Qualified Appraisal

Explore what a qualified appraisal means in Canadian real estate — who performs it, when it’s needed, and why it’s essential for financing and legal purposes.

May 22, 2025

What is a Qualified Appraisal?

A qualified appraisal is a formal, unbiased property valuation conducted by a certified appraiser who meets recognized standards for accuracy and independence.

Why a Qualified Appraisal Matters in Real Estate

In Canadian real estate, qualified appraisals are essential for securing mortgage financing, refinancing, and assessing fair market value for estate or tax purposes.

Key appraisal criteria include:

- Conducted by a certified member of AIC or equivalent

- Based on comparable sales, location, and property condition

- Adheres to Canadian Uniform Standards of Professional Appraisal Practice (CUSPAP)

Lenders rely on qualified appraisals to ensure loan-to-value ratios are appropriate and that the property justifies the loan amount.

Understanding qualified appraisals ensures buyers and borrowers are using credible valuations and complying with lender and legal standards.

Example of a Qualified Appraisal in Action

To finalize mortgage approval, the lender requires a qualified appraisal showing that the home is worth at least the agreed purchase price.

Key Takeaways

- Conducted by certified professionals.

- Required for most mortgage approvals.

- Based on standardized valuation practices.

- Helps ensure lending risk is managed.

- Legally recognized and lender-approved.

Related Terms

- Appraisal

- Loan-to-Value Ratio (LTV)

- Mortgage Qualification

- Fair Market Value

- Underwriting

The LJM Tower at 2782 Barton Street East in Hamilton in June 2025. (Google Maps)

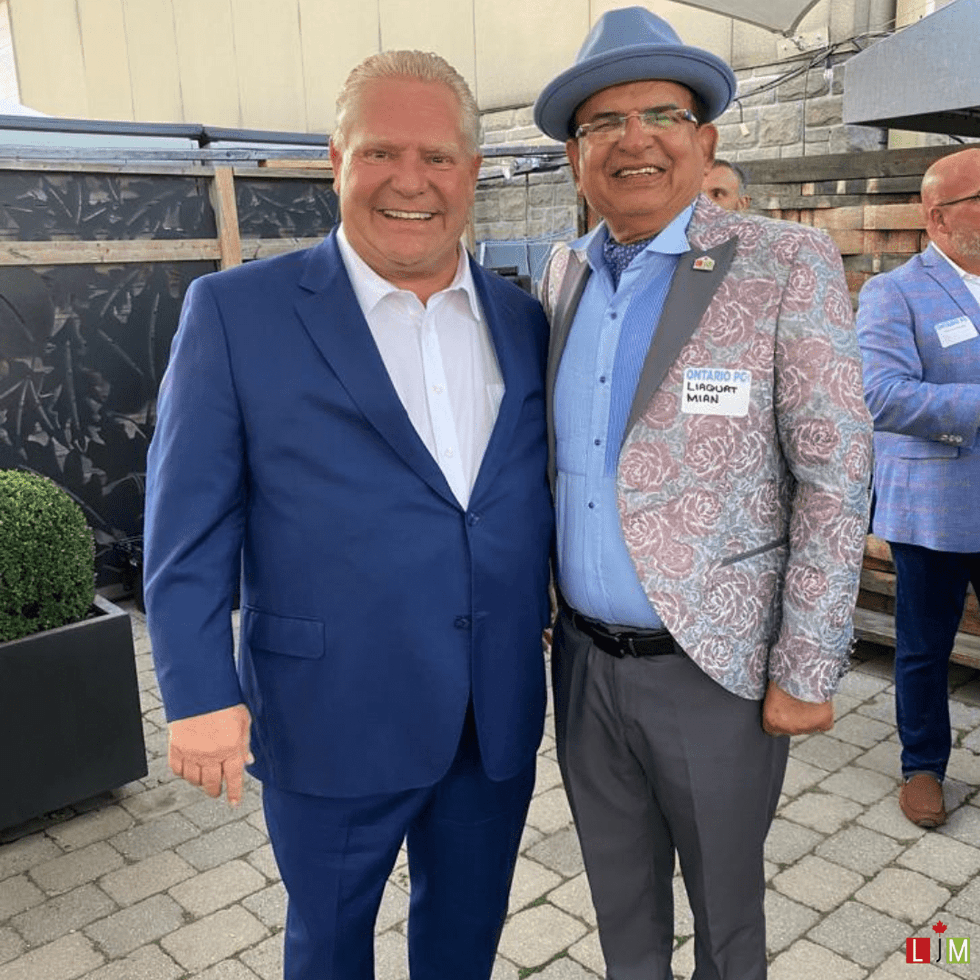

The LJM Tower at 2782 Barton Street East in Hamilton in June 2025. (Google Maps) Ontario Premier Doug Ford and LJM Developments President Liaquat Mian. (LJM Developments)

Ontario Premier Doug Ford and LJM Developments President Liaquat Mian. (LJM Developments)

CREA

CREA

Liam Gill is a lawyer and tech entrepreneur who consults with Torontonians looking to convert under-densified properties. (More Neighbours Toronto)

Liam Gill is a lawyer and tech entrepreneur who consults with Torontonians looking to convert under-densified properties. (More Neighbours Toronto)

Eric Lombardi at an event for Build Toronto, which is the first municipal project of Build Canada. Lombardi became chair of Build Toronto in September 2025.

Eric Lombardi at an event for Build Toronto, which is the first municipal project of Build Canada. Lombardi became chair of Build Toronto in September 2025.

A rendering of the “BC Fourplex 01” concept from the Housing Design Catalogue. (CMHC)

A rendering of the “BC Fourplex 01” concept from the Housing Design Catalogue. (CMHC)