Trouble and debt are actively mounting for Quarry Rock Developments, a Burnaby-based real estate developer of low-to-medium density residential projects across the Lower Mainland.

This month, separate receivership proceedings and foreclosure proceedings were initiated against two more of the company's properties, adding to an already extensive list.

Many of the receivership and foreclosure proceedings against Quarry Rock Developments were initiated in Fall 2023 (after it sold its Parque On Park development for $54M), with more initiated this year, and the numerous cases are currently at various stages of the process. Some are currently looking for buyers via a court-ordered sales process, others have not progressed to that stage yet, but are on their way there.

The Willoughby: Receivership

In November, the Supreme Court of British Columbia granted a receivership order pertaining to The Willoughby, a development at 20335 70A Avenue where Quarry Rock Developments was constructing 87 townhouses. Construction was scheduled to unfold across three phases, with the first phase underway but not complete before construction halted last fall.

The application was initiated by MCAP Financial Corporation against QRD (Willoughby) Holdings Inc., QRD (Willoughby) Limited Partnership, and QRD (Willoughby) GP Inc., which are the legal owner, beneficial owner, and general partner.

MCAP claimed that it was owed $29.6M as a first-ranking mortgagee. Additionally, Atrium Mortgage Investment Corporation via Canadian Mortgage Servicing Corporation, said it was owed $7.55M as a second-ranking mortgagee. Furthermore, Overland Capital Corporation and Wubs Investments Ltd. were also registered mortgagees on the project for $10.5M and $4.5M, respectively, according to the court-appointed receiver, bringing the total amount of debt to just over $52M.

According to case documents, Quarry Rock Developments became unable to advance the project due to delays with development approval, increased estimated costs of construction, increased interest rates, the inability to obtain additional financing to fund those increasing costs, and the inability to pay Steelcrest, their contractor, for work that had been done.

MCAP filed their application to appoint a receiver as a result of this, as well as the reality that the project had to go through winterization — protective measures ahead of construction pausing in the winter — and would see more costs accrued.

According to the receiver, 11 of the 87 units had been presold, but all of the presale deposits have since been returned, at the request of the purchasers, according to a report to the court provided by the receiver this month. The report also noted that the amounts owing had reached $32.99M to MCAP and $7.9M to Atrium, and the receiver noted that they are the only two charge holders that would likely recover all, or a portion, of what they are owed.

That recovery will be coming via a court-ordered sales process of the property, which was approved by the court earlier this month. The property is now being listed for sale, without an asking price, by Casey Weeks, Morgan Iannone, and Bill Randall of Colliers. Colliers will now solicit offers for the property, before one is ultimately presented to the Supreme Court for approval.

The Met: Receivership

This month, Quarry Rock Development's project called The Met, which was planned for 2241-2251 McAllister Avenue in Port Coquitlam, was then also been placed under receivership, effective April 2. The project was set to be a five-story mixed-use condo building.

The proceedings were initiated by Canadian Western Bank against Quarry Rock Developments (McAllister) Inc. and Quarry Rock Developments (McAllister) Limited Partnership, who are the legal owner and beneficial owner of the property. Also listed as respondents are Quarry Rock Developments Inc., Lawson Acquisitions Ltd., and Willis Developments Inc.

Canadian Western Bank claims that it is owed $12.7M, but an analysis conducted by the court-appointed receiver has found that Quarry Rock Developments owes a total of $23M to secured creditors, which also includes $5.5M to VC Management, a general contractor. Case documents listed numerous other secured creditors with amounts owing that are still unconfirmed. They also show that Quarry Rock Developments owes a total of just over $695K to unsecured creditors, which include project consultants such as Atelier Pacific Architecture Inc., MLA Canada, and Spark RE.

Canadian Western Bank's application was actually filed in February.

According to court documents, a company called Northstar Acquisitions Ltd. had entered into an agreement with Quarry Rock Developments in January to purchase the property. If the sale fell through, as it ultimately did, then the receivership order would come into effect on April 2. Had the sale been successfully completed, however, the receivership order could have still came into effect on May 2, if Quarry Rock Developments had failed to pay Canadian Western Bank the full outstanding amount.

There have not been any further updates in the case since the receivership came into effect, but the case appears headed to a court-ordered sales process as well, like that for The Willoughby. BC Assessment values the property at $15,065,000.

Richmond Hamilton Townhouses: Foreclosure

In Richmond, at 23400, 23440, 23460, and 23500 Gates Avenue, near Hamilton Highway Park, Quarry Rock Developments was planning a 60-unit townhouse project, according to a May 2021 development permit application.

The property is legally owned by QRD (Hamilton) Holdings Inc. and beneficially owned by QRD (Hamilton) Limited Partnership, with QRD (Hamilton) GP Inc. as the general partner.

Those three entities are the subject of ongoing foreclosure proceedings that were initiated by the aforementioned Atrium Mortgage Investment Corporation in late-October 2023. In this case, Atrium holds a first-ranking mortgage and were owed $13,128,822.62 with interest accruing at a daily rate of $4,152.49, according to an order nisi granted by the Supreme Court in December, which confirmed the debt.

The order nisi also set the redemption date — the date by which debtors can pay the outstanding amount to stop the foreclosure — at June 12, 2024.

At the moment, the various creditors are lining up to secure the right to sell the property.

A second-ranking mortgage is held by Overland Capital Canada Inc., who were owed $2,951,835.62 as of November 20 and a third-ranking mortgage is held by Tybo Contracting Inc., who claim they are owed $2,132,484.43 as of February 1.

Tybo filed its application for conduct of sale, allowing it to sell the property, on April 24. The application is likely to be approved, as lower-ranking charge holders often get priority when it comes to conduct of sale.

Although BC Assessment values the property — as one parcel under 23400 Gates Avenue — at $10,490,000, Tybo says in its application that it obtained an appraisal of $15.2M from Aian Miiabaev of Colliers in March for the property. The property was also previously listed by Mike Harrison of Avison Young, on behalf of the owner, with an asking price of $21.5M.

Tybo also says that QRD (Hamilton) Holdings Inc. has accepted an offer to sell the property to Tefi Development Group for $25.6M, with subject removal on June 14 and completion on September 30. However, Tybo says that there is no guarantee that the sale will be completed, and are seeking conduct of sale. If granted, Tybo intends to retain Hart Buck and Jennifer Darling of Colliers to list and sell the property. Tybo's application will be heard by the court on Monday, April 29.

The Graham and The Gordon: Foreclosure

Most recently, foreclosure proceedings were also initiated against QRD (Graham) Holdings Inc., QRD (Graham) Limited Partnership, QRD (Graham) GP Inc., QRD (Gordon) Holdings Inc., and QRD (James) Holdings Inc., the ownership entities pertaining to two land assemblies in Langley, which are across the street from one another.

The first land assembly consists of 7010 204 Avenue and 20443 70 Avenue, where Quarry Rock was planning a low-rise condo building with 254 units called The Graham.

The second consists of 7007, 7021, and 7033 204 Street, where Quarry Rock was planning a low-rise condo building with 386 units called The Gordon.

The two land assemblies were again previously listed by Mike Harrison of Avison Young. The two are listed together with an asking price of $51.5M, but the listing notes the assemblies can be purchased separately.

The foreclosure proceedings against both projects were initiated by Amur Capital Income Fund Inc. in a single petition to the court on April 3, with a claim that they were owed $7,614,800, as of March 15, with interest accruing at a daily rate of $3,300. Additional charge holders are listed on the petition, but the amounts they are owed have yet to be confirmed.

The case has yet to proceed to the conduct of sale stage, but is more than likely headed there as well.

Quarry Rock Developments

In addition to the above, Quarry Rock Developments is also subject to several other ongoing foreclosure proceedings.

Those include a foreclosure initiated by Basha Sales Co. Ltd., Leibel Sales Co. Ltd., and Newport Sales Co. Ltd. in October against QRD (Casino) Holdings Inc., QRD (Casino) Limited Partnership, and QRD (Casino) GP Inc., the owners of 20411 Fraser Highway in Langley. In that case, the petitioners claim Quarry Rock Developments are in default of two loan agreements. According to a December case document, Quarry Rock had accepted a $7.5M offer to buy the property that had a subject removal date of December 15 and a completion date of June 24. It's unclear whether subjects were removed, but the Supreme Court issued an order nisi in mid-December confirming the total debt at $5,718,966.74 and set the redemption date at June 14.

Additionally, foreclosure proceedings are also ongoing pertaining to an industrial development in Delta Quarry Rock Developments was undertaking at 10555 64 Avenue. The project was set to be a cold storage warehouse and food processing facility for Delta Fresh and had reached the third reading stage, according to the City of Delta. The proceedings were initiated by Overland Capital in January against QRD (Delta Fresh) Holdings Inc. and other ownership entities, the Supreme Court issued an order nisi in March that confirmed the debt at $9,647,875.11, and the redemption date was set at September 14.

Another foreclosure is also ongoing pertaining to the historic Federal Building in Langley, located at 20402 Douglas Crescent, which is owned by QRD (Douglas) Holdings Inc., QRD (Douglas) Limited Partnership, and QRD (Douglas) GP Inc. The proceedings were initiated by Overland Capital and VWR Capital Corp in late-February, who claimed that they were collectively owed $3,958,885.88 as of December 14. The case has yet to progress any further.

Those same two creditors also initiated, on the same day, foreclosure proceedings against QRD (Fleetwood OAP) Holdings Inc., QRD (Fleetwood OAP) Limited Partnership, and QRD (Fleetwood OAP) GP Inc., the owners of 8286 161 Street in Surrey. Overland Capital and VWR Capital claim that they are owed $5,616,290.13 as of December 14. According to a March case document, Quarry Rock has accepted a $6.2M offer to buy the property that has a subject removal date of March 30 and a completion date of July 31. It's unclear whether subjects were removed by March 30.

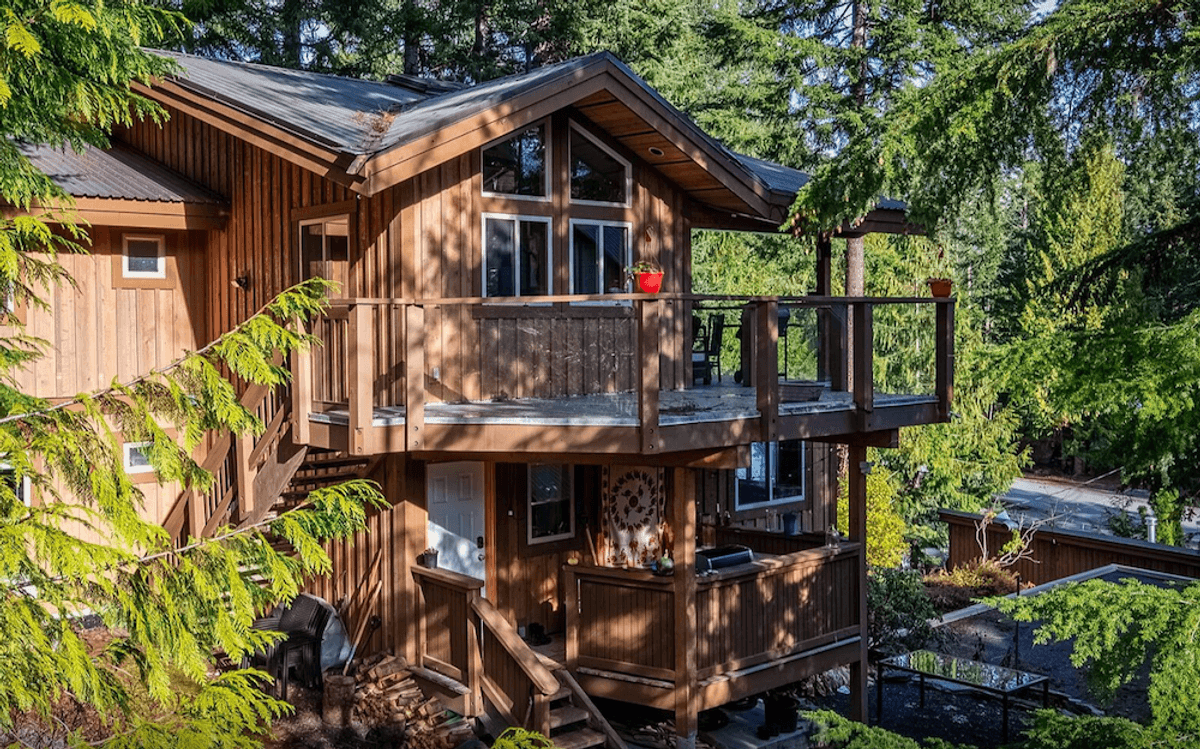

The trouble for Quarry Rock Developments extends out to the Okanagan, where VWR Capital and the Canadian Western Trust Company initiated foreclosure proceedings in late-February, claiming they were owed $3,047,539.42, against QRD (Baden Resort) Holdings Inc., QRD (Baden Resort) Limited Partnership, and QRD (Baden Resort) GP Inc., the owners of a 13-acre property on Shannon View Drive in West Kelowna where Quarry Rock was planning the Baden Resort Spa. According to a March case document, Quarry Rock has accepted a $5.15M offer to buy the property that has a subject removal date of April 3 and a completion date of August 15. It's unclear whether subjects were removed by April 3.

The aforementioned receivership and foreclosure proceedings also list Matthew K. Weber as a respondent. Weber is the Founder and President of Quarry Rock Developments, as well as a guarantor of the various mortgages.

Listed alongside Weber as a guarantor is Richard Norman Lawson, who is — according to BC Financial Services Authority records — associated with Overland Capital, the mortgagee involved in several of the aforementioned proceedings.

It's unclear if these properties represent all of the properties Quarry Rock Developments owns.