Unless things dramatically change, the Ontario government’s much-touted target of building at least 1.5 million homes across the province by 2031 won’t happen. It’s that simple, according to several industry experts – and basic math.

The reality, driven home by everyone from politicians and housing advocates to urban planners, is that we need new homes built now – or we won’t be able to accommodate our growing population and the relentless housing crisis will worsen. Ontario’s current climate, however, isn’t exactly one that facilitates the widespread construction of new homes. And the obstacles are plenty.

In the wake of recent eyebrow-raising reports that reveal slowing housing starts and disheartening projections, the big question is: Will Ontario actually reach its target? For many, it's already more of, “Just how far off will it be from hitting it?”

The Perfect Storm For Slow Builds

Before we jump into it, it’s important to consider how we got here in the first place. Factors include a combo of high and rising land costs, heightened interest rates, rising development fees, construction costs, and bureaucratic delays that have slowed development activity across the province. "The greatest contributors to the province’s slow speed of new home construction has been the increase of development charges, the continued problem of too much red tape, and federal sales taxes," Residential Construction Council of Ontario (RESCON) president Richard Lyall tells STOREYS.

Of course, high interest rates and inflation don't help either. “For the last year and a half, the biggest barrier is the cost to build at a rate that the market can absorb,” says Justin Sherwood, senior vice president, communications and stakeholder relations for Building Industry and Land Development Association (BILD). “The last five years has seen a significant increase in the cost of construction from both a labour and material perspective. Construction inflation in the GTA has resulted in nearly an 80% increase in the cost to build a condominium and 98% in the cost to build a single family home since Q4 2019."

Paired with high land values and sky-high municipal fees to build and the result is a cost structure that is out of line with the market’s ability to absorb, says Sherwood. “As a result, pre-construction sales have plummeted since mid-2022, new projects are not financially viable and starts are following a similar trajectory to sales,” he says. “This is why BILD has been advocating that governments of all levels do something to address the taxes, fees, and charges they put on new homes that adds 25% to the cost of an average new home in the GTA.”

The Provincial Government’s Tough Target

To achieve its ambitious goal, Ford's government has set housing targets for the province's 50 largest municipalities. They've also established a $1.2 billion Building Faster Fund to incentivize municipalities to meet these targets. Municipalities that achieve at least 80% of their annual target receive funding, with additional bonuses for those that exceed their targets.

Late last month, however, the Ford government revealed that housing starts had declined since the last budget... but still said they’d meet target goals. While the province needs at least 100,000 new homes built per year to achieve the target, their fall economic statement reveals that Ontario is not on track to make this a reality between 2024 and 2027. In fact, projected housing starts fall in each of these years. The fall economic statement revised the 2024 housing starts projection from 87,900 to 81,300. This comes significantly short of the Ontario government's goal of 125,000 new homes in 2024, as outlined in the statement.

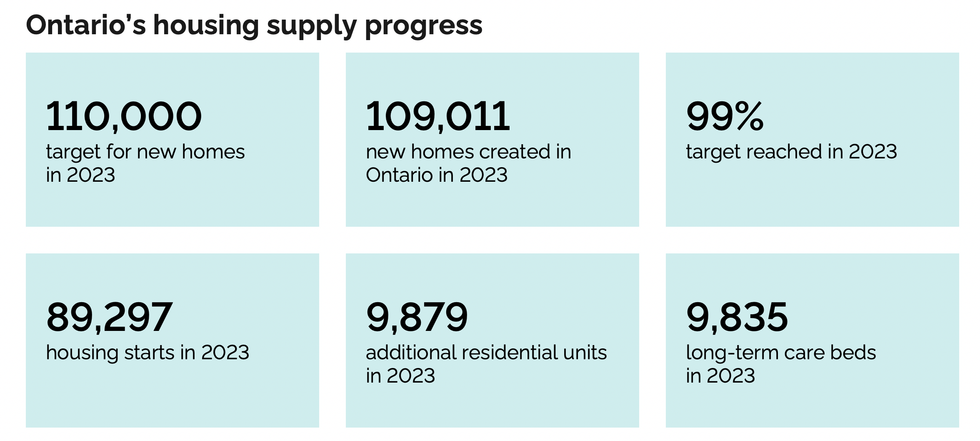

Despite passionate voices from opposition parties, the provincial government says it’s doing just fine in the new home-building department, thank you very much. On its website, a tracker boldly reveals the province’s housing supply progress, based on monthly housing starts and ARUs data provided by the Canadian Mortgage and Housing Corporation (CMHC). Figures show that the Province reached 99% of its housing start target of 110,000 new homes completed in 2023 – with 109,011. Meanwhile, the province saw 89,217 starts in 2023, as well as the addition of 9,879 residential units, which includes non-residential space that is converted to residential units and residential to residential conversions.

“Ontario has achieved the highest housing starts the province has seen in over three decades,” wrote Justine Teplycky, director of communications for provincial housing minister Paul Calandra, in an email to STOREYS. “However, as a result of high interest rates caused by the federal government’s runaway tax-and-spend policies, including the federal carbon tax, homebuilders across the province face a challenging economic environment that is impacting the pace of new home construction.”

As a result, Teplycky says the government is taking proactive measures to address everything from legislation delays to filling the missing middle. “Our government is redoubling our efforts to support the building of even more homes faster by cutting red tape and streamlining approvals,” says Teplycky. “We’ve introduced a new Provincial Planning Statement to provide municipalities with greater flexibility to build more housing. We’ve introduced common sense rules to help encourage the construction of garden, laneway, and basement suites. And we’re investing over $3 billion to address what municipalities have identified as the number one obstacle to building housing, critically needed housing-enabling infrastructure.”

In true Ford government form, Teplycky says these initiatives are more impactful than proposed solutions from other political parties. “In contrast, the NDP wants to double down on inflationary spending with a $150 billion dollar scheme that proposes to build only a fraction of the homes we need, and the Liberals are proposing to copy the federal government with a retail sales tax that will make everything we buy more expensive,” says Teplycky.

Missing the Mark

A report published on November 14 from the Financial Accountability Office of Ontario drove home the reality that Ontario’s new home construction wasn’t looking as promising for 2024 as it (sort of) was for 2023. According to the report, the province saw a total of 20,600 housing starts in Ontario in 2024 from April to September – a 16.9% decline from the 24,800 starts in Q3 of 2023. Most notably, the construction of single-family homes has dramatically dropped. In 2024 Q3, 77% of total housing starts were multiple dwelling units, while 23% were single detached homes. In fact, the construction of single detached homes is on track for the lowest level of annual starts since 1955.

The report cites “affordability challenges, changes in household preferences, and planning efforts aimed at increasing density” as reasons for this declining share of single-family homes. Indeed, in places like Toronto’s core, single-family homes – especially new ones – are becoming an increasingly rare sight.

The report outlines that, to meet its goal of 1.5 million homes by the end of 2031, it would require an average of 34,100 units per quarter, beginning in 2021 Q1 – and that’s not currently happening. From 2021 Q1 to 2024 Q3, Ontario has started an average of 22,900 units per quarter. “To reach the government’s target by the end of 2031, an average of 39,900 units would need to be started per quarter beginning in 2024 Q4,” reads the report. “This represents a 74% increase in the pace of units started since 2021 and about 5,500 above the highest number of starts ever recorded of 34,400 in 1973 Q3.”

Yikes.

To say this seems like a pretty challenging prospect – for housing starts to nearly double – given the current state of things, would be a vast understatement.

When it comes to the future of housing starts, a new report from RESCON isn’t exactly a hopeful one, indicating a predicted decline in housing starts in the upcoming years. Inevitably, this decrease is expected to worsen the current housing shortage throughout the province.

In Housing Market Outlooks in Ontario, RESCON’s analysis underscores the mix of factors that are negatively impacting the construction of new homes across Ontario. A relentless culprit is climbing construction costs. The report highlights that the rising cost of land and government-imposed fees, such as development charges, are the primary factors driving up housing prices. Due to these increased costs, constructing new low-rise housing, in particular, is becoming financially unviable.

This is particularly true in the infamously pricey Greater Toronto Area (GTA) region. Here, municipal fees for single-family homes have jumped $42,000 from last year to a head-shaking average of $164,920, according to BILD. Meanwhile, apartment fees have climbed $32,000 to $122,387. Adding insult to injury when it comes to prices, the report found that approval delays cost developers between $2,672 and $5,576 per month, depending on the municipality. This can raise the cost per unit by up to $90,000.

RESCON's report's long-term outlook presents two scenarios, with both anticipating a continued decrease in housing starts and employment until 2025. A gradual recovery is projected between 2026 and 2028. By the end of 2028, however, conditions will not have fully recovered. As a result, housing availability is expected to remain limited, keeping prices elevated.

Ontario Lags Behind Other Provinces In The Race To Build Homes

Figures released recently from the Canadian Mortgage and Housing Corporation (CMHC) reveal that Ontario housing starts fell significantly behind the national trend between January and October 2024. While the rest of Canada saw an average increase of 14,000 housing starts, the province initiated 13,000 fewer homes during the same period compared to the previous year.

Meanwhile, a new Smart Prosperity Institute (SPI) report authored by Mike Moffat, Economist and Senior Director of Policy and Innovation at SPI, shows that Ontario has lagged behind the other provinces when it comes to new homes for quite some time now.

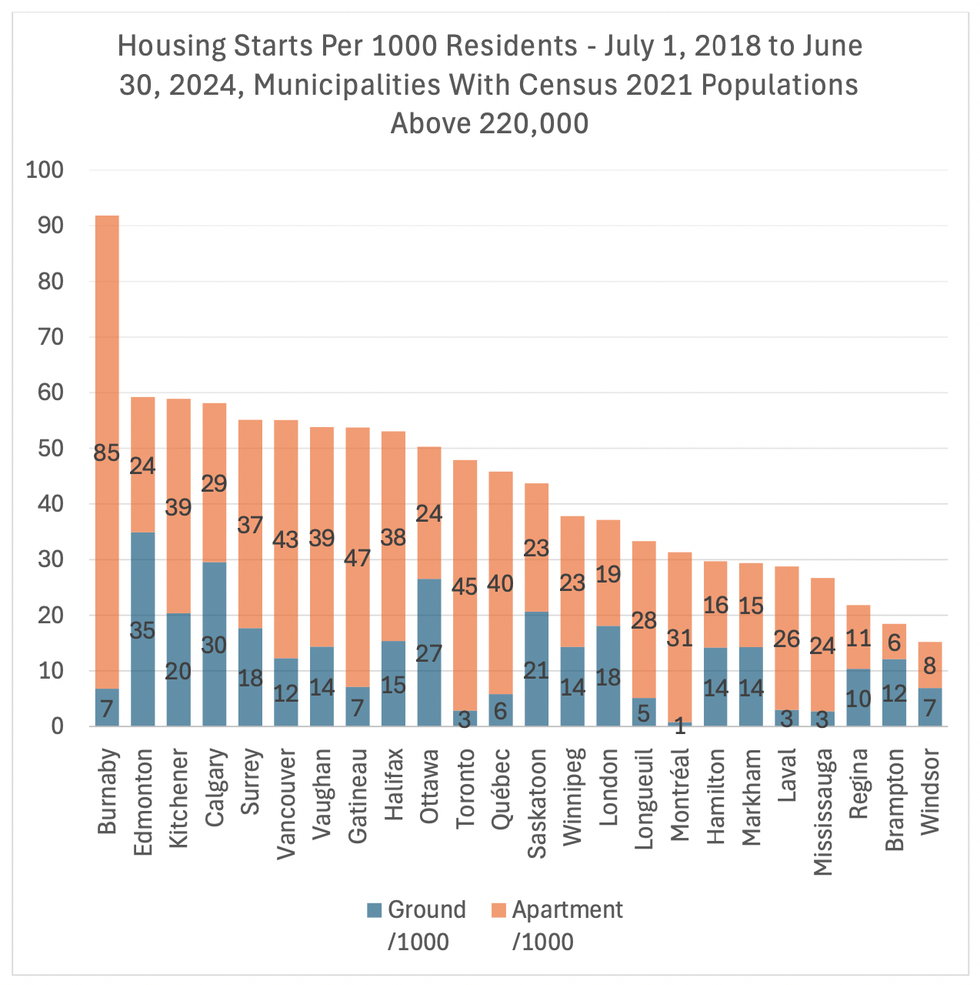

According to the report, data for 2024 suggests that Ontario's homebuilding rate per capita is worsening. The province has consistently ranked in the lower half nationally over the past six years. While British Columbia had eight communities and Quebec had four in the top 20, only three Ontario communities — Pickering, Oakville, and Kitchener — reached this level. In fact, Ontario's cities and towns accounted for 13 of the 20 lowest spots in per-capita homebuilding. These included Aurora, Brampton, Peterborough, St. Catharines, Ajax, Windsor, Burlington, Halton Hills, Sarnia, Sault Ste. Marie, Sudbury, Thunder Bay, and North Bay.

“If we can identify what jurisdictions and municipalities are doing well, then we can start to identify why they’re doing well and adopt the best practices that they’re doing,” says Moffatt. “Kitchener, for example, has done a good job in allowing for density and their official plan has been quite helpful zoning-wise when it comes to welcoming diversity of housing types.”

While every province is obviously dealing with the same aforementioned high interest rates, things like provincial differences in approval times influence the outcome. “Why can a municipality like Edmonton return an approval in six months, but it takes on average 20 months in the GTA?,” asks Sherwood. Tellingly, Alberta has seen record-breaking numbers of housing starts in the first half of the year.

It's Everyone's Problem

The housing supply crisis is an issue for all Ontario residents – even those who own appreciating houses with manageable mortgage payments. “Housing affordability is at an unprecedented level which is having a broader impact on the economy and lowering quality of life for many,” says Lyall.

In his report, Moffat outlines the consequences of six years of slow growth on the homebuilding front. In no uncertain terms, he highlights how Ontario’s inability to build new housing has resulted in record-low vacancy rates, sky-high rents, record food bank use, and an unofficial estimate of 234,000 Ontario residents experiencing homelessness.

“Today’s housing starts are the housing supply of tomorrow,” says Sherwood. “If ‘starts’ are the lowest level now since 1955, then over the next few years the new supply coming to the market will be the lowest level since 1955. This will mean price appreciation, when the objective of the entire exercise of expanding supply is intended to increase affordability. But this isn’t just about putting roofs over people’s heads – it’s about the socio-economic wellbeing of the economic engine of Canada. What happens when young families and workers leave the region in pursuit of housing choices and prices they can afford?”

The SPI report highlights how inadequate housing has contributed to a "brain drain" in Ontario. Over the past four years, the province has seen a net outflow of over 100,000 people to other provinces, says Moffat. This migration pattern suggests that a significant number of educated and professional individuals are leaving Ontario in favour of better housing options and improved living conditions (and, perhaps, remote work culture).

Recent record-breaking immigration won’t fill all the holes, either. “It’s a question of who is leaving, and we are losing a lot of talented young people just starting out their careers,” says Moffatt. “It doesn’t help out society if people go to school here but realize that they can’t afford to live here and move out to Edmonton, where wages are the same and home prices are half as much. We desperately need these people – the ones most likely to leave – in our province.” Our cities only work if we have a robust middle class, says Moffatt. “We need to have nurses, teachers, doctors, and electricians live within the city,” he says. “There’s no point being an aging person in the city if you can’t find a personal support worker or all of the services you need.”

As for the fortunate set who already own their homes, they should care too. “On one hand, I live in a single-family, detached home, so some may think people like me benefit from housing scarcity and high prices,” says Moffatt. “But, I want my daughter to also be able to afford a home and she won’t be able to do that if housing is scarce. You may like housing scarcity as a homeowner, but you’d probably like to have a teacher at your kids’ school and nurses in the hospital. So, we can’t price the middle class out of our cities.”

Furthermore, as highlighted in RESCON’s report, employment in new residential construction has peaked and will likely fall further in the years ahead. The slowing construction of new homes could lead to widespread job losses both in the housing sector and industries linked to construction.

'Building' The Path Forward

What needs to be done? Clearly, something. Experts agree that it comes down to cutting development charges, speeding up the permitting process, zoning reform, and better land use planning to accommodate our growing population.

“With a critical need for new housing, it is imperative that all levels of government take immediate action to boost construction by lowering taxes, fees, and levies and reducing the red tape and bureaucracy which slows the industry and adds to the cost of housing,” says Lyall. “To spur the market, we need conditions that allow builders to build houses that people can afford. Otherwise, we may be in dire straits as new home construction stalls and unemployment in the industry rises.”

RESCON’s report states that for new home sales to rebound, affordability must be restored to previous levels. This can be achieved through a combination of lower interest rates and reductions in government-imposed costs and land prices. However, both scenarios are unlikely. The report also highlights other challenges that need to be addressed, including delays in land use approvals and infrastructure development, the limited availability of developable land for builders, and stricter mortgage regulations that have reduced the borrowing capacity of buyers.

“If we lower fees, we can lower costs, more people can afford to purchase pre-construction, we get more housing starts and we increase supply,” says Sherwood.

Lyall tells STOREYS new actions could have a positive impact. “For example, the recent plan floated by the federal Conservatives to remove the sales taxes on new housing sold for under $1 million, the recent announcement that Vaughan would dramatically cut its development charges back to 2018 levels, and new efforts by the Province to further reduce red tape could all help,” he says.

The City of Toronto recently passed a package of measures to offset the cost to build crisis by reducing development costs and property taxes for a defined period -- but Lyall and Sherwood say it falls short.

"This package recognized the problem, but defined the solution so narrowly that only a handful of projects could qualify – specifically the city’s own Housing Now projects," says Sherwood. "If those projects were finding it challenging to proceed, on city donated lands with federal financial support, is it no wonder that market rate projects for the average resident are struggling. While BILD applauds the City for taking a small step forward, we are calling for a much more comprehensive package to jump start the estimated 30,000 stalled units in the City of Toronto alone. Addressing stalled out residential construction requires a package that delivers development charge and property tax relief for stalled purpose built rental projects and development charge relief for stalled condo projects."

If immediate action isn't taken, the grim reality is that we will have a serious shortage on our hands, with the crisis worsening, in the near future. There is room for optimism, however. “We have a dynamic, vibrant, and innovative home grown residential construction sector in the GTA,” says Sherwood. “They have literally built the communities, towns, and cities of where we all live and work, and many local home builders are now some of the largest home builders across North America, building across Canada and the United States. In the right environment, with the right supportive policy framework today’s challenges are solvable and our industry can deliver.”