Actions to protect homeowners and communities from climate-related risks must be taken immediately, the Insurance Bureau of Canada (IBC) says, and the proposed solution is the creation of a Real Estate Climate Risk Index.

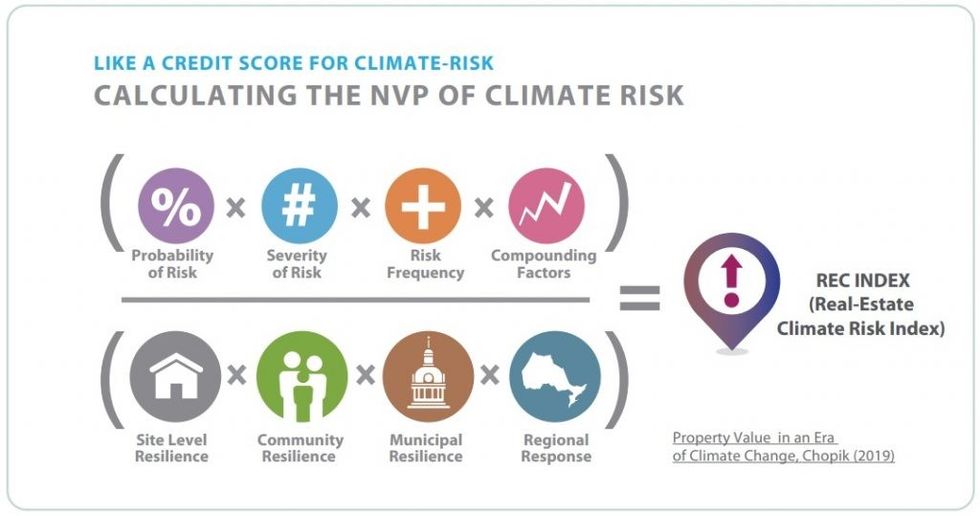

That Index would be like a credit score, based on a property's "susceptibility to catastrophic loss based on known risk factors," and would "form the basis for managing and reducing household, community, and municipal climate risk."

"Canada must develop a universal climate risk disclosure system by 2025," said Craig Steward, IBC's Vice-President, Climate Change and Federal Issues. "We simply can't wait until 2050 to be climate compatible in the housing sector. Immediate action must be taken to protect homeowners and communities, or catastrophic loss to homes and communities will continue to increase in severity and cost, year after year."

That was the key takeaway from the IBC's latest report, titled "Designing the Path to Climate Compatibility: Climate Risk Disclosure and Action in the Canadian Housing Context" and conducted in partnership with the Canada Mortgage and Housing Corporation (CMHC).

The goal behind the partnership was to "examine disclosure of physical hazards and climate risk in the Canadian housing context" and was motivated by "the need to respond to the accelerated frequency and severity of catastrophic loss events in the housing finance system, as well as the need to create an aligned view of climate risks for homeowners."

IBC statistics show that Canada suffered $2.1B in insured loses due to severe weather events last year. Furthermore, seven of the 10 years where Canada saw its highest insured losses of all-time have occurred in this decade, indicating that there is indeed an acceleration in frequency of extreme weather events. Just last month, Hurricane Fiona stormed through Atlantic Canada, resulting in what the IBC has estimated to be $660M in damages.

READ: Droughts, Floods, and Storms Could Cost Canada $139B by 2050

The IBC and CMHC say that climate risk data and analytics can assist homeowners, homebuilders, the financial sector, and governments in "mobiliz[ing] capital toward effect and efficient property-level climate resilience and prioritize community-level adaptation investments." That conclusion was reached following a series of interviews the IBC and CMHC conducted with leaders in the housing and financial sectors.

The report came up with two major recommendations, one of which was the Real Estate Climate Risk Index, which would take into account eight factors: probability of risk, severity of risk, risk frequency, compounding factors, site-level resilience, community resilience, municipal resilience, and regional response.

The other big recommendation was to establish an "action matrix" which would ensure that lenders, insurers, municipalities, and homeowners shared an aligned view of risk and how to reduce it. The IBC and CMHC did not detail what such a matrix would look like, but action matrixes are typically a two-axis chart with "effort" on one axis and "impact" on the other, creating four action types: quick wins (low-effort, high-impact), fill-ins (low-effort, low-impact), major projects (high-effort, high impact), and thankless tasks (high-effort, low-impact).

Other guiding principles that emerged from the study include recognizing that contexts differ from region to region, community to community, and even site to site. As an IBC representative previously told STOREYS, different regions across Canada can often have their own unique set of risks. Atlantic Canada has a higher risk of hurricanes, while Western Canada is more susceptible to wildfires.

READ: How Climate Change is Affecting Property Insurance, Mortgages, and Buyers

Yet another principle was to increase resiliency planning in order to achieve more efficient recovery in regions with known risks. Additionally, the IBC and CMHC also repeatedly emphasized throughout their report that actors across the housing supply chain -- buildings, insurers, lenders, sellers -- should take up the responsibility of disclosing risk factors to homeowners, and prospective homeowners, throughout the homeownership life cycle.

Members of the study recognized that barriers to this disclosure currently exist, such as privacy laws, constraints on the bank level, and differing alignments between levels of government, but that those barriers need to be quickly removed if Canada wants to meet its stated goal of having net-zero emissions and being climate-resilient by 2050.