The old adage that speaks to paying through the nose to live in a shoebox-sized condo apartment (as long as it's in the heart of the city), is one that, many a Torontonian will agree, has hit the mark.

But that might be changing.

Whether the digs have been in downtown proper, or on the east or west side of town, city-dwellers have long justified sky-high rents for their tiny apartments simply by looking to all the joys and adventures that await them in the urban streets.

That's what we're really paying for, they might say. The adventure outside my four walls.

But, in the days of COVID-19, those city-specific delights -- the independent café, the family restaurant, the night out at the wine bar -- have felt increasingly out of reach... which has brought the worthiness of a pricey-but-tiny condo's cost into question.

And the numbers are proof.

READ: Freehold Homes Continue to Outpace Condos as Buyers’ Preferences Shift

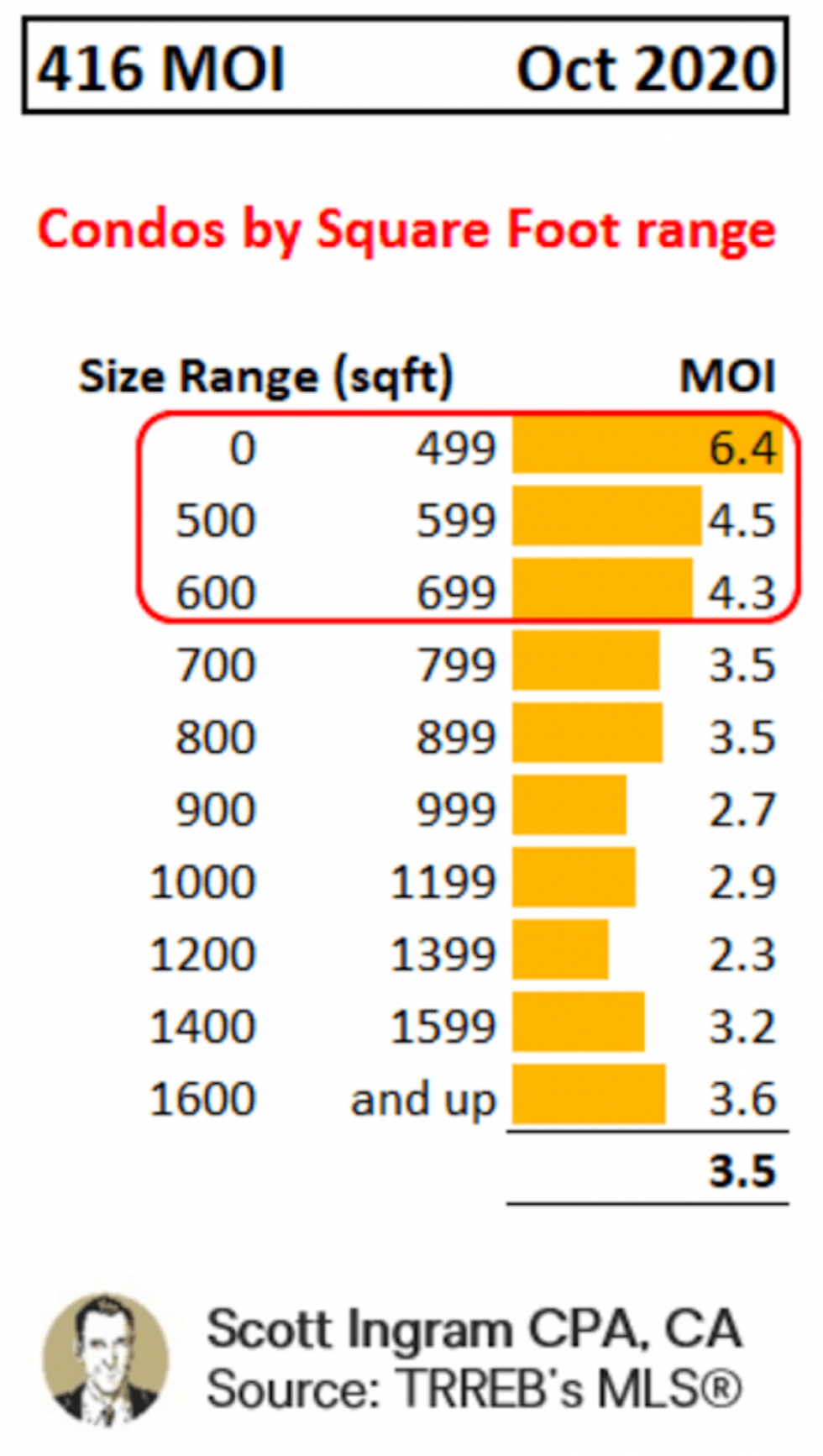

According to Toronto realtor and chartered accountant Scott Ingram, October data from TRREB's MLS showed the Months of Inventory (MOI), or the number of months it would take to sell current inventories at the current rate of sales activity, to be 6.4 for condos ranging from 0 to 499 square feet.

For spaces 500 to 599 square feet and 600 to 699 square feet, the MOI were 4.5 and 4.3, respectively.

Ingram said his analysis shows data for both apartments and townhouses, though apartments typically represent 90% of the total units.

"There's only so many ways you can lay out 450 square feet, so [the] only differences would be location and the building's amenities. But with many amenities not accessible right now, if you're a renter signing a one year lease you may never be able to access the pool in the course of your tenancy," says Ingram.

The numbers analyzed in the above chart specifically apply to the resale market, however, and Ingram notes they're not the standard.

"The unusual thing for the MOI shown above is that MOI usually increases by price point. So the entry level prices have a way larger buyer pool so those units tend to turn over much quicker than $2 million penthouse condos do. And prices increase with size generally, so for these smaller sized units to have the highest MOI is really something."

Indeed, the average MOI for units smaller than 700 square feet, according to Ingram, is 4.6 -- well over the mean for units over 700 square feet (3.1).

"I checked based on what's available right now and 11.6% of the condos for sale in C01 and C08 are 0-499 [square feet]. In the rental market that's 15.8%. Now I don't have a historical comparison for this to see if those numbers are high or low, or which way they're trending, but if those places aren't popular right now then you figure it should hurt the rental market more. If I look to under 600 square feet, 32% of the active listings in the condo resale market downtown (C1 and C8) are that size. But in the rental market 40% are under 600 square feet," Ingram says.

Ultimately, the smaller spaces -- which, Ingram explains, are a lot more likely to be investor-owned -- are facing challenges right now, regardless of whether they're leasing or selling.

Of course, condos come in all shapes and sizes, with many offering perks like storage, private outdoor space, and, if you're lucky, unmatched views. But there's no denying that when it comes to dwellings with more space, ground-level homes are top of mind. It fits, then, that as October's numbers show a general sway from smaller spaces, the third quarter of 2020 saw a 58% increase in transactions (and a 13% increase in prices) for freehold houses in Toronto, according to real estate agent Doug Vukasovic.

Recent data from online mortgage brokerage nesto backs up Vukasovic's report, revealing that in September, homeowners targeted houses over condos for their next property.“Enabled by a future of remote working being the new normal, our users are fleeing the condo-life for more house and land, with less crowding,” reads the nesto report.

“In Toronto, this price-growth disparity between freehold homes and condos is worrisome: If the gap continues to widen, it will become harder, and take longer, for current condo owners to trade up into the freehold market,” said Vukasovic.

And, based on Ingram's analysis, for those simply hoping to level up from their shoebox into a condo that boasts enough space for an office chair, finding a new home looks like it'll be easier -- and quicker -- than offloading your last one.