It’s not a “What if?” scenario -- it’s already happening. And condo owners need to know big building costs are coming.

There are two problems here, says Lyndsey McNally, Vice President at the Canadian Condominium Institute. One: There’s a very good chance your condominium corporation doesn’t have enough in its reserve fund to pay for critical repairs as the building ages.

Two: Even if they did have enough cash based on past projections, construction inflation has thrown those numbers out the window.

“It’s already happened -- people just don't see it yet,” McNally says. She points to a 2020 Auditor General of Ontario report that found 69% of surveyed condo boards did not have adequate funds to pay for major repairs.

When these gaps were corrected, condo owners had to increase their reserve fund contributions -- part of their regular condo fees -- by an average of 50%. In one extreme example, owners had to pay 258% more.

“When we’re talking about these capital projects, we’re talking about projects that are very expensive,” McNally says, ticking off the usual repairs: window replacements, underground garage restoration, ceilings, concrete panels, balconies, water mains. “These are multimillion-dollar projects.”

"A Snowballing Effect of Inflation Costs"

The Auditor General report was from 2020, however.

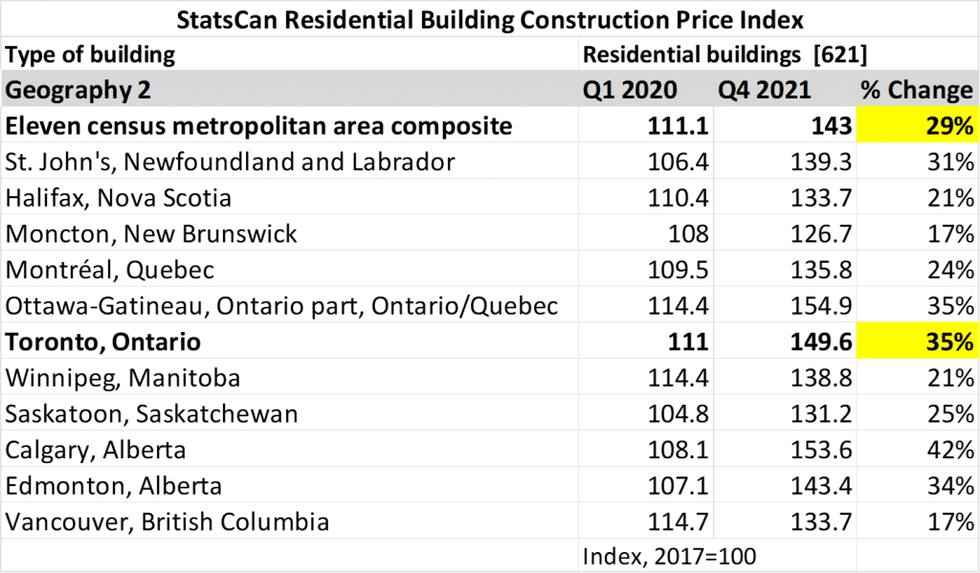

The second half of this story is inflation -- construction inflation has been staggering. McNally cites StatsCan figures showing a 35% increase in construction prices from 2020 to 2021 -- and 29% averaged across 11 metropolitan areas in Canada.

McNally says some condo boards are already panicking -- both for projects planned for the next year or two, as well as future projections.

“So typically, an engineer preparing [a reserve fund study] might have assumed a 3 per cent inflation increase over time, which has been generally true for construction inflation for a long time,” McNally says. “And now, with [construction] inflation jumping up 35% in an 18-month period, if [condos were ready to start a project] and they thought they have the money -- they no longer do.”

“But the longer-term problem is that it’s not just projects today that are impacted by inflation, it’s all of the projects that you’re going to do in the future.”

Justin Tudor, President and partner of Keller Engineering, already sees these price jumps first-hand. His firm prepares reserve fund studies, but also offers consulting and tendering services -- they are on the frontlines of these projects, working with vendors.

“We’re seeing a snowballing effect of inflation costs in some of the projects,” Tudor says. “We’re seeing window replacement projects come back at almost 30 per cent higher than we would have seen pre-pandemic -- the same projects. We’re seeing that it’s not just the window frame, everything around it is increasing in price -- the glass is increasing in price, the caulking is increasing in price, the labor is increasing in price.”

“What we’re really seeing is very real.”

Even the condo corporations with relatively healthy reserve funds are now facing a new reality, Tudor says.

“Anybody who’s been more conservative can accommodate these pressures a little bit better,” he says, “but certainly, everybody’s going to have to deal with the inflationary forces that has shown up here in the construction market.”

"Heading for a Disaster"

Armand Conant, Shibley Righton lawyer and partner leading the Condominium Law Group, has seen the worst of the worst.

Conant has been a court-appointed administrator five times now, which is a “draconian” measure that means he assumes control of a dysfunctional condo board that is “spiralling down into a mess.” He was asked to step in on a building that was going to be condemned by the municipality -- with residents evicted -- before he cleaned up finances and arranged for repairs. The bill for owners? $36,000 per unit, spread over several years.

How can buyers avoid buying into a building with financial landmines lurking in the future? Work with condo agents and condos lawyers specifically, Conant says -- professionals with expertise in condominium finance. They can determine if reserve funds are adequate for the age of the building and work already completed.

“There are some buildings that are beautifully run, and their reserve funds are huge -- and generally they’ll be fine,” Conant says. “So I don’t want anybody to think it’s every single corporation. But is there a crisis in the industry? Generally? Absolutely.”

Conant sees a broad swath of the industry, as his firm represents hundreds of condo corporations in their legal matters, including reserve fund issues. And with these new financial pressures from construction inflation, he’s sounding the alarm.

“[An expert] from a lending institution was telling me they call the reserve fund crisis ‘the new pandemic,’ because they’re seeing it across the board,” Conant says. “I think generally -- with many, many corporations -- we are heading for a disaster with reserve funds.”

‘You Need to Be Prepared for This’

There’s no way out -- condo owners are on the hook for a building’s upkeep. Even owners in a new building without major repairs will likely see reserve fund contributions jump up to accommodate the inevitable future.

And in particularly dire situations, if an owner wants to sell their way out, a mortgage might not be available to the buyer.

According to one example in the Auditor General report: “We were advised by a real estate professional that new purchasers in this building would not be able to obtain mortgages for units in the building because of the condo’s finances and expected future demands on owners.”

McNally backs that up -- she says she’s aware of a handful of buildings that have been “blacklisted” by lenders who will not provide mortgages to buyers. In these cases, owners may have to sell at a loss to an investor who doesn’t require a mortgage.

For families already struggling with gas prices and inflation for groceries, McNally says it’s important to also prepare for a spike in condo fees.

“This is the economy that we’re living in,” McNally says. “And I don’t know that it’s going to get better. If you live in a condo, you need to be prepared for this. This is real, and it’s expensive.”