducted by the court-appointed receiver found that the total debt — to BMO as well as other creditors — may be closer to $169M.

Development Potential

Like other multi-family residential and land transactions, how much the sellers will be able to get is greatly determined by the development potential of the site.

The property is legally owned by Harlow Holdings Ltd. and beneficially owned by Haro-Thurlow Street Project Limited Partnership, which itself is owned by 11044227 BC Ltd. (45%), Forseed Haro Holdings Ltd. (45%), and Terrapoint Developments Ltd. (10%).

For the site, the developers were planning one 55-storey strata condo tower and one 15-storey tower with a total of 450 strata condominiums and 66 rental units, according to the project website, which remains online. Plans also called for 42,000 sq. ft of retail space, a 49-space childcare facility, and a new public plaza.

In July 2022, the City of Vancouver itself said that the plans showed "significant non-compliance" with the City's view cone policies. Since then, however, the City has also undergone a process to review those view cone policies and potentially eliminate some of them in order to free up housing development.

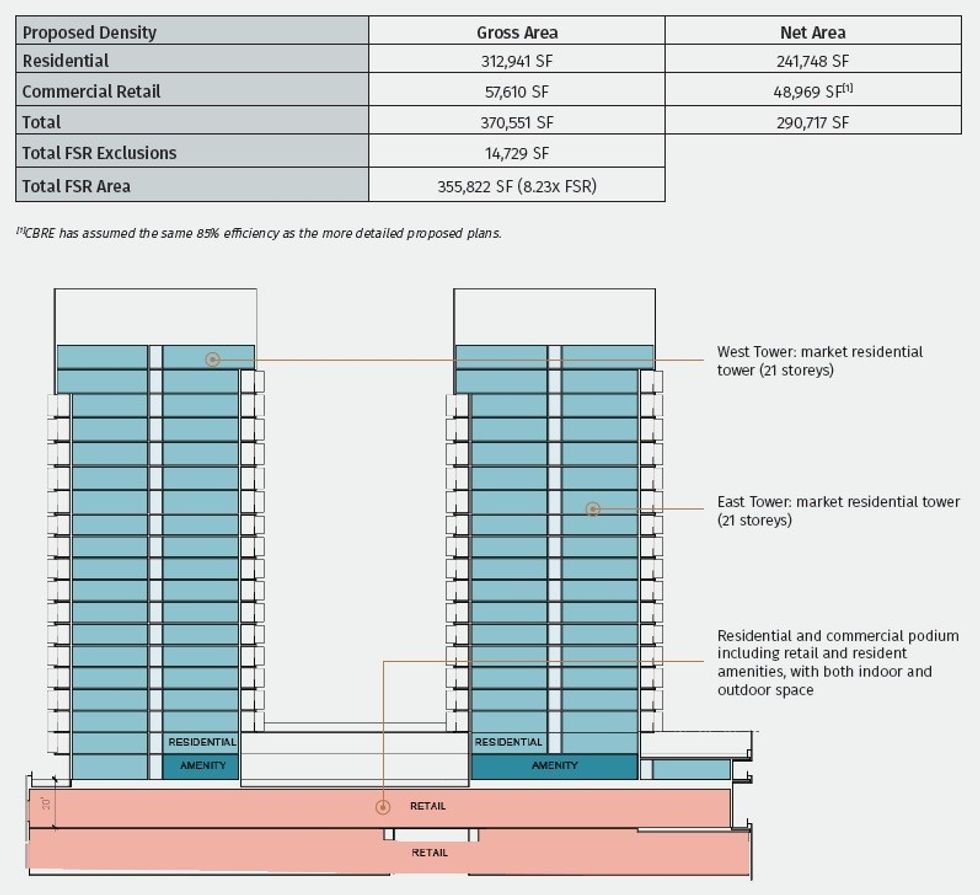

Recognizing that the 55-storey tower plans are non-compliant, CBRE has also outlined "an alternative redevelopment scenario." This alternative plan, which CBRE points out is just one of many other options, entails two 21-storey towers with a total of 357 units, which would both sit atop a four-storey podium with commercial retail space on the first two floors.

Market Conditions

Another significant factor in the sale of 1045 Haro Street is the current condition of the market, which is not exactly booming right now, as many buyers are still waiting for the Bank of Canada to cut interest rates.

"Generally, the larger the property, the depth of the market and the pool of buyers decreases," says Mark Goodman, Principal at commercial real estate brokerage Goodman Commercial. "But in this price range, with a property of this stature, most of the players have seen it or heard about the property. There's only so many developers that can handle something like this."

Goodman also says that acquiring a property through a court-ordered sales process can be both a positive or a negative for a developer, or neither. Some may like the certainty that the property has to be sold, while others may not like the risk that an offer they make could potentially be rejected, as all court-ordered sales require approval from the court.

One executive at a long-running development company in Vancouver, who asked to remain anonymous in order to speak freely, says that "nowadays, there are very few developers that would entertain a risky rezoning application in the vein of what was proposed by the current ownership group."

The development executive also noted that one general risk for developers with court-ordered sales is that properties are sold on what is called an "as-is, where-is" basis, "with the purchaser assuming liability for the condition of the property at the time of closing." The executive also notes that there is "a lot of uncertainty in the marketplace" at the moment and that "developers don't feel the urgency today to jockey for position on new property acquisitions."

The receiver and CBRE will now continue to market the property until a set of offers are found. It will then whittle down the offers to identify the best one available, and then present it to the Supreme Court for approval.

- Vancouver Davie & Nicola Project Site To Be Sold In Foreclosure Over $37M Debt ›

- Site Of Planned 28-Storey Tower In Vancouver West End To Be Sold After Foreclosure ›

- BC's Quarry Rock Developments Subject Of 9 Receiverships, Foreclosures ›

- Marvel Group's 3-Building North Van Project To Be Sold Over $47M Debt ›

- Sale Of Garibaldi At Squamish Approved Following Provincial Objection ›

- Fourth Project From Align Properties Falls Into Foreclosure In Vancouver ›

- Wall Financial Selling Planned Rental Project In Vancouver West End ›

- Quarry Rock's The Willoughby Sold For $35M Through Receivership ›

- Site Of Foreclosed 67-Storey AimForce Project In Surrey Listed For $75M ›

- Bayrock Terrace Project In Port Moody Placed Under Receivership ›

- Slate-Owned Metrotown Place Office Towers Under Receivership Listed By CBRE ›

- Chard Buys Site Of 55-Storey Vancouver Project In Receivership ›

- Chard Planning Twin Towers For Vancouver Site After $85M Purchase ›