After being placed under receivership in December and securing a stalking horse bid to buy the property in January, the sale of the planned Garibaldi At Squamish ski resort was set to be approved in March, before the Province made a last-minute objection to the sale that delayed the approval. The sale has since been approved, on May 3, according to filings in the Supreme Court.

The Garibaldi At Squamish project was being undertaken by Vancouver-based developers Aquilini Development and Northland Properties. Aquilini Development is owned by the Aquilini family, who own the Vancouver Canucks and Rogers Arena, while Northland Properties is owned by the Gaglardi family, who own the Dallas Stars.

The project was owned by Garibaldi At Squamish Inc. (GAS Inc.) and Garibaldi At Squamish Limited Partnership (GAS LP), who do not own the property — 6,800 acres about 13 minutes north of downtown Squamish — but rather the right to develop it, through an Environmental Assessment Certificate from the Province. The EA Certificate was issued on January 26, 2016 and includes numerous conditions that have to be satisfied before construction can commence and that have to be met by no later than January 26, 2026, after the certificate was extended in 2021.

Because GAS Inc. and GAS LP did not own any physical assets and income-producing assets, it became insolvent last year, with its lenders issuing demand for payment on August 3, 2023 for the sum of $64,897,339.40 on August 3, 2023.

The creditors consist of Aquilini Development Limited Partnership, Garibaldi Resort Management Company Ltd., and 1413994 BC Ltd., who are the petitioners that sought out the appointment of a receiver. Case documents state that Roberto Aquilini is a director of Garibaldi Resort Management Company Ltd., while Luigi Aquilini is the sole shareholder of 1413994 BC Ltd. Luigi is the father of Roberto, as well as Francesco, the Chairman of the Vancouver Canucks and Managing Director of the Aquilini Investment Group, the parent company of Aquilini Development.

Garibaldi At Squamish: The Sale

By mid-January, the receiver had secured a stalking horse bid — an initial offer conditional on no better bid being received. The bid was for $80.41M and was made by the three aforementioned creditors, in what is referred to as a credit bid, a bid where a secured creditor bids its secured debt against the purchase of the collateral.

The sales process then commenced, but after a total of nine prospective buyers progressed to the point of signing confidentiality agreements, no official offers were made to buy the property. As a result, the receiver moved forward with the stalking horse bid, which was set to be approved on March 15.

However, at the last minute, the Province asked the court to adjourn the proceedings so it could review the transaction.

In a judgement dated May 3, the judge presiding over the case said that the Province's opposition was primary because the proposed transaction would be completed with what's called a "reverse vesting order" (RVO), a relatively new, but increasingly popular, tool when it comes to insolvencies.

Usually, in vesting orders, the desired assets of an insolvent company are transferred — "vested" — to the buyer. However, with reverse vesting orders, the unwanted components of the insolvent company are transferred to a third company specifically incorporated to hold them. The buyers then purchase the shares of the insolvent company, which retain the desired assets, and the company holding the undesired assets is assigned into bankruptcy. The result is a change in control rather than a transfer of assets.

Reverse vesting orders are viewed as having less risk and allows permits and contracts to be preserved, according to McMillian LLP, a Toronto-based business law firm.

The Province questioned the use of an RVO in this case, among other things, but the judge ultimately found the Province's argument to be lacking, and approved the transaction.

Of note, however, is that the bid has been reduced by $20M, from the $80.41M proposed as the stalking horse bid.

"The credit bid is reduced by $20M," said Judge Walker. "That amount, owed by the Garibaldi entities (as interest) under their security to the petitioners, will be a retained liability. Also retained will be any potential liabilities arising under the Environmental Management Act."

What Happens Now

According to court documents, no actual work on the site has been done since the project was conceptualized decades ago and little has been done to meet the EA Certificate conditions.

However, the judge noted that a master plan has been drafted and is substantially complete.

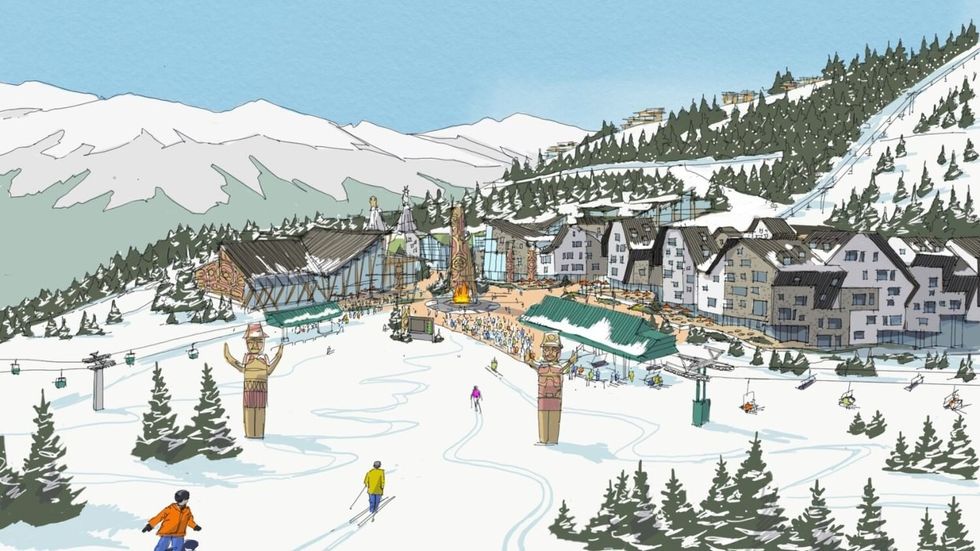

"It includes as a key component the incorporation of Squamish Nation tourism (such as cultural and educational centres that highlight the Squamish Nation culture, history, and traditions), ongoing consultation with the Squamish Nation with certain rights of first refusal, mentorship, internship, and training opportunities, along with an opportunity for Indigenous representation in the Sea-to-Sky Corridor of the Province," noted Justice Walker. The Squamish Nation holds a 10% interest in GAS LP.

And there are signs that Aquilini Development and the new owners will progress the project. According to Justice Walker, as part of the transaction, the purchasers "have committed to incur the costs to complete the construction pre-conditions, including $5.5M in the next 12 months."

The planned ski resort was intended to be a world-class, all-season resort that would see approximately 2,800 hectares converted into recreational uses that consisted of 126 ski and snowboard runs with 21 ski lifts, as well as over 5,000 housing units spread across across condominiums, townhouses, single-detached homes, and hotels.

As originally planned, construction of Garibaldi At Squamish would unfold in four phases across 30 years.