"In 2025, many of the challenges that defined the presale market in 2024 are expected to persist," said real estate sales and marketing firm MLA Canada in its 2025 Intel Report, published today.

One significant challenge is the absence of investor purchasers, who represent an important segment of the presale market and are now having difficulty achieving the rental income and positive cash flow they need to cover mortgage payments and justify their investments. This will likely have an impact on the feasibility of larger-scale concrete towers, MLA Canada says, as those projects are more reliant on investors than smaller projects.

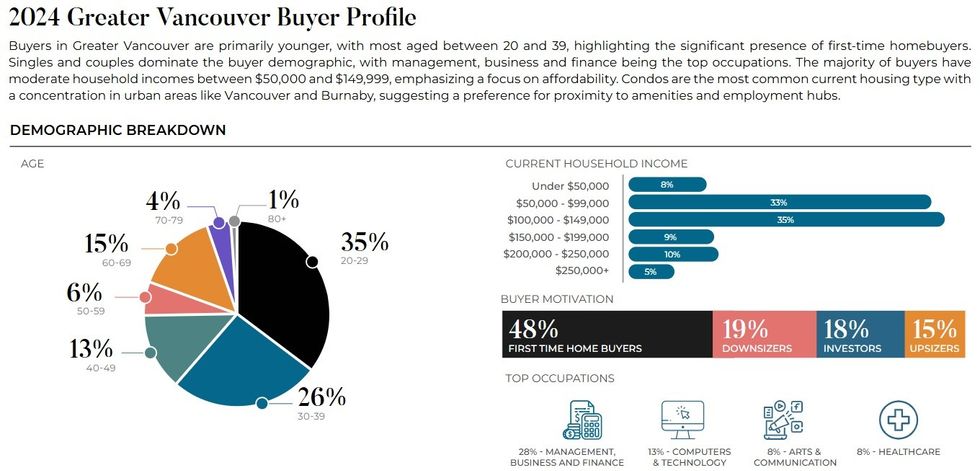

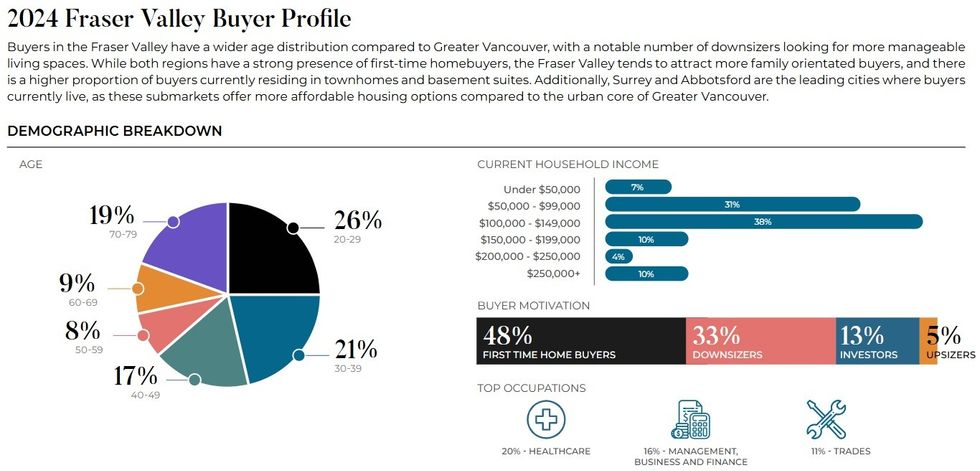

As a result, the 2025 presale market in Metro Vancouver will likely be driven by end users and first-time buyers, who may be less influenced by present-day market fluctuations. With affordability remaining a top priority, this means much of the presale market interest is expected to be seen in smaller-scale low-rise projects.

For developers, buyer uncertainty from 2024 is also expected to be carried over into 2025. Under British Columbia's Real Estate Development Marketing Act (REDMA), developers have 12 months to obtain a building permit, which typically entails hitting the presale targets required by their lender. With uncertainty permeating the market, a growing number of projects are at risk of missing their 12-month deadlines. If those deadlines are missed, developers are required to give presale purchasers the option to exit the purchase agreements.

Another challenge is the resale market, which will need to improve before the presale market will see growth, says MLA Canada.

"Contract completion risks for projects sold at peak prices from 2020-2022 will persist, reflected in rising 2024 assignment activity at or below original sale prices, adding pressure to the resale market. While resale prices are expected to rise 3-6%, this is unlikely to boost presale demand until later in the year. Resale prices remain about 20% lower than presale for concrete and 10% lower for wood frame, requiring roughly a 5-10% increase in resale pricing to result in presale price growth."

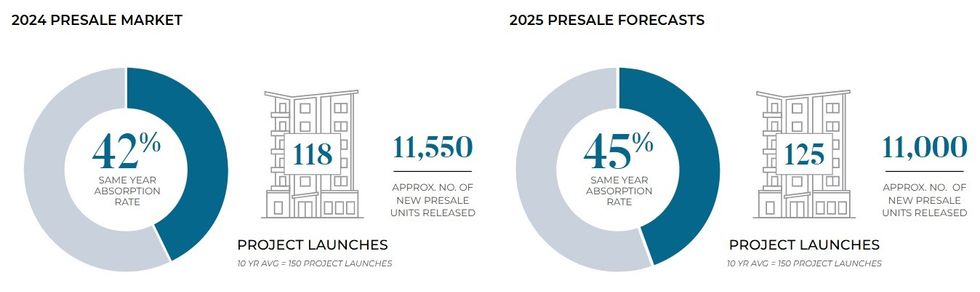

After projecting 110 project launches for 2024 and ultimately seeing 118, MLA Canada is projecting a total of 125 launches in 2025. Despite the increase in launches, the amount of new presale units is expected to decrease, as a result of the aforementioned buyer focus on smaller-scale projects. Same-year absorption, however, is expected to see a small uptick from 42% to 45%.

2024 Presale Market Breakdown

The 118 launches and 11,550 units released in the Lower Mainland in 2024 were split as follows:

- Greater Vancouver: 54 launches, 5,083 units released; and

- Fraser Valley: 64 launches, 6,467 units released.

"Greater Vancouver's presale market experienced a decline in both the number of projects and units launched in 2024 compared to 2023," said MLA Canada. "While project launches decreased by 21.7%, the total number of units decreased by almost half, with only 5,083 units released. This disparity indicates a shift toward smaller-scale projects, departing from trends in 2021 and 2022 where concrete developments dominated the region."

In recent years, presale launches in the Lower Mainland typically saw a 60%-40% split between Greater Vancouver and the Fraser Valley.

"Buyers are increasingly attracted to the balance of suburban and urban lifestyles offered in the Fraser Valley," added MLA Canada. "They've taken advantage of the region's more affordable price points, especially in markets like Surrey and Langley, which are easily accessible by transit or by Highway 1. Wood frame condominiums have consistently attracted buyers in 2024, as evidenced by stronger sales performance compared to concrete offerings."

According to MLA Canada, of the 6,467 units released in the Fraser Valley in 2024, 57.7% were woodframe construction, 30.1% were concrete, and 12.2% were townhouses projects, and absorption was also much higher in woodframe projects (52.0%) than concrete projects (30.7%).

A big theme across both the Greater Vancouver and Fraser Valley market in 2024 was the use of presale purchase incentives, such as reduced deposit structures, guaranteed rental income for investors, and giveaways.

"While traditional monetary savings remain a key offering, these newer strategies often move beyond immediate financial discounts, focusing instead on easing psychological barriers for buyers and providing greater flexibility," said MLA Canada.

Presale purchase incentives, along with strong brand recognition and proven track records, are expected to remain as important as ever in 2025.

In addition to the 118 launches projected for 2025, MLA Canada is also expecting the completion of 98 projects that launched around 2017 and 2018, adding 14,812 new homes to the market.

"While the number of completing homes is relatively small, over half remain unsold," MLA Canada noted. "These units are entering a market where appraised values are often significantly below the original presale prices, creating serious completion risks for buyers and developers alike."

"Looking ahead to 2025, the road remains challenging. Developers continue to face high costs, regulatory uncertainty, and slower presales. Many are opting to delay launches as the market absorbs existing resale, assignment, and standing inventory. This reflects a market with more sellers than buyers, emphasizing the importance of creative marketing strategies and strong sales practices. Persistence will be paramount this year."

- CURV Developer Sues Presale Purchaser Over Unpaid Deposits On 4 Units ›

- Wesgroup SVP Of Development Brad Jones On The Challenges With DCCs, REDMA ›

- BCFSA Launches Pilot Program Extending REDMA Presale Period ›

- KEY Marketing's Cam Good On Why The "Condo Day" Concept Works ›

- BC Extends REDMA Presale Period. Will It Make A Difference? ›