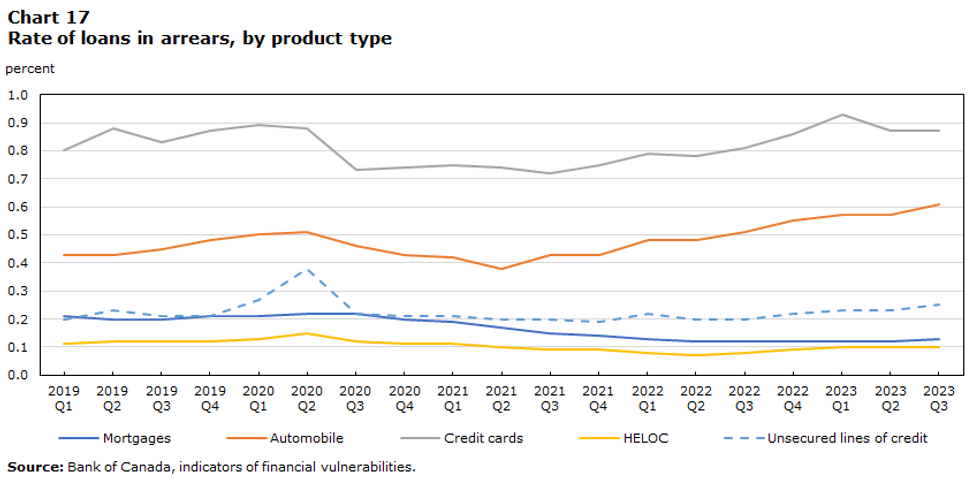

Despite the fact that arrears for auto loans, credit cards, home equity lines of credit, and unsecured lines of credit are all on the rise, mortgage loan arrears appear to be bucking the trend — though mind you, it's a fairly nuanced matter.

Data released Wednesday from Statistics Canada (StatCan) shows that, between the first quarter of 2019 and the third quarter of 2023, the percentage of mortgage loans in arrears edged down from 0.21% to 0.13%, representing the only loan product type to see a decrease during that course of time.

“Households with loans in arrears are those that are late on their debt payment obligations by 90 days or more,” StatCan said of non-mortgage loan products specifically. “During the first and second quarters of 2020, all loan categories saw a slight increase in arrears, as closures in several sectors of the economy put financial stress on many households. Government support to households during the pandemic contributed thereafter to a decline in arrears as households’ disposable income rose. However, as interest rates began rising and the government pulled back on COVID-19-related support, non-mortgage loan arrears began to climb again in 2022.”

On the contrary, StatCan’s data indicates that mortgage loan arrears have not ticked up on par with interest rates, and have remained below pre-pandemic levels.

There are couple of things at play here. For one, despite interest rates being brought up to a 22-year high of 5% in 2023, not all borrowers that have hit their trigger rates have seen an increase in their mortgage payments, said StatCan.

“Some chartered banks have been accommodating borrowers by allowing the principal owed to grow to 105% of the original loan value before requiring any additional payments. Consequently, the share of mortgages with an amortization period longer than 25 years has been increasing. The share of new uninsured mortgages with an amortization period longer than 25 years rose to 52% in the third quarter of 2023, up 12% from 40% in the third quarter of 2019.”

“Ultimately, borrowers who have extended their amortization period will not see an increase in their payments before the end of their term,” the government agency went on to say. But it also warned that borrowers who have extended their amortizations will face significant interest rate shock when it comes time to renew. “According to the Bank of Canada, these borrowers will need to increase their payments by approximately 40% to maintain their original amortization schedule, assuming a renewal in 2025 or 2026.”

Meanwhile, according to a widely-cited estimate from Canada Mortgage and Housing Corporation (CMHC), some 2.2 million mortgages will be facing interest rate shock over the course of this year and next, and that figure represents around 45% of all outstanding mortgages in the country.

“Most of these borrowers contracted their fixed-rate mortgages at record-low interest rates and, most likely, at or near the peak of housing prices around 2020-2021,” said CMHC in a research report from November 2023. “This holds true for both households who took out a mortgage when buying their new home. It also applies to the numerous existing homeowners that used the increased equity on their property by refinancing and taking cash out for consumption.”

“The total amount of mortgage loans to be renewed during this period represents over $675B, which represents close to 40% of the Canadian economy,” CMHC also said at that time.

There are other estimates out there when it comes to renewals and rate shock, and those are similarly gloomy. RBC Capital Markets analyst Darko Mihelic wrote in a report (again from November) that as many as 60% of Canadian mortgages have been and will be up for renewal by 2026, and that “payment shock” is on the horizon those who locked in fixed-rate products prior to the Bank of Canada’s barrage of interest rate hikes and variable-rate carriers alike.

“Variable-rate mortgagors are set to see significant payment shock, perhaps as high as 84% by 2026 if interest rates do not decline,” Mihelic warned. “Interest rates would need to decline significantly to ‘save’ this cohort.”

Mihelic added that, unless interest rates decline significantly, “credit losses will inevitably rise, perhaps significantly in 2025 and beyond.” This would present a risk to Canadian chartered banks, as payment shock is likely to lead to mortgage delinquencies and implicate loan and revenue growth.

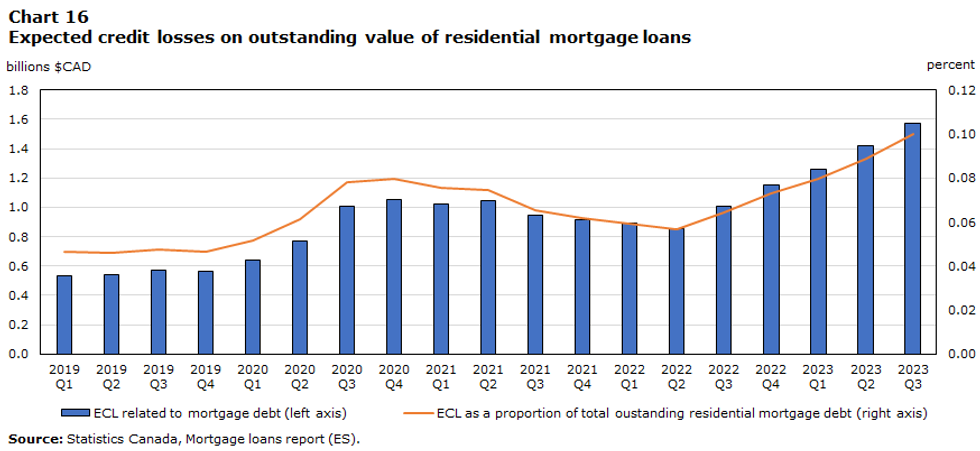

Circling back to StatCan's data from Wednesday, the government agency said that while credit losses are expected, they represent a small part of total mortgage loans.

“As part of their risk management activities, financial institutions estimate the proportion of their mortgage loan portfolio that may default within each period. These expected credit losses (ECLs) are based on actuarial assumptions that attempt to anticipate the default rates on their loans and, subsequently, the amount of impaired loans that may need to be written off in each period.”

According to the data, ECLs related to mortgage debt were at $1.6B in the third quarter of 2023, representing 0.10% of total outstanding residential mortgage debt. Even so, both of those figures are up substantially from pre-pandemic levels ($5M and 0.05% in Q1-2019). ECLs related to mortgage debt have peaked to their highest level, StatCan said.