The Garibaldi At Squamish ski resort that was conceived as early as 2007 may have to be put on hold even longer, if it gets off the ground at all, as the development company behind the project has now been placed under receivership, according to filings in the Supreme Court of British Columbia.

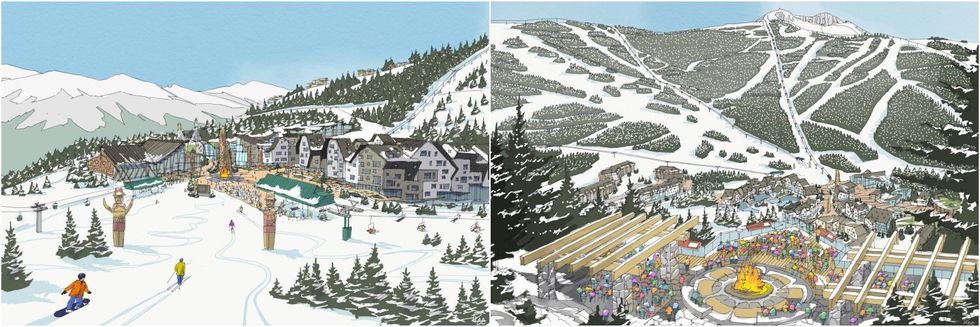

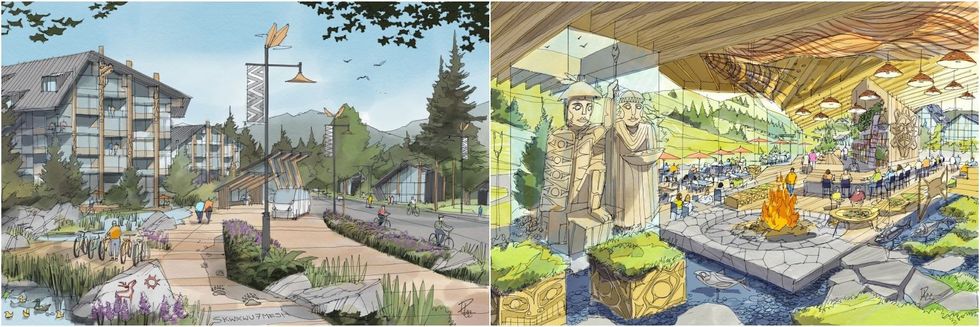

The resort was planned for a 6,800-acre site along the Sea-to-Sky Highway near Garibaldi Lake, about 13 minutes north of downtown Squamish, with hotels, retail, restaurants, and other resort amenities taking up 1,300 acres of the site. However, no progress has been made on the development in recent years, with the developers now allegedly owing over $64M in unpaid loans.

The project was being undertaken by Garibaldi At Squamish Inc. (GAS Inc.) and Garibaldi At Squamish Limited Partnership (GAS LP), with Vancouver-based developers Aquilini Development and Northland Properties listed on the project website. Aquilini Development is owned by the Aquilini family, which owns the Vancouver Canucks and Rogers Arena, while Northland Properties is owned by the Gaglardi family, which owns the Dallas Stars.

Receiverships are often sought out by external creditors, but in this case, the receivership application against GAS Inc. and GAS LP was brought forth by its related companies — Aquilini Development, Garibaldi Resort Management Company Ltd., and 1413994 BC Ltd. — over inter-company loans.

Court filings state that Roberto Aquilini is a director of Garibaldi Resort Management Company Ltd., while Luigi Aquilini is the sole shareholder of 1413994 BC Ltd. Luigi is the father of Roberto, as well as Francesco, the Chairman of the Vancouver Canucks and Managing Director of the Aquilini Investment Group, the parent company of Aquilini Development.

The site of the planned resort is also on the unceded land of the Skwxwu7mesh (Squamish) Nation, who signed a memorandum of understanding with the developers in 2007 but is not a party in the receivership proceedings.

The Receivership

The petitioners sought out the receivership because of a lack of progress on the project and a lack of evidence that any progress can be made in the near future.

After receiving an Environmental Assessment Certificate (EAC) for the project on January 26, 2016, the developers were required by the EAC to have substantially started on the project by January 26, 2021. By then, the project had not progressed and the developers sought out a five-year extension, which was ultimately granted. The project still has not been able to progress, and no further extensions are permitted under the Province's Environmental Assessment Act.

"No construction has been commenced and many of the conditions to the EAC remain outstanding," the petitioners stated in their receivership application. "GAS and the project generate no income and are entirely dependent on third party funding."

In 2018, GAS Inc. received loans of $2,280,082 from Aquilini Development and $14,492,071 from Garibaldi Resort Management Company, in the form of debentures — debt secured without collateral — with maturity dates of December 31, 2021. Luigi Aquilini subsequently issued two loans, also debentures, to GAS LP in 2018 and 2022, both with maturity dates of December 31, 2022. In 2018, GAS Inc. also entered into a general security agreement, for an amount that was not specified in court documents, with the three entities who sought out the receivership.

GAS Inc. and GAS LP have since defaulted on all three loan agreements, with the petitioners making demand for payment for the sum of $64,897,339.40 on August 3, 2023.

The petitioners said GAS "has failed or neglected to pay the amount demanded (or any part thereof)," and subsequently sought out the receivership in an application filed in September, which was not granted until December 4, with Ernst & Young appointed as the receiver.

What Happens Next

With no indication that the developers can continue on with the Garibaldi At Squamish, the project is now headed towards a sales process.

"For a number of years, there has been a lack of consensus among the directors of GAS Inc. regarding the future of the project and the best way in which to facilitate and fund its ongoing development," said Andrew Brown, VP of Finance for Aquilini Development, in an affidavit in September. "This has severely hampered the ability of GAS to raise the funds necessary to continue the development of the project. Without third party funding, GAS has no ability to advance the project, including the work necessary to satisfy the conditions to the EAC such that work on the project can be substantially started by the January 2026 deadline."

If work on the project has not commenced by January 26, 2026, the EAC will expire, resulting in the loss of "all of the effort and costs expended to date." As a result of this, and in light of the ongoing loan defaults, "the petitioners have determined that the appointment of a receiver is necessary and appropriate to pursue a transparent, orderly and timely sale process for the assets of GAS."

The 10-person Board of Directors of GAS Inc. consists of Roberto Aquilini, Bob Gaglardi, Stephen Jackson, David Suzuki, Fabio Banducci, Hunter Milborne, Alex Lau, Bill Aujla, Vice Chairman Robert Toor, and Chairman James Chu. Chu was formerly the Constable Chief of the Vancouver Police Department before joining Aquilini Development in 2015. Both Chu and Toor also currently hold Vice President roles within the Aquilini Group.

During deliberations between when the receivership application was filed and when it was granted, members of the board expressed concerns of a conflict of interest as it relates to both Chu and Toor, as a result of their roles within Aquilini, and asked that they recuse themselves, according to court documents dated December 1.

A special committee was subsequently formed with all members of the board, minus Chu, Toor, and Roberto Aquilini, but the special committee remains concerned about the conflict(s) of interest, saying that it will be monitoring to ensure that the receivership process and sales process are "fair and transparent."

In court-ordered sales processes, the next step will be to hire a broker to list and market the property. The initial group of offers will then be whittled down before an offer is selected and presented to the court for final approval. The sales process can take several months, but can also be expedited if warranted.

- Inside The $68M Court-Approved Sale Of Coromandel Properties' Southview Gardens ›

- Slate Asset Management's Stephen Avenue Place In Calgary Placed Under Receivership ›

- Planned 55-Storey Vancouver Tower Placed Under Receivership ›

- Nexii Building Solutions Placed Under Creditor Protection ›

- Garibaldi At Squamish Ski Resort Project Finds $80M Bid ›

- Squamish Receives $7M From Housing Accelerator Fund ›