There could be some good news on Canada’s interest rate front. In its latest provincial forecast, CIBC Capital Markets predicts that the country could be in store for a 1.25% rate cut in 2024.

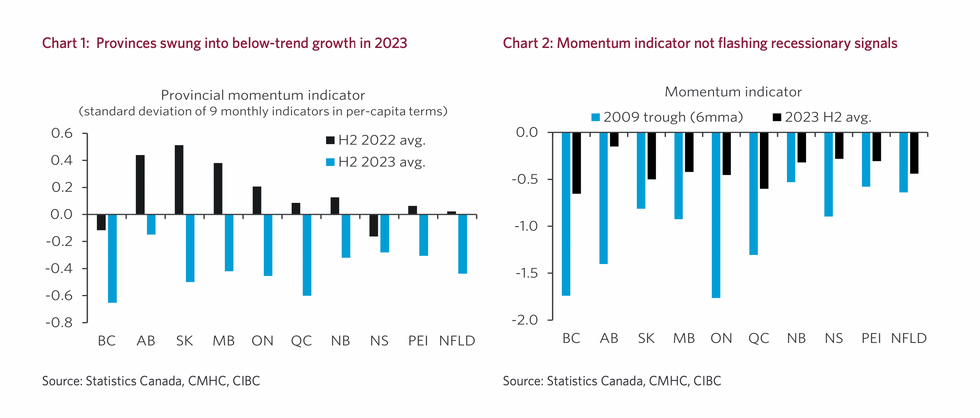

The report’s overall theme is that economic growth will be unlikely in the first half of 2024. It begins by declaring that this year will be characterized by slowing growth across the country – something that comes as little surprise to many, in a climate rife with recession talk. Times are bleak for economies across the country, with activity shifting from above trend growth at the end of 2022 for most provinces, to below trend growth by the second half of 2023.

However, author Katherine Judge says that the country won’t “tip into an outright recession,” thanks to anticipated rate cuts from the Bank of Canada (BoC) this year. According to Judge, CIBC economists expect that Canada’s central bank will cut interest rates by 125 basis points (bps) this year, with a 25-bp cut expected in June.

While it’s still not where we were on the rate front this time two years ago, it’s still something – and a much needed relief to countless Canadian households from coast to coast.

“Rate cut expectations should provide some reassurance to provincial governments as budget season approaches, since fiscal room to cushion the growth slowdown is limited, particularly in Canada’s most populous provinces,” writes Judge.

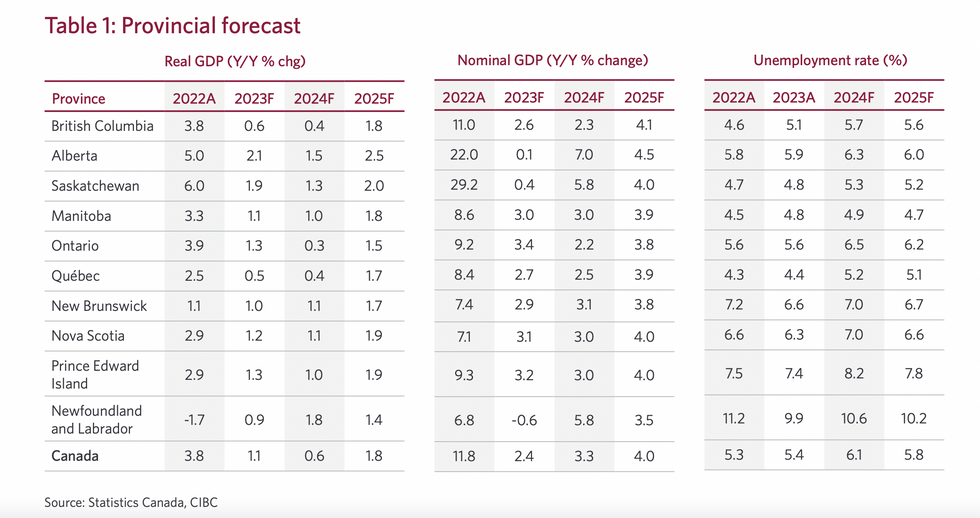

Naturally, some provinces will feel the economic pinch more than others. “Rather than being about which province comes out on top, however, it will more be about which provinces look the least bad,” writes Judge, bluntly.

Ontario and British Columbia, where the housing markets are notoriously pricey, will see the slowest growth, along with the Quebec, according to the report. “The cooling seen in BC and Ontario owes largely to constrained housing market activity and the impact of mortgage renewals on consumption, with an added negative for Ontario coming from the supply chain impacts tied to the auto sector strike in the US, and weakness in BC compounded by the port strike,” reads the report.

In both BC and Ontario, the percentage of mortgages in arrears is roughly in line with 2019 peaks, a time when financial stress was started to spread following a slowdown in growth. “But the mortgage market is being protected to a degree by the safety cushion built into regulatory changes that were introduced over the last decade,” acknowledges Judge.

Meanwhile, Quebec’s activity will be limited by a weaker population growth than other provinces, writes Judge, and is heading into 2024 on softer footing as a result of the strikes in the public sector. On the east coast, the Atlantic provinces “look less bad,” thanks in part to their robust population growth – something that picked up traction during the thick of the pandemic.

Judge predicts that commodity-producing provinces should see a boost due to stronger commodity prices and a recovery of the demand side as interest rates fall globally.

According to Judge, the housing market and related spending categories are set to rebound towards the end of 2024 as demand recovers with interest rate cuts. However, 2025 will bring “a new set of challenges and triumphs,” with the introduction of international study permit caps impacting BC and Ontario the most on the population front.

The latest report from CIBC is in line with expectations from most of the country's economists, who predict that spring showers will bring interest rate cuts. In December, a forecast from TD predicted that BoC will drop its policy interest rate to a much more attractive 2.25% by 2025. In the meantime, lending rates remain at 5% after the BoC's most recent announcement on January 24.