With the federal election taking place today, the Conservative Party of Canada has pledged to make homeownership more attainable by amending the B-20 mortgage stress test and cultivating a stronger market for seven- to 10-year fixed mortgages.

While the former is welcome, the latter comes with its own set of problems, Dustan Woodhouse, president of Mortgage Architects, said, adding that these reforms may increase the number of loan-eligible homebuyers but also lead to higher housing prices in the long run.

“It may allow more Canadians to enter the market because it gives them more purchasing power, but it effectively pushes prices higher. If it does anything, it puts more buyers in the market instead of more supply. There’s no counterbalance on the supply side,” Woodhouse said.

That housing supply isn’t commensurately growing with demand is only the tip of the iceberg, he added.

RELATED: Your Last-Minute Housing Guide for the Federal Election

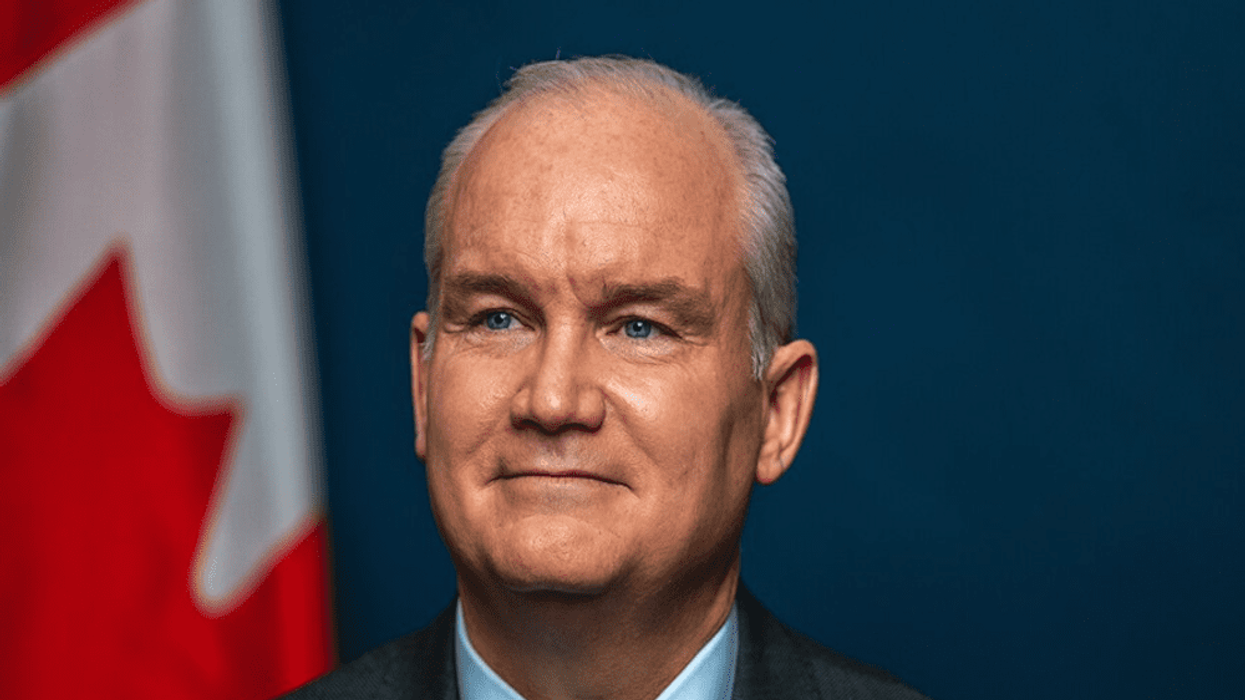

According to Canada’s Interest Act, the penalties for breaking lengthy terms are steep. Considering the average Canadian mortgage holder breaks term in the third year, when penalties are relatively small, borrowers contemplating doing this with a seven- or 10-year fixed term would be penalized severely. Tory leader Erin O’Toole hasn’t been clear on whether these penalties under the proposed Conservative reforms would be less severe, Woodhouse said.

“The other problem with this proposal is seven- and 10-year mortgages both have massive, massive prepayment penalties,” he said. “In particular, in the third, fourth and fifth years, the penalties drop to three months’ interest at the five-year mark, as per the Interest Act. The worst one I’ve seen was on a 10-year fixed and the clients paid an 11%-of-balance penalty. It was a million-dollar mortgage and their penalty was $110,000.”

It is likely penalties would ease because the Tories’ platform specified “creating a new market.” Still, mortgage brokers seldom advise their clients to enter such lengthy fixed-term mortgages, despite the fact that their broker fees would nearly double to around 160-180 basis points.

RELATED: The Question of Having to Pay a Mortgage Penalty Isn’t If, It’s When

While offering longer terms on fixed-rate mortgages would increase borrowing power by as much as 10%, according to Woodhouse, the increased demand from homebuyers in a supply-deficient environment could spark more bidding wars, further escalating housing prices.

The Conservatives have also promised to index mortgage insurance, currently capped at $1 million, to inflation, making homeownership less prohibitive. Additionally, the party wants to eliminate B-20, which stress tests mortgages at 5.25% or 2% above the posted rate, whichever is greater, for borrowers who want to shop for new mortgages with different lenders when it comes time for renewal, Woodhouse said. “A borrower could, in theory, shop their mortgage and get a lower rate than what they were paying. [They] could retain a broker to go to work for you and have them find it for you,” he said.

While the Canadian Real Estate Association and the Toronto Regional Real Estate Board have lauded federal parties for acknowledging Canada’s housing supply crisis, nearly unanimous agreement exists that none of the parties’ proposals adequately address supply in any meaningful way, especially in new housing-starved cities like Toronto and Vancouver.

RELATED: Federal Parties Hurry to Address Housing Issues, But Miss Root Cause

“A huge part of problem is the red tape,” said Christopher Alexander, Chief Strategy Officer at RE/MAX INTEGRA. “It takes a year and a half to get projects approved. That’s a lot of bureaucracy.”

A study by the Residential Construction Council of Ontario (RESCON) showed, for example, Toronto’s rezoning process took six months in 2006, but a decade later it was already up to three and a half years. The study also found that site plan approvals took 18 months as of 2016. Most industry estimates now indicate it can take up to two years. RESCON’s president says overhauling the entire system would remedy the excessive delays.

“The present system, quite simply, is inefficient and needs to be modernized and digitized,” Richard Lyall said. “However, we aren’t even close to that happening. Presently, there are too many government agencies and ministries that all have their fingers in the pie, which only bogs down the approvals process.”

Bureaucratic impediments in Toronto’s municipal government are so omnipresent that even getting a simple project like the proposed Rail Deck Park approved by City Council was so riddled with roadblocks that, after two years, the project is most likely dead, Alexander said.

“The project was squashed because city council and approval board couldn’t come to a consensus. You have a platform to change dynamic of city for green space, which it’s desperately lacking, and bureaucracy got in the way of that too,” Alexander said.