Permanent Financing

Understand permanent financing in Canadian real estate — what it is, when it applies, and how it supports completed projects.

August 01, 2025

What is Permanent Financing?

Permanent financing is long-term financing used to replace short-term construction or bridge loans once a property is completed and stabilized.

Why Permanent Financing Matters in Real Estate

In Canadian real estate, permanent financing provides developers and owners with predictable, long-term debt after project completion.

Key points:

- Typically a mortgage with fixed or floating rates

- Secured once occupancy and cash flow targets are met

- May be provided by banks, insurance companies, or CMHC

Understanding permanent financing helps developers plan exit strategies from construction financing.

Example of Permanent Financing in Action

The apartment building transitioned from its construction loan to permanent financing after achieving 95% occupancy.

Key Takeaways

- Replaces short-term construction or bridge loans

- Provides long-term financial stability

- Secured once property is stabilized

- May involve fixed or variable rates

- Key milestone in project lifecycle

Related Terms

- Construction Loan

- Bridge Financing

- Draw Schedule

- Mortgage Term

- Public-Private Partnership

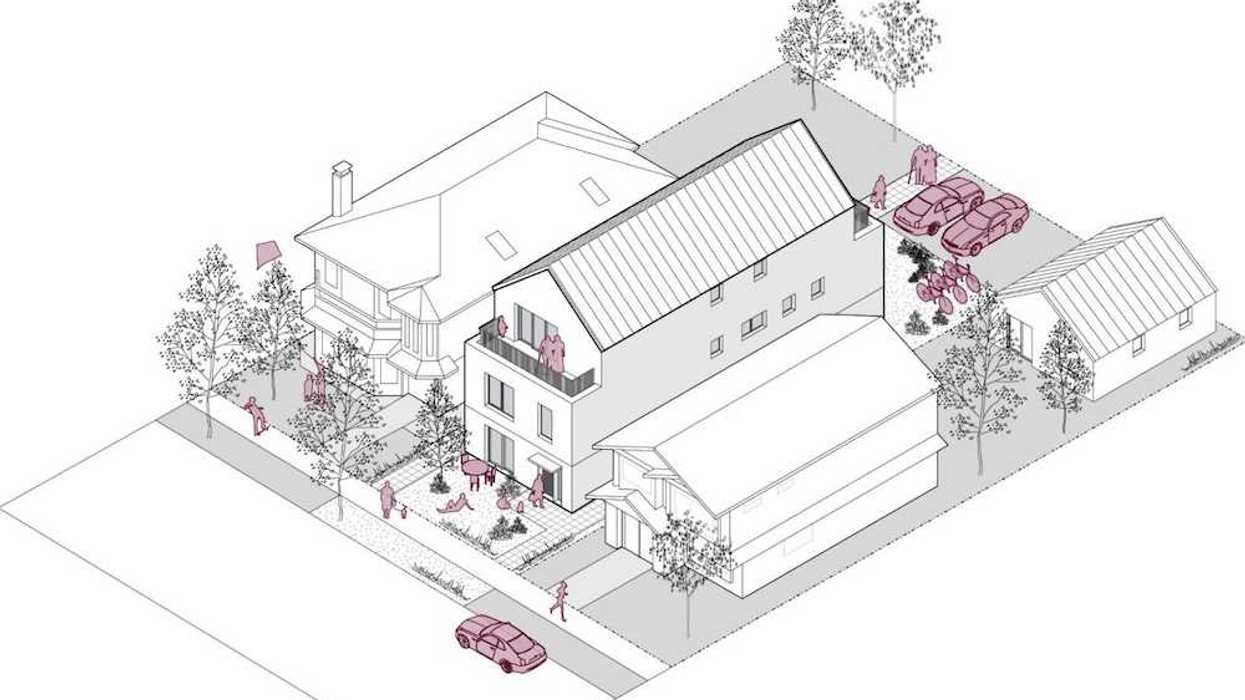

A rendering of the “BC Fourplex 01” concept from the Housing Design Catalogue. (CMHC)

A rendering of the “BC Fourplex 01” concept from the Housing Design Catalogue. (CMHC)

Rendering of 9 Shortt Street/CreateTO, Montgomery Sisam

Rendering of 9 Shortt Street/CreateTO, Montgomery Sisam Rendering of 1631 Queen Street/CreateTO, SVN Architects & Planners, Two Row Architect

Rendering of 1631 Queen Street/CreateTO, SVN Architects & Planners, Two Row Architect Rendering of 405 Sherbourne Street/Toronto Community Housing, Alison Brooks Architects, architectsAlliance

Rendering of 405 Sherbourne Street/Toronto Community Housing, Alison Brooks Architects, architectsAlliance

The Yonge Corporate Centre at 4100-4150 Yonge Street. (Europro)

The Yonge Corporate Centre at 4100-4150 Yonge Street. (Europro)

Jon Sailer

Jon Sailer