A University of BC think tank, partly funded by taxpayers, is arguing that those Canadians fortunate enough to be sitting on properties worth more than $1M should pay a surtax on their equity gains.

Generation Squeeze received funding from the Canada Mortgage and Housing Corporation (CMHC), as part of the National Housing Strategy, to come up with a proposal to charge homeowners a surtax on their houses.

For several decades, residents haven’t been taxed on capital gains they make on their primary residences, a policy designed to give homeowners a break. Generation Squeeze is eyeing the equity made on principal residences as a taxable source that could subsidize other programs, such as co-op housing. They blame the exemptions for fuelling demand and turning housing into a commodity.

Paul Kershaw is a University of BC policy professor who founded the think tank, with a focus on helping the Millennial age demographic. He commissioned an extensive poll in February to get feedback on how people feel about a surtax on $1 million-plus homes, as well as capital gains tax, or a ban on foreign buying, or how they perceive people who are house rich but cash poor, and a host of other issues involving wealth from home ownership. Vancouver’s Research Co. polled 1,010 people across Canada.

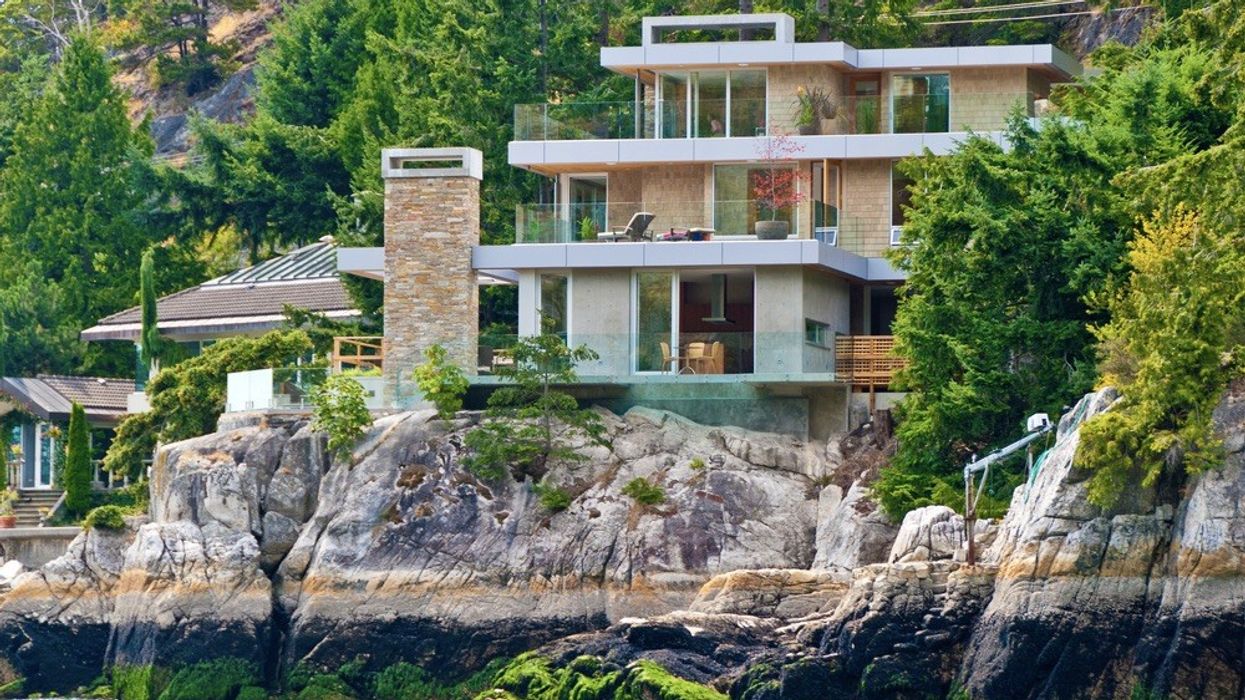

One million dollars is the cost of a starter home in expensive markets such as Vancouver and Toronto regions. If people do manage to buy in, that $1M can grow to $1.5M in value within a few years, but that doesn’t mean the owners are wealthy. Kershaw says these fortunate homeowners have the advantage of borrowing on that equity with home equity lines of credit.

READ: October the “Beginning of the End” for Canada’s Housing Market Correction: RBC

“That windfall gives you so much security,” says Kershaw. “So you’re benefitting and gaining security for what’s causing harm to others. We’ve already tried to deal with low hanging fruit -- the mean spirited developer, the NIMBY, the foreign buyer. We’ve tackled those policy changes and they have been important… but it’s still not enough. How are the broad majority of us implicated in sustaining a system that reinforces a culture of allowing home ownership costs to rise?”

Kershaw is aware that talk of taxing people is not a popular discussion. He’s received the angry emails. People already feel over taxed and under paid.

Simon Fraser University City Program director Andy Yan says that at least 50% of City of Vancouver homeowners own properties worth more than $1M -- so a lot of people would be affected. Kershaw proposes an annual surtax that kicks in when a home is valued at $1M and goes higher at $2M. He says it would generate $5B, mostly from BC and Ontario, where property values are highest.

The poll showed 81% of British Columbians polled blamed the inflow of offshore wealth for lack of affordability. Other popular reasons chosen were lack of supply, speculation, misguided municipal zoning laws, and low wages. A higher tax for foreign owners of real estate is across the board popular with Canadians.

Kershaw, owner of a high-value home in the suburbs, was pleased to see support for some kind of extra levy to even the playing field. The poll showed that 57% of owners of $1M-plus properties were willing to consider a levy when described as “a modest price on housing inequity.”

However, when described more pointedly as “a surtax,” that support fell off. Only 3% of Canadian owners of homes worth more than $1M supported the idea of “a modest surtax” on homes of that value or more.

The surtax is on the overall value of the home, which makes it an unusual tax. Another critic pointed out that people don’t get taxed for money in their savings accounts. They don’t get taxed on their Apple shares until they’re sold, when the owner realizes their profit.

Kershaw says the surtax could be deferred until the home is sold, similar to the way BC residents can defer property taxes, incurring a small interest rate charge.

However, if long-time owners deferred the surtax, it would likely mean that they wouldn’t be eligible to borrow against their homes. If homeowners can’t tap into their equity, they no longer have an advantage.

As well, if the surtax were used to fund other federal programs, BC residents would essentially end up subsidizing the rest of the country, says Yan.

"For what amounts to a new form of quasi-federal property tax, one would think that it should deal the specific issues within the jurisdictions generating that tax revenue as opposed to being redistributed throughout the country,” he said.

Research.co president Mario Canseco, who conducted the poll, acknowledged the challenge of bringing together perspectives on housing when dealing with vastly different markets.

“This idea of putting a price on inequity by adding a small surtax on high value homes, you have 52% of people who think it’s a good idea. In BC it’s 47%, so a bit lower than the average,” says Canseco. “But we get into the question of what is a high value home? Is it the $40M mansion that [realtor] Faith Wilson is selling? Or is it somebody next door to me? This is where it gets tricky because the way in which somebody in other parts of the country is going to look at a high-value home is going to differ greatly from what we see here.”

There are other differences, he adds. For example, BC needs more rental housing and housing supply than other provinces.

“It’s not as if [a surtax] is the only solution,” said Conseco. “We had a very good conversation when we were developing the questions. It has to be part of a broader plan... it's not a silver bullet, but a way in which policy makers can look at more holistic solutions.”

Kershaw founded Generation Squeeze more than a decade ago. He says their research is independent of funding that they’ve received, which includes funding from government agencies, the Urban Development Institute, and developer Wesgroup, among others. Their work on the surtax was part of a collaborative effort with other academics across Canada.

Another study out of UBC looked at extremely low income taxes paid by owners of ultra high value properties. The paper, authored by UBC’s Tom Davidoff, Paul Boniface Akaabre, and Craig Jones, says that homes in the top 5% of value in Greater Vancouver in 2018 had a median value of $3.7M, while the owners only paid income tax of $15,800. As the authors note, that amount “is strikingly low.” They propose a federal minimum income tax based on property value, or, at the municipal level, a property surtax that offers exemptions according to income tax paid. Retirees on fixed incomes who’d purchased long ago would likely pay less or be exempt.

In their conclusion they observe: “Most luxury homes in Greater Vancouver appear to be purchased with wealth derived from sources other than earnings taxed in Canada.”