Canada’s first-time homebuyers – and would-be homebuyers – know that entering the Canadian real estate market isn’t exactly what it was for previous generations. Between sky-high interest rates, mortgage stress tests, and home prices (especially in major cities), times are tough for borrowers and prospective buyers across the country -- even those with what are widely seen as "good jobs."

And things didn't get any easier in 2023, even as prices softened in many parts of the country.

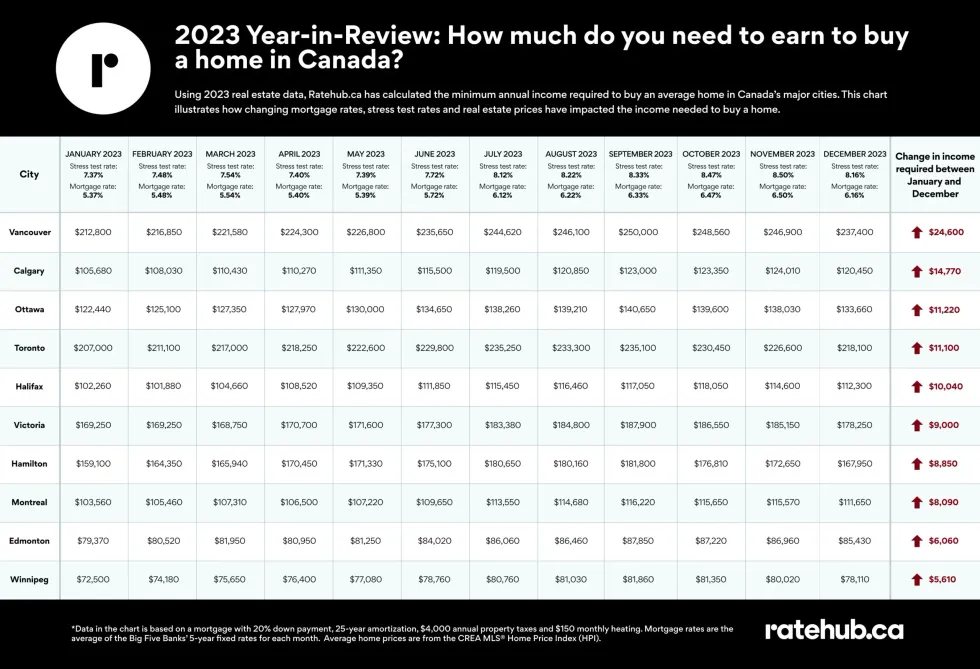

A new report from Ratehub.ca outlines how affordability declined in Canada over the course of 2023. Ratehub.ca compiled year-in-review data to illustrate how buying conditions deteriorated in each of the 10 major Canadian cities studied, thanks to changing mortgage and stress test rates and real estate prices. As Ratehub.ca highlights, the persistently high mortgage stress test rose over the course of the year from the 7% range to 8.16% today, based on an average fixed mortgage rate of 6.18%.

Of course, sky-high inflation and relatively stagnant wages don’t make things any better.

The report reveals the minimum income now required to qualify for a mortgage in each market. In some cities, this rather defeating figure isn’t for the faint of heart. In fact, Ratehub.ca had one word to describe housing affordability in 2023: “terrible.”

“This was a terrible year for home affordability in Canada; mortgage rates went up, driving the stress test higher and homes were more expensive in seven out of 10 cities,” says James Laird, Co-CEO of Ratehub.ca and President of CanWise mortgage lender. “The income required to purchase a home increased significantly in all 10 cities. The income required ranged from an extra $5,610 in Winnipeg all the way up to an additional $24,600 in Vancouver.”

As the report outlines, affordability declined in markets even where the average home price decreased due to the impact of the country’s high mortgage qualification. “The cities where home values dropped were Toronto, Victoria, and Hamilton, yet all three were still less affordable due to rising mortgage rates,” says Laird.

Coming as little surprise, the most challenging market was Vancouver, where the income required to purchase a home increased by $24,600, to a total of $237,400. According to Ratehub.ca, the notoriously pricey west coast city’s average price hit $1,168,700 in December, an increase of $57,300 since the start of the year.

Calgary – a city that’s seen its once relatively attainable home prices skyrocket in recent years – was the second most challenging in terms of the year-over-year change in income required to enter the market. Here, required income rose by $14,770 to $120,450, as home prices increased by a significant $44,600 over 2023 to an average of $554.500.

Next on the list is Ottawa, where required income rose $11,220 over the course of the year to $218,100. Meanwhile, in Toronto – a city that’s right up there with Vancouver when it comes to home prices, though it's seen a reduction in prices as of late – income required to buy a home increased $11,100, from $207,000 to $218,100.

Of course, with all this said, there are obviously other factors aside from income that impact one’s ability to enter the real estate market. Things like inheritances, parental financial gifts, and savings accumulated from perhaps living at home definitely help the fortunate set with access to these things.

Either way, as we set our sights on the year ahead, the state of Canada’s housing affordability hinges on the rate direction. As Ratehub.ca highlights, the country’s economists predict there could be some relief on the interest rate front come spring, when rate cuts could be in store.

In the meantime, Canadians are eagerly anticipating the Bank of Canada’s next interest rate announcement on Wednesday, January 24 (and potentially preparing themselves to ask for that well-deserved raise).