If you were born in the 1990s and own real estate, there’s a good chance you’ve had a little help from your parents. It’s understandable; sky-high costs of rent render saving money difficult, home prices have shot up in recent years, and interest rates remain high. In short, even many 90s-born young professionals with “good jobs” find home ownership currently unattainable. That’s where the parents come in – especially in Canada’s priciest cities.

A report from the Canadian Imperial Bank of Commerce found that nearly 30% of first-time homebuyers in 2021 received a monetary gift from their parents, a figure that's – tellingly – up from 20% in 2015.

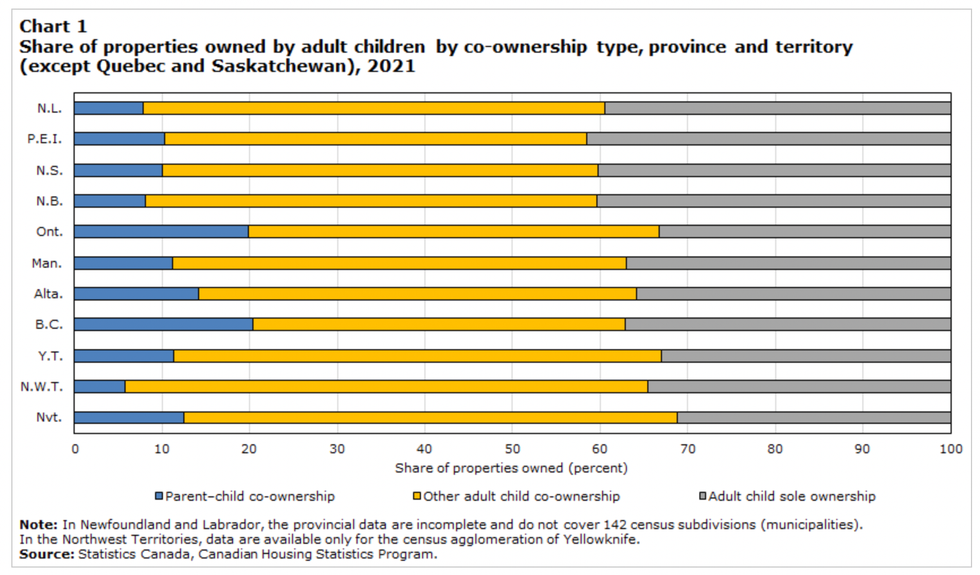

To better understand possible barriers and advantages for young people in Canada, Statistics Canada (StatCan) has initiated a series of research articles investigating housing market outcomes for millennials and Generation Zers born in the 1990s. The first study in this series documented that the children of homeowners were twice as likely to own a home as those of non-homeowners in 2021. According to a new study from Statistics Canada StatCan, "Intergenerational housing outcomes in Canada: Parents' housing wealth, adult children's property values and parent–child co-ownership," one in six residential properties (17.3%) owned by people born in the 1990s were co-owned with their parents in 2021.

This proportion was higher in more expensive urban markets, such as Toronto, Guelph, Abbotsford–Mission, Vancouver, and Victoria. According to StatCan, in around three in 10 of these co-ownership situations, the adult child lives in the co-owned property and the parents live in another property they own, which may correspond to so-called mortgage "co-signing." In the notoriously pricey Toronto, 27.2% of 90s-born homeowners relied on their parents for co-ownership. Meanwhile, more affordable cities like Moncton, New Brunswick saw a lower rate than the national average.

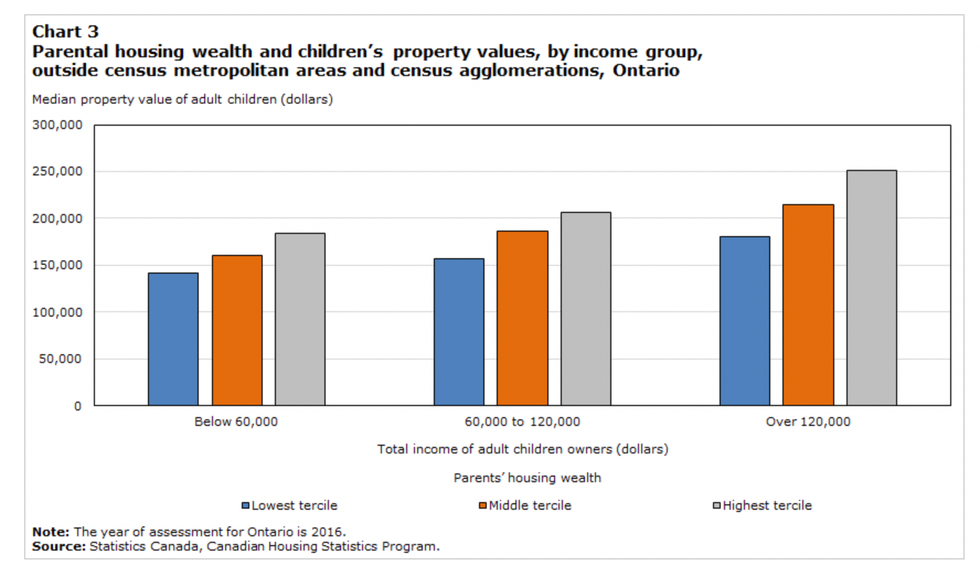

The study found that parents' housing wealth was associated with higher property values for their children, especially in Toronto, Kelowna, Vancouver, and Victoria. In these cities, children whose parents were at the top of the housing wealth distribution owned properties that were on average 29.6% to 37.4% more valuable than properties owned by people whose parents were at the bottom of the housing wealth distribution.

Interestingly, in the notoriously pricey cities of Toronto and Vancouver, StatCan’s data reveals that there was a higher number of 90s-born homeowners in possession of high-value homes, despite having low incomes. Property values of children in the lowest income range were comparable with those of the highest income range, and higher than the intermediate range ($60,000 to $120,000), consistent with what StatCan calls “a U-shaped” relationship between values and income.

From coast to coast, the co-ownership trend is especially prevalent among immigrant families, according to StatCan. Immigrant families comprise about half of the '90s babies who co-own with their parents – and more than 80% in Toronto.

In Toronto, about half (52.1%) of the high-ratio properties had at least one adult child who was a first-generation immigrant listed on the title, compared with 35.2% of all properties analyzed. In Vancouver, 65.4% of the high-ratio properties were owned by at least one first-generation immigrant adult child, compared with 37.3% of all properties owned by adult children.

As StatCan highlights, their results suggest that parental property ownership affects not only children's ability to access home ownership as adults, but also the value of the properties they own and, therefore, their ability to build up greater home equity and financial assets.

As for those presumably without the good fortune of being able to rely on the 'bank of the parents', new research from the BMO Real Financial Progress Index reveals that a huge number of aspiring homeowners are waiting for interest rates to drop before entering the ever-dramatic market.