Softening market conditions and the acceptance of a “higher for longer” interest rate environment have led the Canadian Real Estate Association (CREA) to downgrade its resale housing market forecast.

After a brief springtime resurgence, sales activity has slowed across Canada for the last three months. While the decline is due in part to the resumption of interest rate hikes in June, fears of further hikes and uncertainty over how long rates will remain high also contributed.

Alongside falling sales, new listings have been edging up since hitting a 20-year low in March. As a result, the national sales-to-new-listings ratio has dropped from nearly 70% to just over 50% in five months. The pace of price growth has slowed too; sizeable declines in Ontario led to a national decline in September.

"As a result of these weaker sales and pricing trends since the summer, combined with softer market conditions going forward and 'higher for longer' interest rates, the forecast for sales and average prices over the balance of 2023 and into 2024 has been lowered," CREA said.

"The major risk to this forecast remains what happens with the data that the Bank of Canada is eyeing and what that means for its key policy interest rate between now and next spring. The current assumption is either no more hikes, or at most one more, along with some indication from the Bank at some point that the next move will likely be down."

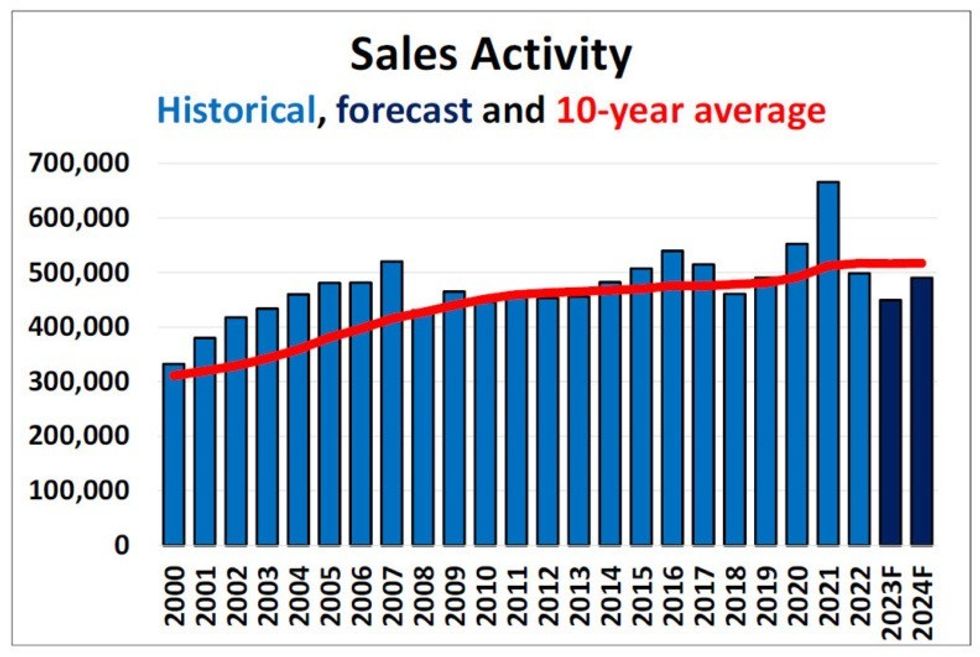

CREA now anticipates 449,614 residential properties will change hands across the country in 2023, a 9.8% decline from 2022 and a 3.15% drop from its July forecast.

While July’s downgrade was broad-based, October’s is due to fewer expected sales in Ontario and British Columbia, which more than offset an upward revision to activity in Alberta.

Ontario and BC are expected to see sales fall 11.8% and 7.0%, respectively, while Alberta will experience a 6.5% decline. The east coast will be hit the hardest, though, with activity forecast to drop 16.1% in Nova Scotia, 13.6% in Newfoundland, and 13.4% in New Brunswick.

The sales forecast for 2024 has likewise been revised downwards. CREA expects 490,257 sales next year, a 9% increase over 2023 levels, but a 5% drop from the July forecast. Despite the dip, the revised forecast puts activity close to the pre-pandemic 10-year average.

Every province is expected to see sales rise in 2024, with the largest rebounds occurring in those that were hardest hit in 2023. Activity is forecast to rise 10.8% in Ontario, 10.4% in Nova Scotia, and 9.8% in Newfoundland, while BC and Alberta will see sales jump 7.2% and 9.6%, respectively.

Regarding property values, the national average home price is forecast to fall 3.3% on an annual basis in 2023, to $680,686. The figure marks a 3.09% drop from July’s forecast.

The anticipated decline is once again due to the impact of lower sales in Ontario and BC, which are the most expensive provinces. Prices are forecast to fall 6.3% in the former and 2.4% in the latter.

Meanwhile, small price gains are expected in Alberta (0.8%), Quebec (0.4%), New Brunswick (1.3%), Nova Scotia (1.7%), and Newfoundland (1.2%) in 2023.

Come 2024, prices in Alberta are expected to outpace the rest of Canada, with a 4.8% increase compared to 2023. In contrast, Ontario will see “virtually no growth,” with prices forecast to edge up 0.2%. Other provinces will see gains between 1.1% and 2.7%.

Alongside CREA, TD Economics and Royal LePage have also downgraded their forecasts for Canada's housing market.