When it comes to buying a home in Toronto, it's not as easy as you might think. Not only is the average price for a home now well over the $1 million mark, but saving to afford a down payment for a home is practically a life sentence, according to a new report from the National Bank of Canada.

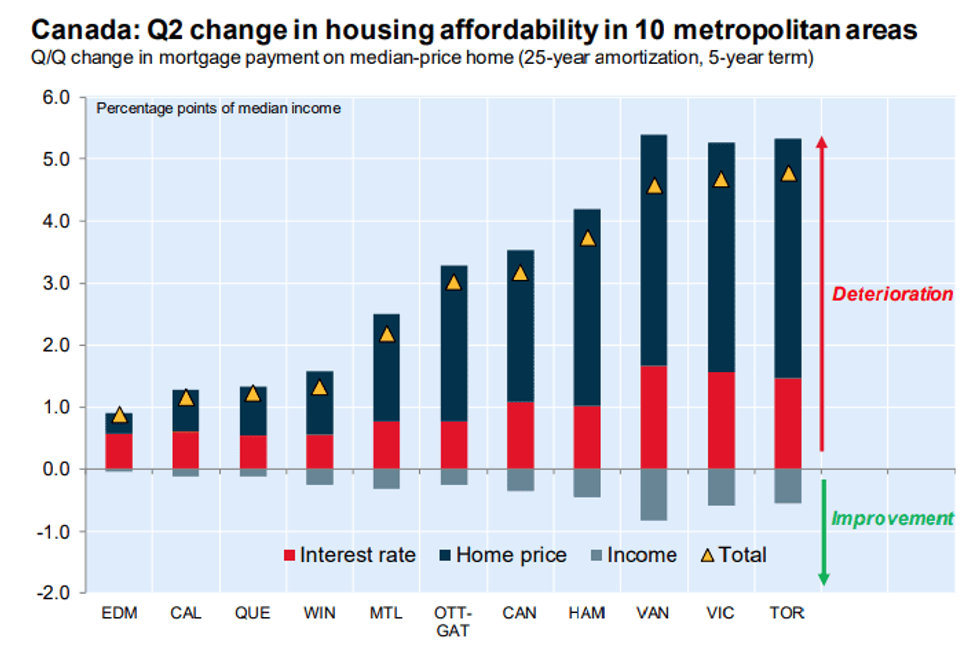

Earlier this week, the National Bank of Canada released its Q2-2021 Housing Affordability Monitor, and, unsurprisingly, housing affordability worsened across the country by the most in 27 years in the second quarter of this year, marking the sharpest deterioration since 1994.

While income growth and lower interest rates were favourable for improving affordability for most of the past two years, the National Bank of Canada says that is no longer the case in 2021, as income growth is being easily outpaced by home price increases, while mortgage interest rates also continue to rise on a quarterly basis.

As such, the Bank says a typical mortgage payment now engulfs 45% of household income.

READ: Four in 10 Canadians Can’t Afford a $500 Rise in Monthly Mortgage Payments

Here in Toronto, affordability continued to deteriorate in Q2-2021 for both condos and non-condo dwellings.

According to the Bank, the deterioration was mostly attributable to higher home prices, as condo prices "swelled 5%, while non-condo prices sprang 7.1%."

For all types of dwellings, home prices jumped 6.9% in the quarter, marking the highest quarterly growth since the last quarter of 2016. On an annual basis, home prices in the city shot up 16%, also surpassing the index’s mean increase of 14.8%.

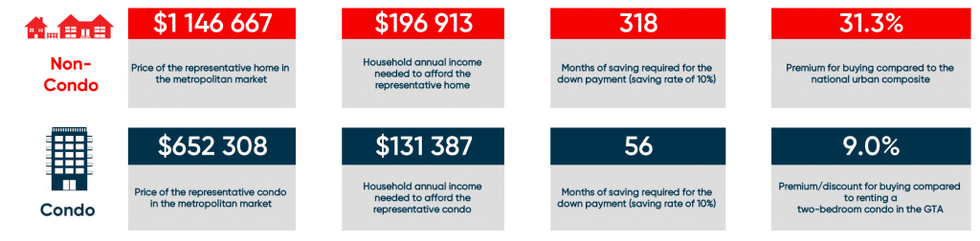

According to the National Bank of Canada, a house in Toronto that’s representative of the current real estate market is currently priced at $1,146,667, and to be able to afford this home, a buyer needs a household income of $196,913.

And, assuming a saving rate of 10%, a buyer would have to have saved up for 318 months in order to make the down payment -- that’s 26 and a half years.

While some might assume that buying a condo in this market might be more feasible, it is, but only to an extent. According to the affordability monitor, the representative condo in Toronto is currently priced at $652,308. To afford that, you’ll need a household income of $131,387 and 56 months' worth of savings.

But what's more, monthly mortgage payments are also eating up a huge chunk of Toronto homeowners' paycheques, with non-condo payments now accounting for 65.6% of household income -- up 5.4% from the previous quarter. For condo owners, payments are 37.3% of their income -- up 2.4% quarter-over-quarter.

When it comes to saving for a down payment, Anne Arbour, Financial Educator at Credit Counselling Society explained to STOREYS that a great way to start preparing is to track your current spending to get a better idea of where your money is going.

"Saving for a down payment can be an important but intimidating goal for many Canadians. An essential first step is to track your current spending for two or three months to truly understand where your money is going, and how much you can realistically set aside each month or each pay period," said Arbour.

"Treat that amount like any other bill that must be paid, automating the transfer into an off-limits account so you’re not tempted to spend it on anything else. Paying off high-interest debts, like credit cards, will also free up more funds for that dream property. Are there any assets like a car or rarely-worn clothes you can sell to give your savings a boost?"

Arbour also suggests that prospective homeowners should 'test drive their mortgage' before buying a property if it's higher than what they're paying in rent right now.

"This can be done by setting aside the difference into a savings account and then budgeting the rest as normal. This will give insight on whether or not paying that mortgage every month is feasible long-term -- plus it can be a great way to set aside some extra funds! If you’re feeling stuck or overwhelmed, a professional credit counsellor at a non-profit credit counselling organization can review your finances with you, usually for free, and help you make a plan to reach your goals," added Arbour.

The report comes as the average price of a home in Toronto fell 11% year-over-year to $1,016,580 in July, according to the Toronto Regional Real Estate Board (TRREB).

TRREB Chief Market Analyst Jason Mercer says that the annual price growth rate has moderated since the early spring but has remained in the double digits.

“This means that many households are still competing very hard to reach a deal on a home. This strong upward pressure on home prices will be sustained in the absence of more supply, especially as we see a resurgence in population growth moving into 2022,” said Mercer.