Escrow

Learn what escrow means in Canadian real estate, how it works in holding deposits and documents, and why it's important for a secure property transaction.

May 22, 2025

What is Escrow?

Escrow is a financial arrangement where a third party holds funds or documents on behalf of two other parties until all agreed-upon conditions of a real estate transaction are met.

Why Escrow Matters in Real Estate

In Canadian real estate, escrow is most commonly used to hold a buyer’s deposit during the period between the acceptance of an offer and the closing date. The funds are kept in a trust account—usually by the seller’s real estate brokerage or lawyer—and are only released once all contractual obligations are fulfilled.

Escrow protects both parties: the seller knows the buyer has committed funds, while the buyer is assured their deposit won’t be misused. In some complex deals, escrow may also involve holding legal documents, mortgage instructions, or tax-related forms until closing.

If the transaction falls through due to unmet conditions, the escrow holder returns the deposit to the buyer (assuming no contractual breach). However, if the buyer walks away without justification, the seller may have the right to keep the deposit, as outlined in the Agreement of Purchase and Sale.

Understanding how escrow works helps buyers and sellers manage risk, comply with contract terms, and avoid legal disputes over funds or paperwork.

Example of Escrow

A buyer puts down a $25,000 deposit on a Toronto condo. The deposit is held in escrow by the listing brokerage and applied to the purchase price once the deal closes.Key Takeaways

- A neutral third party holds funds or documents until deal conditions are met.

- Protects buyers and sellers during real estate transactions.

- Most commonly used to hold the buyer’s deposit.

- Funds are released only once terms of the agreement are satisfied.

- Reduces financial risk and improves transaction security.

Related Terms

- Deposit

- Agreement of Purchase and Sale

- Trust Account

- Conditional Offer

- Closing Date

The LJM Tower at 2782 Barton Street East in Hamilton in June 2025. (Google Maps)

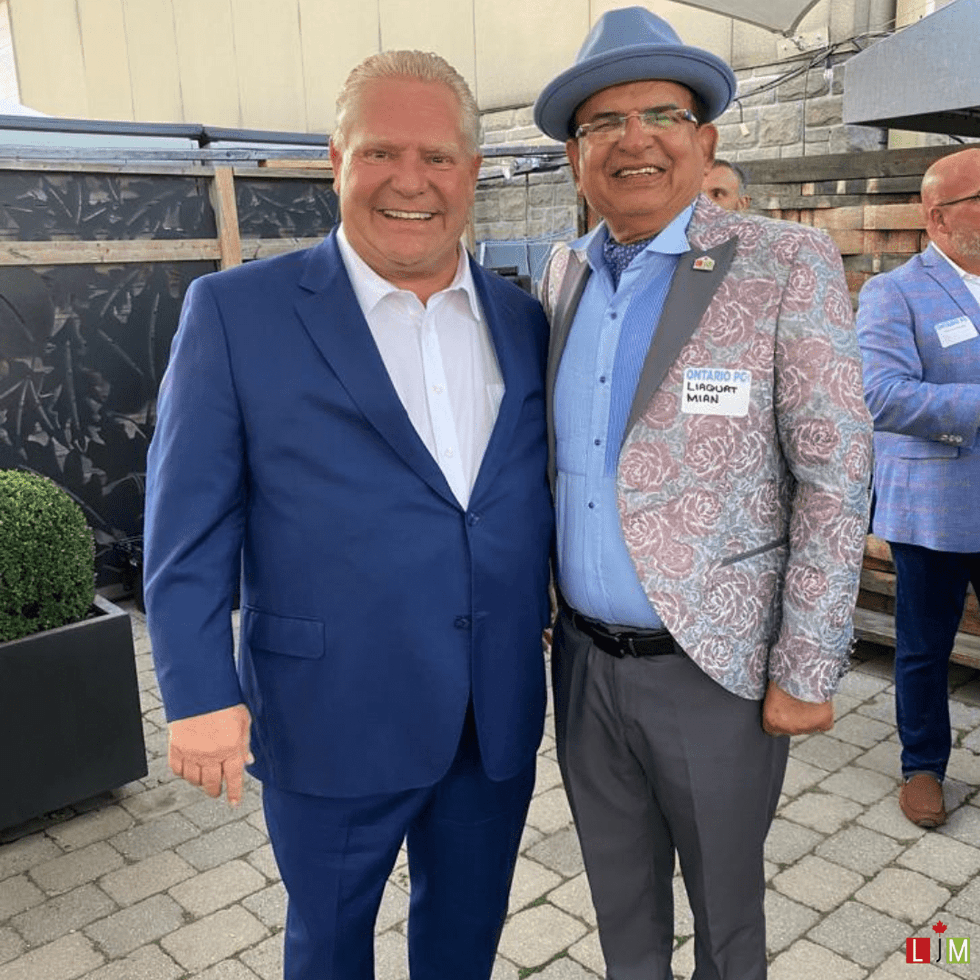

The LJM Tower at 2782 Barton Street East in Hamilton in June 2025. (Google Maps) Ontario Premier Doug Ford and LJM Developments President Liaquat Mian. (LJM Developments)

Ontario Premier Doug Ford and LJM Developments President Liaquat Mian. (LJM Developments)

CREA

CREA

Liam Gill is a lawyer and tech entrepreneur who consults with Torontonians looking to convert under-densified properties. (More Neighbours Toronto)

Liam Gill is a lawyer and tech entrepreneur who consults with Torontonians looking to convert under-densified properties. (More Neighbours Toronto)

Eric Lombardi at an event for Build Toronto, which is the first municipal project of Build Canada. Lombardi became chair of Build Toronto in September 2025.

Eric Lombardi at an event for Build Toronto, which is the first municipal project of Build Canada. Lombardi became chair of Build Toronto in September 2025.

A rendering of the “BC Fourplex 01” concept from the Housing Design Catalogue. (CMHC)

A rendering of the “BC Fourplex 01” concept from the Housing Design Catalogue. (CMHC)