The Greater Toronto Area housing market continues to be hammered by the effects of rising interest rates, as sales came in at nearly half of last year’s levels, and price growth essentially flattened.

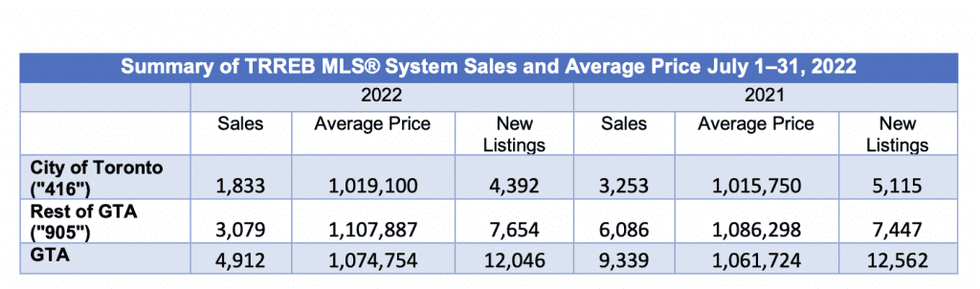

The Toronto Regional Real Estate Board (TRREB) reports a total of 4,912 homes traded hands through the MLS system in July, a year-over-year decrease of 47%. That’s also down a sharp 24% from June levels, reflecting a difference of just over 1,500 fewer transactions.

That’s contributed to continued softening in GTA home prices, with the region’s average at $1,074,754, up a scant 1.2% annually -- the smallest year-over-year increase recorded since the first pandemic lockdowns of April 2020. That spread in price has dwindled steadily this year since tighter monetary policy kicked off in March, and is now 19% below what is now known as the market’s peak in February, reflecting a dollar loss of $259,790.

Compared to June, GTA home prices have fallen by $71,500 (-6.23%).

READ: Metro Vancouver Home Sales Down by Over 40% in July

Narrowing down on the submarkets revealed similar trends playing out; in the City of Toronto proper, sales fell by -43.6% YoY, with price growth edging up just 0.32% annually. In the 905, sales activity is down -49%, with price growth up 1.9%.

TRREB notes that in addition to fewer transactions, less expensive home types, such as condos, saw the greater pace of price growth, as homebuyers sought out the most affordable entry points to the market to mitigate the impact of higher interest rates.

As is seasonally typical for July, fewer sellers are keen to put their home on the market, with new listings down -4% YoY and -26% MoM at 12,046. However, as that hardly put a dent in the decline in sales, the sales-to-new-listings ratio moderated further, to 59.5% - the edge of a balanced market.

READ: “Peak-to-Trough”: Benchmark Canadian Home Prices Expected to Fall 12 - 13%

TRREB says they expect the trend for new listings to mirror sales through the second half of the year, and into 2023, leading to all-around more favourable conditions for buyers, with more inventory choice and a much less frantic run up in prices. However, given the tight fundamentals of the GTA market, this isn’t a time for policymakers to become complacent, says Jason Mercer, the board’s Chief Market Analyst.

“The Greater Toronto Area (GTA) population continues to grow and tight labour market conditions will drive this growth moving forward. Despite more balanced market conditions resulting from rapidly increasing mortgage rates, policymakers must continue to take action to boost housing supply to account for long-term population growth,” he says.

“TRREB has put realistic solutions on the table to address the existing housing affordability challenges. With savings high and the unemployment rate still low, home buyers will eventually account for higher borrowing costs. When they do, we want to have an adequate pipeline of supply in place or market conditions will tighten up again.”

Rapidly rising interest rates have dramatically reduced homebuyers’ purchasing power in recent months; the Bank of Canada has implemented four interest rates hikes since March, bringing the cost of borrowing from 0.25% to 2.5%. As a result, both fixed and variable mortgage rates have risen, to the point where many new and renewing borrowers are being stress tested in the 6 - 8% range. That translates into being approved for hundreds of thousands of dollars less in mortgage financing from their lender.

Policymakers should heed the impact this is having on the market and consumer psychology, says TRREB CEO John DiMichele.

“Many GTA households intend on purchasing a home in the future, but there is currently uncertainty about where the market is headed. Policymakers could help allay some of this uncertainty,” he says.

“As higher borrowing costs impact housing markets, TRREB maintains that the OSFI mortgage stress test should be reviewed in the current environment. Consumers looking to renew their existing mortgages with a different lender should not be subject to an additional stress test burden beyond what they would face with their existing lender. Given the importance of the housing industry as a driver of economic growth, a transparent process and sound rationale in the development and management of stress test guidelines are also of utmost importance.”

Added TRREB President Kevin Crigger, “With significant increases to lending rates in a short period, there has been a shift in consumer sentiment, not market fundamentals. The federal government has a responsibility to not only maintain confidence in the financial system, but to instill confidence in homeowners that they will be able to stay in their homes despite rising mortgage costs.”

He says that additional mortgage options, such as extending amortizations to 40 years (from the current maximum of 30 years for an uninsured borrower, and 25 for insured) for those coming up for renewal should be considered.

The central bank has also come under fire for kicking off its monetary policy adjustments too late in the face of soaring inflation, which has contributed to the front-loaded shock experienced by today’s consumers.

Says Crigger, “Now we are dealing with outsized increases to curb generationally high inflation. The federal government must enact measures which will assist buyers facing affordability challenges in an inflationary environment where costs are rising at the gas pumps, the grocery stores and everywhere in between.”