For the first time in a year, home builder confidence has risen in Canada, but high interest rates and the rising cost of construction are keeping prospective buyers on the sidelines.

On Tuesday, the Canadian Home Builders' Association (CHBA) released its Housing Market Index (HMI) for Q1 2023, an indicator of the current and future health of the residential construction industry.

The single-family and multi-family HMIs both rose, albeit slightly, in Q1 2023 from their previous record-lows, the first time that builder sentiment has increased since Q1 2022. On a quarterly basis, the single-family HMI rose from 26.2 to 34.3 in Q1 2023, while the multi-family HMI increased from 26.0 to 33.5.

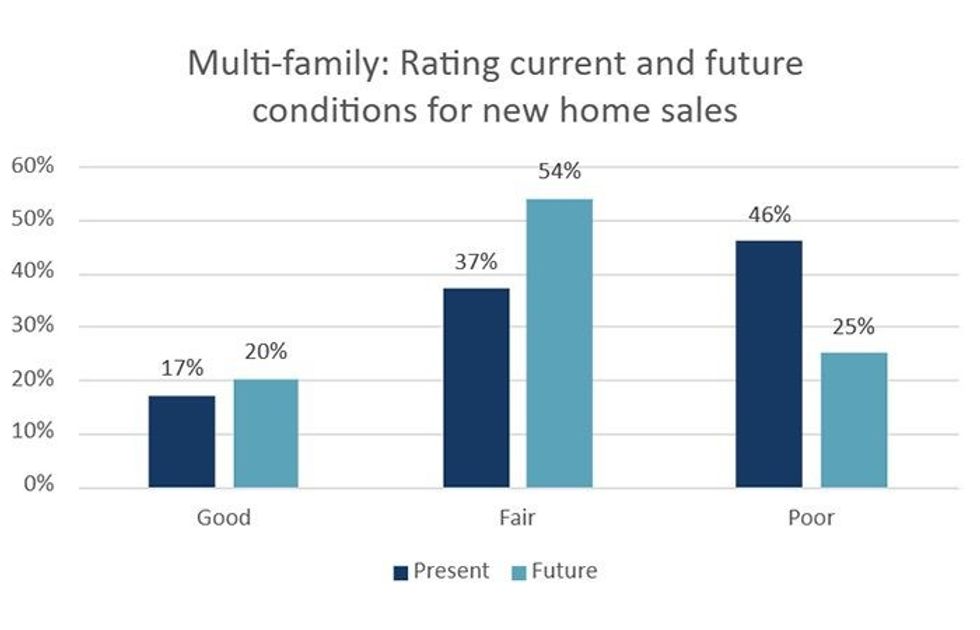

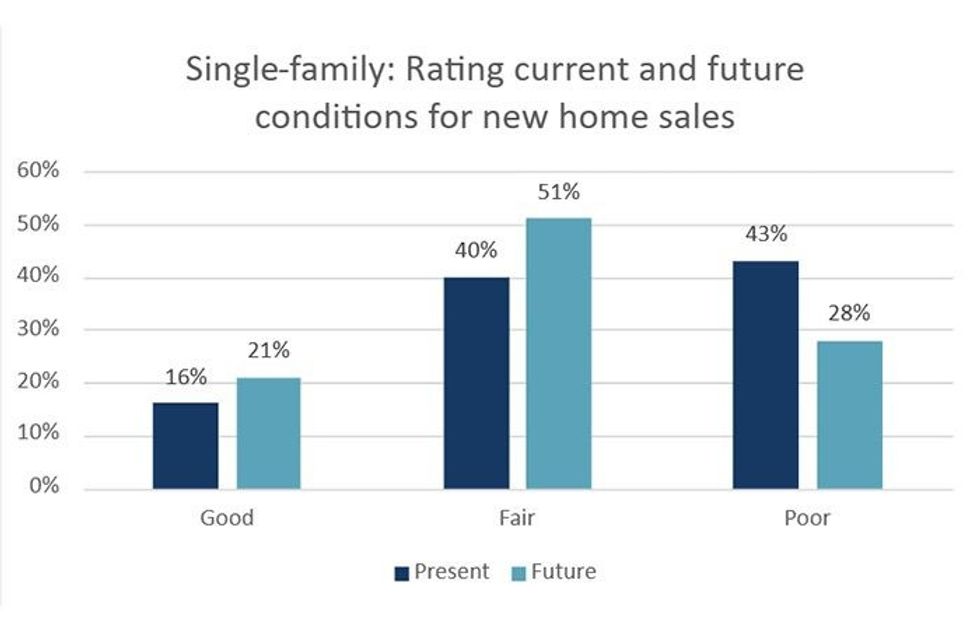

When asked about the current conditions of new home sales, the relative majority of single-family (43%) and multi-family (46%) builders felt that conditions were "poor." Regarding future conditions, more than 50% of both groups predicted "fair" conditions. While the outlook is far from focusing on "good" conditions, it has improved markedly since Q4 2022.

"This slight increase in builder sentiment is indicative [of] slightly better conditions, reflective of the plateau on interest rates," the CHBA reports. "But the market remains slow and housing starts in future quarters will reflect that."

Released quarterly, the HMI is based on responses from a panel of CHBA homebuilders across Canada.

According to homebuilders, most of the sales seen in Q1 2023 were due to "significant" price cuts, as high construction costs and interest rates remained areas of concern for prospective buyers.

Buyers are expectantly waiting for prices to drop, especially in the entry-level market, but input costs continue to rise. Nationally, the average construction costs for a 2,400-sq.-ft. home are nearly $68K higher than before the pandemic. Labour costs have also increased, up 26% from pre-pandemic levels, while supply chain issues continue to cause an eight-week delay, on average, in home completions.

Meanwhile, the repeated interest rate hikes of the last year continue to play a "huge role" in affordability and are limiting housing supply. In order to close in the higher rate environment, one-third of purchasers have had to seek alternative lending solutions, and 30% of builders have had to make accommodations on buyers' behalf.

Fifty-nine percent of respondents said the market slowdown is leading them to build fewer units, and 23% said it's causing them to cancel projects altogether. Although 36% feel that traffic is starting to return somewhat following the pause in rate hikes, 64% of builders still expect to have fewer starts this year than in 2022.

With the number of housing starts expected to drop, the CHBA is advocating for a "holistic" approach to make up for the deficit, which, according to the Canada Mortgage and Housing Corporation (CMHC), requires more than doubling the current level of starts and building 5.8M new homes by 2030.

Said approach entails using skilled immigrants to fill vacancies in the new home construction and renovation industry, but the key solution to increasing housing starts is using more factory-built solutions, such as pre-fabricated wall panels, in order to increase productivity.

The sector is proving adaptable to the approach -- 29% of builders have produced or used such a solution in the past year, and 90% are considering doing so in the next one to three years.

"Canada will need to build more houses with fewer workers per home," the CHBA said.