Power of Sale

Learn how power of sale works in Canadian real estate, how it differs from foreclosure, and what borrowers and investors need to know about the process.

May 22, 2025

What is Power of Sale?

Power of sale is a legal process used by lenders in several Canadian provinces to recover mortgage debt by selling a defaulting borrower’s property without going through the court system.

Why Power of Sale Matters in Real Estate

Common in Ontario and Nova Scotia, power of sale allows lenders to act more quickly than foreclosure. Once a borrower is in default, the lender can issue notice and, after a waiting period, sell the home to recover the debt.

Key features of power of sale:- Property is sold by the lender, not the court

- Borrower may still owe any shortfall after the sale

- Any surplus funds after debt and costs are paid go to the borrower

This process protects lender rights while offering transparency and oversight. Homeowners in power of sale should seek legal counsel promptly.

Understanding power of sale helps homeowners, investors, and agents navigate distressed property sales and lender recovery procedures.

Example of Power of Sale in Action

After a borrower defaults, their lender exercises power of sale, selling the property to recover the remaining loan balance and legal fees.

Key Takeaways

- Enables lender to sell defaulted property.

- Faster and less costly than foreclosure.

- Common in Ontario and Nova Scotia.

- Borrower may retain surplus after sale.

- Governed by provincial statutes.

Related Terms

- Foreclosure

- Default

- Mortgage Arrears

- Distressed Property

- Judicial Sale

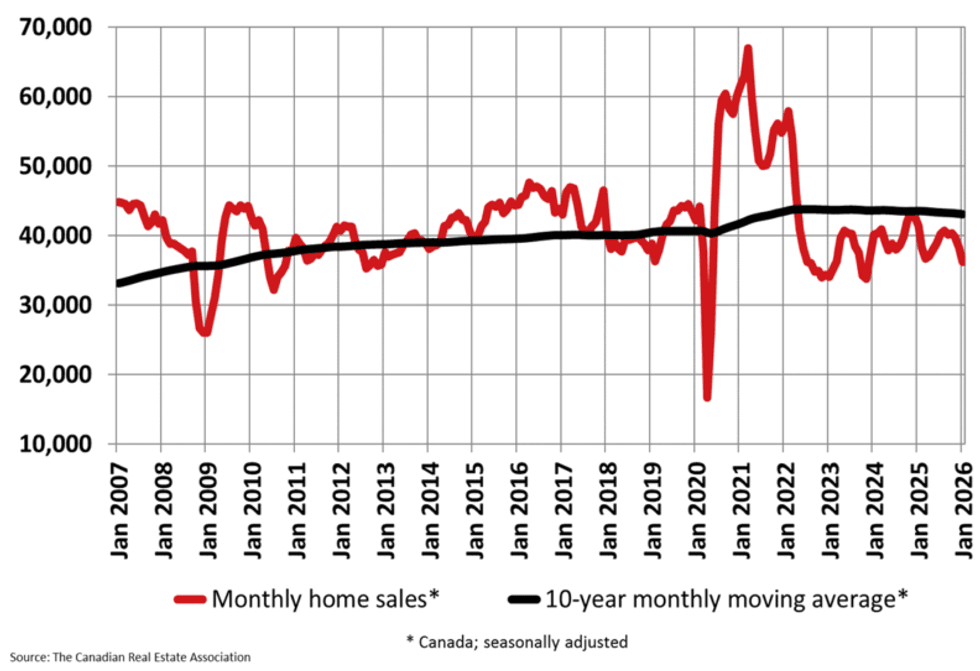

CREA

CREA

Liam Gill is a lawyer and tech entrepreneur who consults with Torontonians looking to convert under-densified properties. (More Neighbours Toronto)

Liam Gill is a lawyer and tech entrepreneur who consults with Torontonians looking to convert under-densified properties. (More Neighbours Toronto)

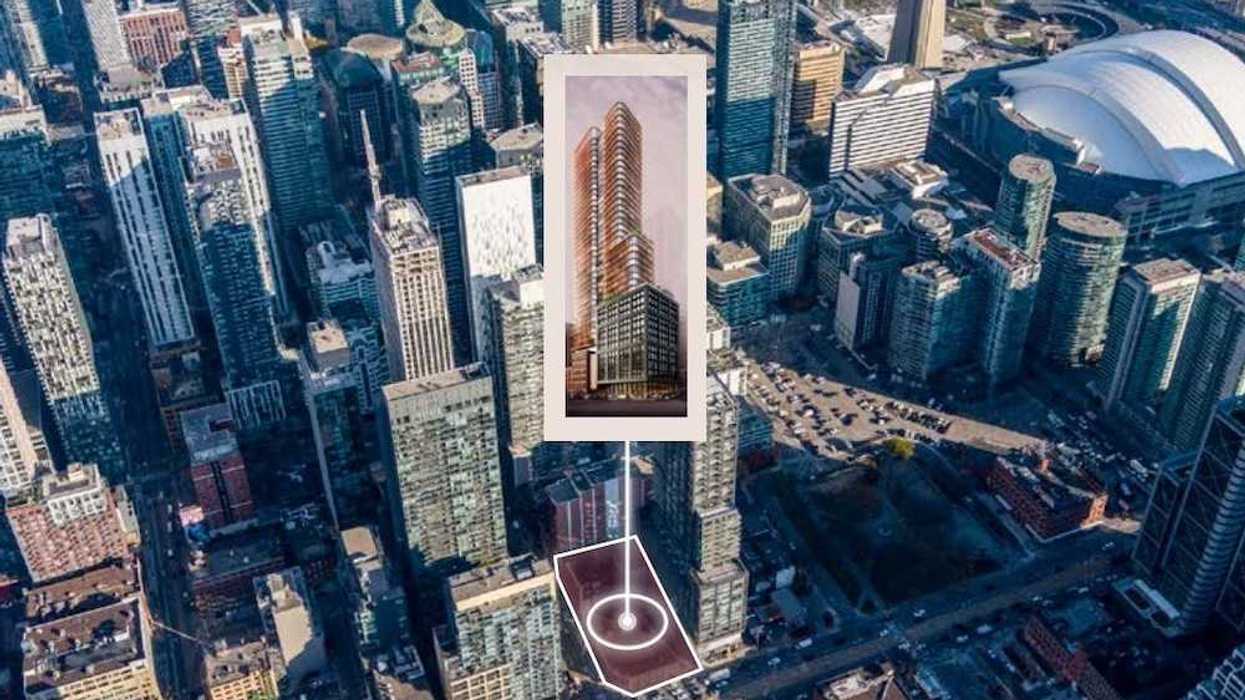

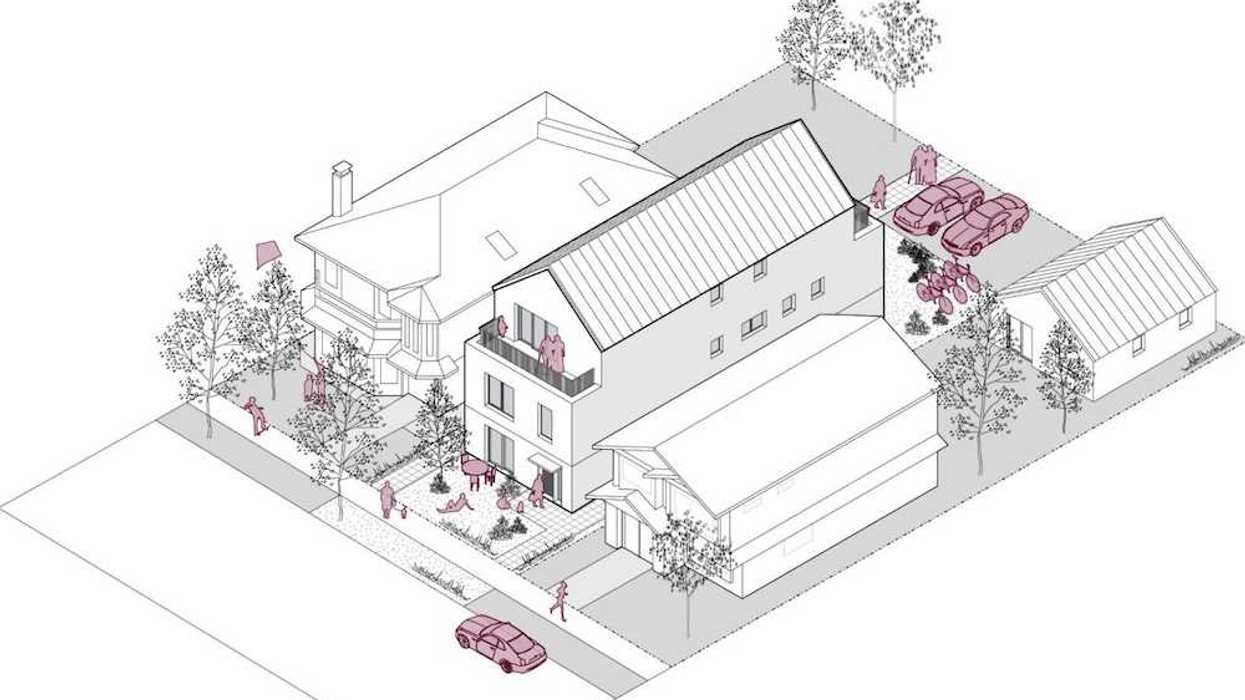

Rendering of 9 Shortt Street/CreateTO, Montgomery Sisam

Rendering of 9 Shortt Street/CreateTO, Montgomery Sisam Rendering of 1631 Queen Street/CreateTO, SVN Architects & Planners, Two Row Architect

Rendering of 1631 Queen Street/CreateTO, SVN Architects & Planners, Two Row Architect Rendering of 405 Sherbourne Street/Toronto Community Housing, Alison Brooks Architects, architectsAlliance

Rendering of 405 Sherbourne Street/Toronto Community Housing, Alison Brooks Architects, architectsAlliance

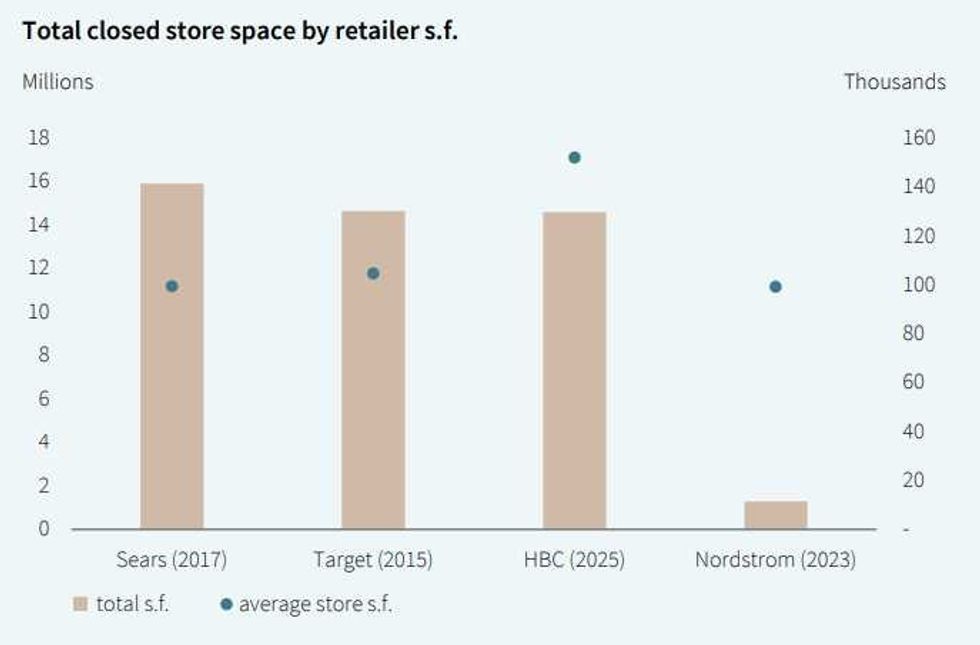

Hudson’s Bay vacated about as much space as Target did in 2015. (JLL)

Hudson’s Bay vacated about as much space as Target did in 2015. (JLL)