As Ontario struggles with a significant undersupply of housing, investors are holding onto a marked share of condominium apartments across the province.

According to newly-released data from Statistics Canada (StatCan), investors, including landlords, short-term rental owners, businesses, and developers, accounted for 41.9% of the condos owned in Ontario in 2020. In the City of Toronto, investors made up 36.2% of condo owners.

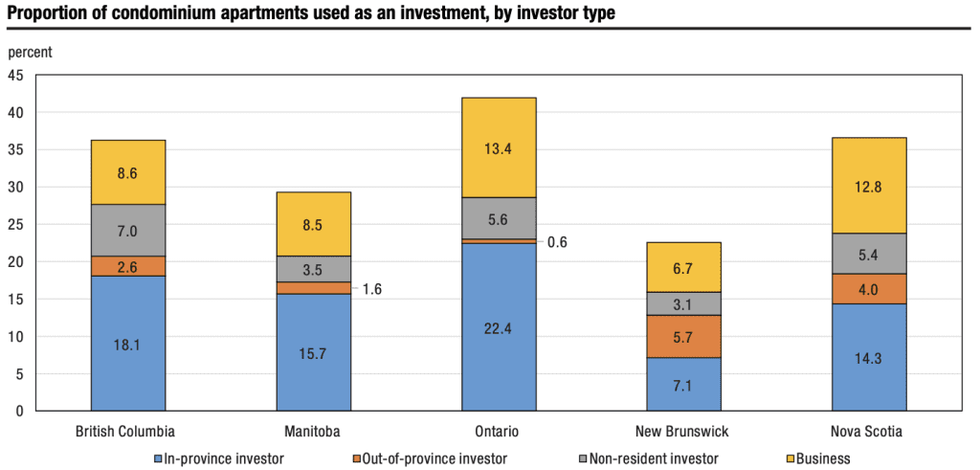

Businesses owned 74,485 condo apartments for investment purposes, or 13.4% of the property type, in Ontario. However, at 22.4%, the majority of condos used as an investment were owned by in-province investors, like landlords. Non-resident investors accounted for 5.6% of condo owners.

The StatCan report looked at the proportion of investors among homeowners in five provinces, which, in addition to Ontario, included British Columbia, Manitoba, New Brunswick, and Nova Scotia. Of all the homeowners in Ontario, 20.2% were investors. The figure was highest in Nova Scotia, at 31.5%.

Across all five provinces, 918,695 houses were used as an investment, of which 584,615 were in Ontario alone. As with condos, in-province investors accounted for the highest proportion of owners, at 10.9%, while out-of-province investors made up just 0.3% of owners. The latter figure is likely due to higher real estate prices, StatCan noted.

Properties located outside CMAs were more likely to be used as a secondary residence or a recreational property, like a cottage, when the owners resided in the same province. Having a pied-à-terre in the city as a secondary residence was less common, the report found.

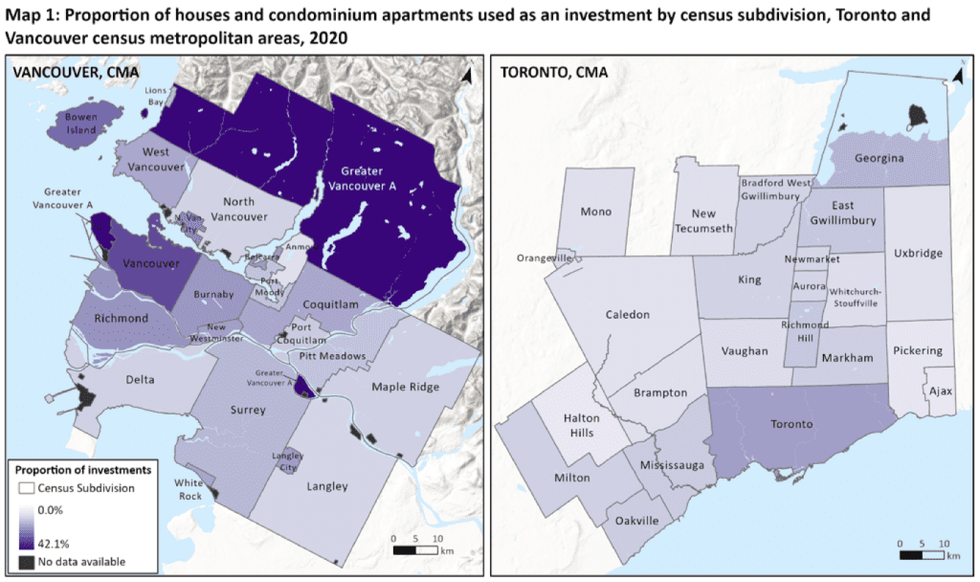

In the Toronto CMA, which stretches east to Ajax, west to Milton, and north to Georgina, investment properties - both condos and houses - were concentrated in the downtown core.

While the proportion of investment properties in the CMA as a whole was 16.3%, in the City of Toronto it was 21.7%. This amounts to 112,220 condo apartments and 52,935 houses being used as an investment in the city in 2020.

"When properties are owned by investors, they can contribute to the rental housing supply -- and therefore meet the population's need for rental housing," the report noted. "But that can also limit the number of properties available to buyers who intend to use it as a primary place of residence."

According to the latest census data, homeownership rates in Ontario declined by 3% from 2011 to 2021, while renter households grew by 25.1%.

On a provincial level, Ontario had the second-highest rate of unaffordable housing in 2021, at 24.2%. Toronto had the highest rate of unaffordable housing of any CMA, at 30.5%