Home prices across Canada have fallen significantly since the spring of 2022, but amid strained inventory and high interest rates, purchasing property is still no easy feat.

Homeownership is a process made endlessly easier by familial support or a dual income, but it's not completely impossible to go about it on your own -- you just need to know where to look.

A new report from Zoocasa delves into which Canadian markets are the most affordable for single-income buyers, and which property types are the most attainable.

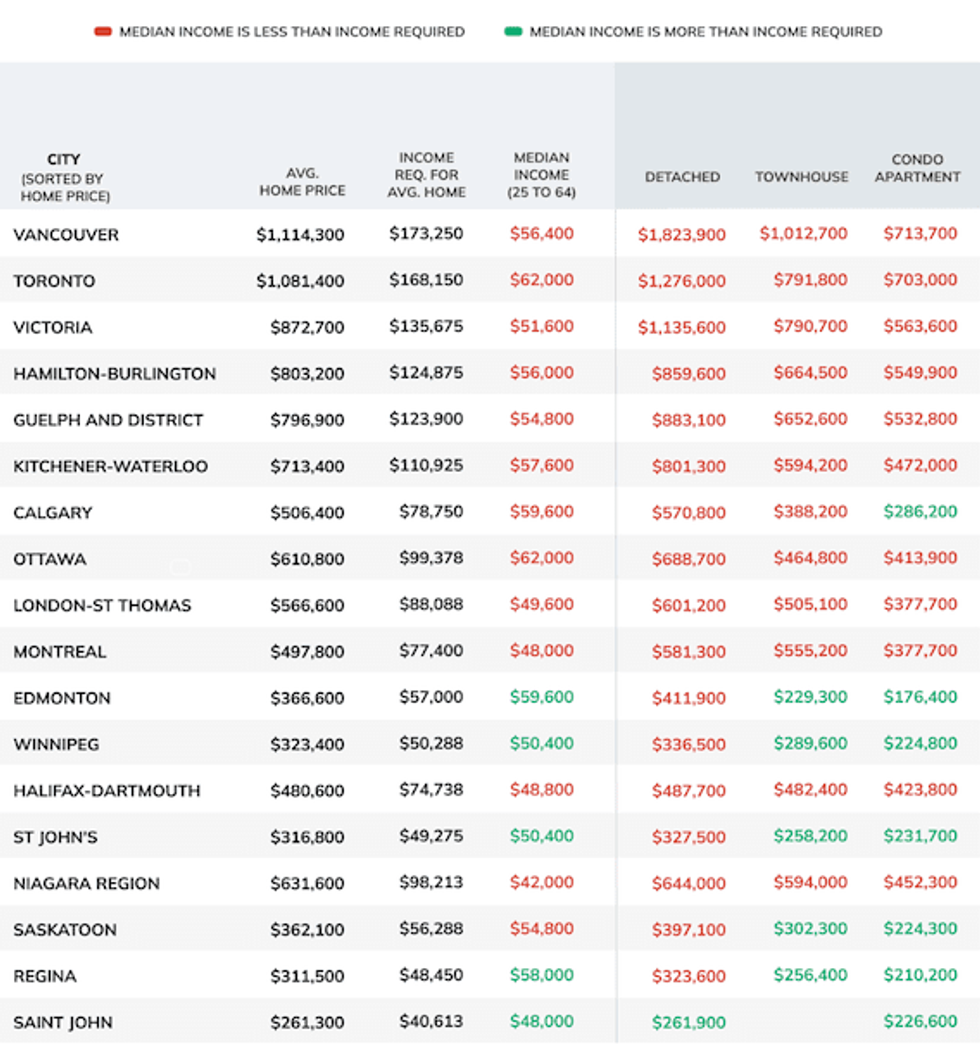

Using December 2022 home prices from the Canadian Real Estate Association (CREA), and assuming a 20% down payment, a 4.74% mortgage rate, and a 30-year amortization period, Zoocasa calculated the minimum income required to afford an average priced home in more than a dozen cities and regions across the country.

The results were then compared to median income data for people living alone, which was sourced from Statistics Canada's 2021 census.

Of the 18 areas analyzed, there were only five cities where a single person earning the median income could afford to buy the average home; Edmonton, Winnipeg, St. John's, Regina, and Saint John.

With just $48,450 needed to purchase the average price of a home in Regina ($311,500), it was deemed the most affordable city for single-income buyers, who make a median salary of $58,000 in the provincial capital.

Saint John, New Brunswick followed with a median income of $48,000 and just $40,613 required to purchase the average home at a price of $261,300.

While the east coast and the prairies are hospitable for single-income buyers, Canada's priciest provinces remain out of reach.

More than $173,000 is required to purchase the average home in Vancouver, but the median salary in the city is just $56,400. The $168,150 needed to afford the average Toronto home is more than double the city's median single-income salary of $62,000.

When broken down by property type, detached homes were almost entirely unattainable for single-income buyers. Only Saint John, where the average detached home costs $261,900, was within the realm of affordability.

Condominium apartments were the most affordable, with single-income buyers being able to purchase condos in seven cities, including Saskatoon (average condo price: $224,300) and Calgary ($286,200).

Affordable townhouses can be found in five cities, with Edmonton having the lowest average price at $229,300 -- "well within" the affordability range allotted by the city's median single-income of $59,600.

While the options may be limited, it's entirely possible to afford a home on a single income in Canada.