The developers of the planned 55-storey high-rise tower that was set for 1045 Haro Street in the West End of Vancouver is in much deeper debt than what was previously known.

As first reported by STOREYS last week, the developer — Harlow Holdings Ltd., which is beneficially owned by Haro-Thurlow Street Project Limited Partnership — was placed under receivershp after an application was filed to the Supreme Court of British Columbia by the Bank of Montreal (BMO), which was claiming $82.2M in debt.

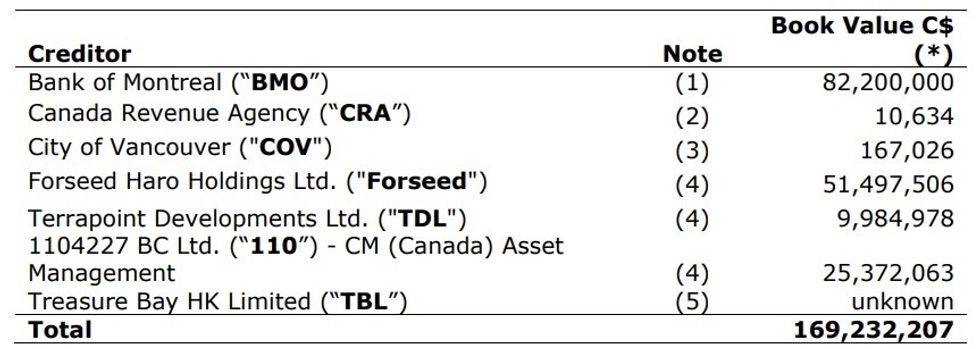

Since then, however, the court-appointed receiver has begun its work examining the financials of the developers, revealing that the extent of the debt is at least $169M.

While the amount owed to BMO is the largest single line item, Haro-Thurlow Street Project Limited Partnership owes an additional $51,497,506 to Forseed Haro Holdings Ltd., $25,372,063 to 1104227 BC Ltd., and $9,984,978 to Terrapoint Developments Ltd.

Those three entities are the three shareholders of Haro-Thurlow Street Project Limited Partnership, the beneficial owner of the property. According to the receiver, the amounts due stem from outstanding loans.

Moreover, Haro-Thurlow Street Project Limited Partnership also owes $167,026 in 2023 property taxes to the City of Vancouver and $10,634 in GST to the Canada Revenue Agency.

Additionally, there is another creditor — Treasure Bay HK Limited — that is owed an amount, but the exact amount has yet to be determined, meaning the current total debt of $169,232,207 could further increase.

"TBL has a pending action against Harlow Holdings and several other parties and has registered a certificate of pending litigation against the property," the receiver said in a statement to the court dated January 22. "The amount of any potential claim against Harlow Holdings is not known at this time."

The receiver notes that the listed values are based on the financial statements of the debtors as of December 31, 2023, and that the amounts have not been thoroughly verified. If accurate, however, the total amount owed would likely exceed the $172,750,000 price that was paid to acquire the site in August 2018. BC Assessment's latest assessment values the property at $98.1M.

Furthermore, the receiver has also identified a group of unsecured creditors who together are owed a total of $959,951, according to the debtors financial statements.

The largest single amount owed is $900,518 to Intracorp Homes, who was serving as the development manager of the project and is also a minority stakeholder in the project through Terrapoint Developments Ltd. The architect of the project — Patkau Architects — is owed $10,000 and Bunt & Associates — the transportation consultant — is owed $574.

Other unsecured debts include $23,742 owed to business law firm McMillan LLP, $19,570 owed to commercial real estate law firm Terra Law Corp, and $5,547 owed to accounting firm KPMG LLP.

According to the receiver, it will continue to investigate the affairs of the debtors while considering how to implement the sales process for the property, which cannot commence until after February 23 at the earliest.