There’s no disputing that buying conditions are finally starting to level off in the Greater Toronto Area.

Sales tumbled 41% in the region in April, followed by price cuts in Toronto’s exurbs and surrounding municipalities; averages in the Durham, York, and Halton markets all slid more than $100,000 from March, marking month-over-month declines between 10 - 12.5%.

Meanwhile, economists like BMO’s Doug Porter are going as far to say that the GTA is suddenly getting into "buyers’ market terrain”, pointing to the region’s sales-to-new-listings ratio dipping to 45% in April.

READ: Ontario Is Moving Towards a Buyers’ Market, Here’s What That Means

However, the City of Toronto proper has seemed largely insulated thus far -- the April data shows the city bucked the price decline trend with a 2% monthly increase. However, more recent metrics are starting to show telling cracks.

According to Toronto realtor and chartered accountant Scott Ingram, listing terminations -- when a seller pulls their property from market for a reason other than a sale or suspension -- are seeing a sharp uptick, hitting a new high in the condo segment, and trending steadily up in the detached market. This is indicative of sellers switching to their “plan B” of removing and re-listing at a different price point in attempts to generate fresh interest.

Ingram, who started tracking terminations in the spring of 2017, says it’s a metric that’s both indicative of sellers’ confidence, and is a more accurate look at supply trends than new listing numbers, which don’t capture the number of homes that are simply being re-added to the market, rather than brand-new supply.

READ: Is Now the Time to Buy?

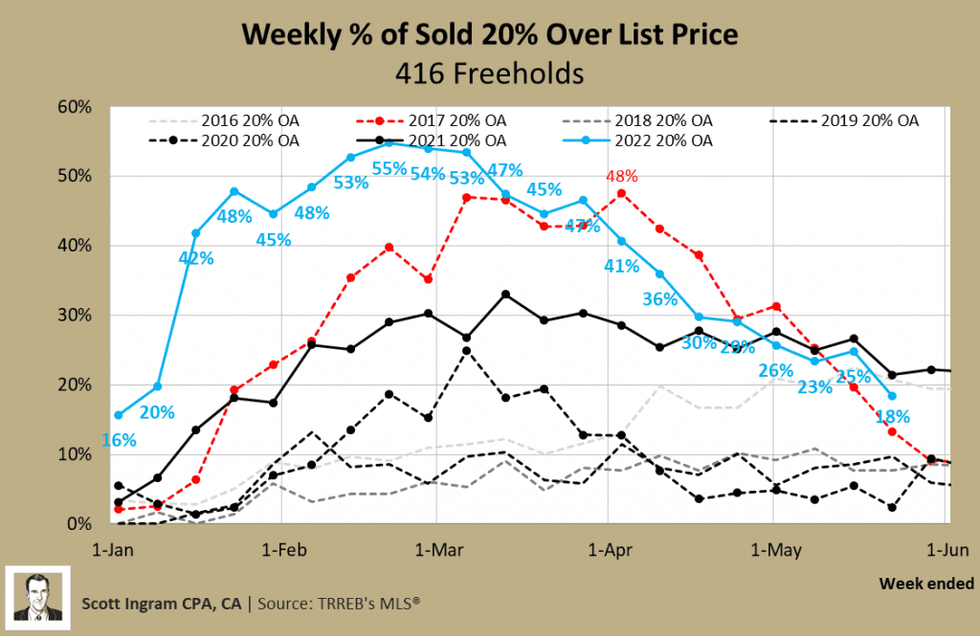

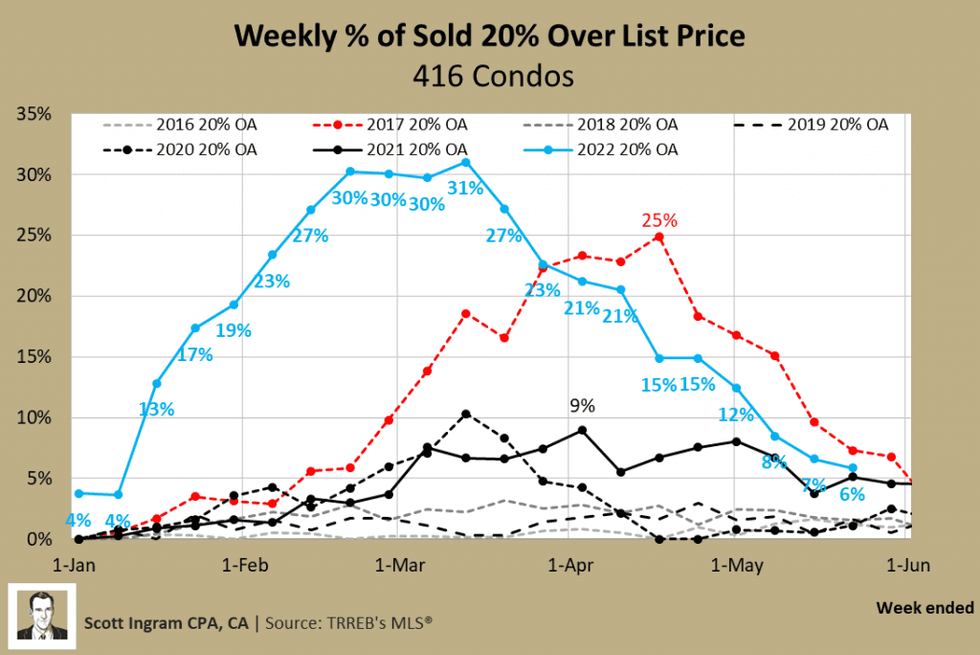

Another tell-tale sign, he says, is that the percentage of homes that were selling for more than 20% of their listing price -- the range he defines as “market froth” -- are down considerably, now accounting for 18% of freehold sales, and 8% of condos. That’s down one-third from the peak market conditions observed in February, he says.

“I would say it has been softening,” he tells STOREYS. “The pendulum is swinging back, it was far out the one way in an extreme sellers’ market, and now it’s moving back. Now, where is it? I don’t know -- it hasn’t swung all the way back to an extreme buyers’ market, that’s for sure, it’s a lot more towards the middle than it was."

“I feel like there will be more people taking their foot off the gas, there definitely seems to be a wait-and-see thing happening now. Buyers are a lot more cautious; they don’t want to get involved in a bidding war or multiple offer situation.”

Rising interest rates are certainly a culprit behind slowing buyer activity -- the trend-setting Bank of Canada Overnight Lending Rate has increased by 0.75% since March, with another 0.5% increase to come in June, pushing variable mortgage costs higher. Meanwhile, soaring bond yields have driven five-year fixed mortgage rates to the 4.5% range, meaning many prospective borrowers are being stress tested at a threshold upwards of 6.5%.

Weakness in the stock market, pulled-forward buyer demand over the last few years, and a restriction-free summer of travel are also all factors lending to weaker buying conditions, Ingram adds.

Higher rates in particular are likely the impetus behind declines in the condo segment, given its larger proportion of investor buyers rather than end users.

“If you’re looking at it as, ‘This is where I’m going to be living for the next 15 years,’ fluctuations in interest rates -- while they are going to affect you -- won’t as much because it’s a roof over your head, whereas investors are looking at it for a short period of time and how cash flow negative they’re going to be on it.” he says. “While rents are on the way up, they have not kept pace with the increase in principal and interest payments, so I think investors are even more cautious right now. And if they’re not buying the stuff, inventory will build up.”

“I don’t know if they’re unloading, like we saw in 2020, when investors were unloading, whereas I think now, I don't think necessarily they’re unloading, but I feel like they’re definitely holding back or being a lot more cautious.”

In contrast, freeholds continue to be supported by tight inventory, currently at an average of 1.7 months. In all, Ingram concludes, today’s softer market is all about perspective, given how historically abnormal housing market activity was over the course of the pandemic.

“It’s not like people have stopped buying houses,” he says. “Everyone loves to glom onto year over year, but you’re comparing it to a ridiculous time. So if I’m looking at what sale volumes are, I’m looking at the 10-year average, rather than the best year of all time. it’s only natural things will regress to the norm of the longer-term average. Last year was the highest number of all time, the year before was the now-fourth most transactions, so you’re coming off that, it probably will be below average because some of that demand did get satisfied before, so it’ll be interesting to see these next couple of years.”