Residential mortgage debt in Canada soared in early 2023 as high inflation, rising interest rates, and cooling housing markets weighed on consumer confidence.

According to the Canada Mortgage and Housing Corporation's latest Residential Mortgage Industry Report (RMIR), the figure reached $2.08T in January, a 6% annual increase.

With fewer people looking to purchase property, the rate of growth for mortgage debt slowed compared to recent years. But despite the deceleration, Canadian households still face record levels of mortgage debt.

READ: 75% of Canadian Household Debt Comes From Mortgages: CMHC

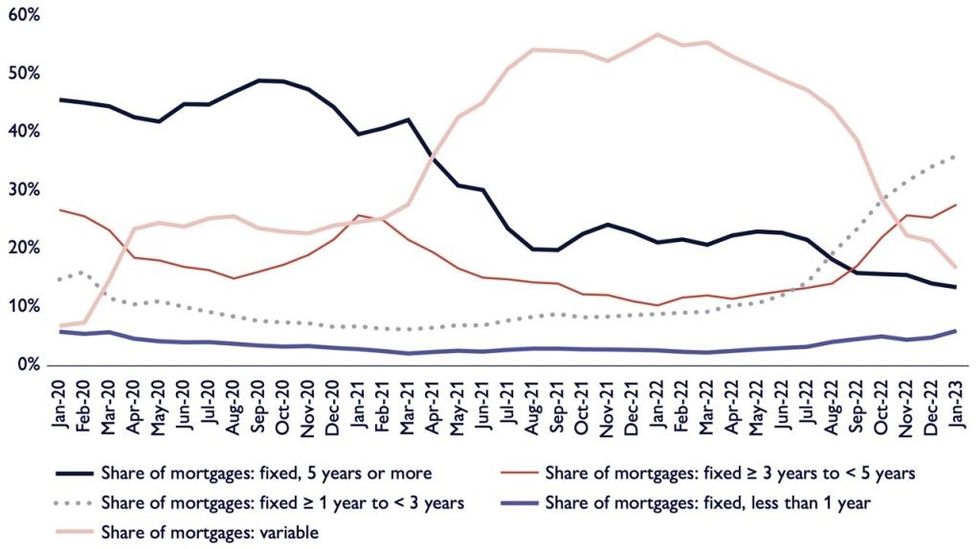

In response to high interest rates, many Canadians are opting to reduce their monthly debt servicing costs or choosing shorter-term fixed-rate mortgages in anticipation of future rate cuts.

New uninsured mortgages with an amortization period of over 25 years have become increasingly popular at chartered banks since Q2 2021, now accounting for 60%. The longer amortization period allows borrowers to pay less each month towards the principal of their loan.

Previously the most popular choice for borrowers, fixed-rate mortgages of five years or more fell to 13% of all mortgages in January. They accounted for 21% of mortgages in January 2022, and 40% in January 2021.

Since September 2022, fixed-rate mortgages between one and three years and between three and five years have become the top options, accounting for roughly 36% and 28% of mortgages, respectively, as of January 2023. A year ago they accounted for 7% and 26%.

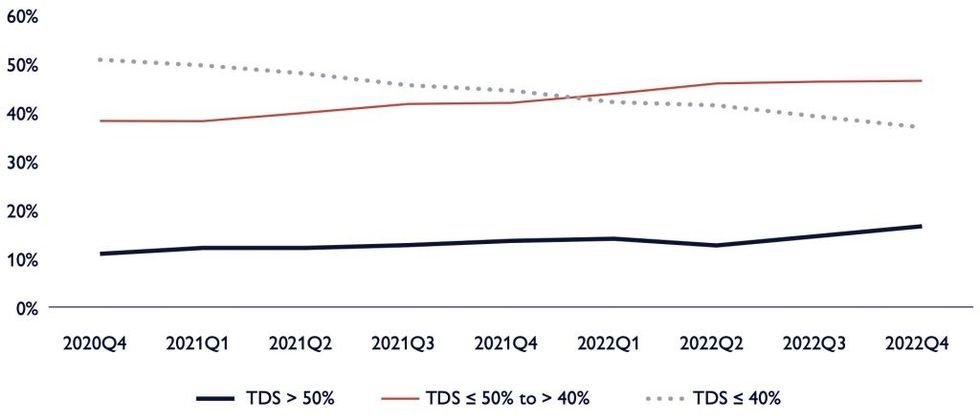

As high interest rates and inflation persist, borrowers are allocating a larger share of their disposable income to debt obligations.

The share of uninsured new mortgages with a total debt service ratio (TDS) above 50% has increased from 10.9% in Q4 2020 to 16.6% in Q4 2022. Meanwhile, the share of those with a TDS at or below 40% declined from 50.8% to 36.9% over the same time period.

Mortgage activity by non-bank lenders increased steadily from Q1 2021 until Q3 2022, and now matches the pace of mortgage growth in the banking industry. Higher interest rates and a gradual tightening of mortgage policy contributed to the increase, according to the report.

"With record levels of mortgage debt and the higher cost of living, questions are arising around the ability of Canadian households to make their monthly debt payments," said Tania Bourassa-Ochoa, Senior Specialist of Housing Research for CMHC.

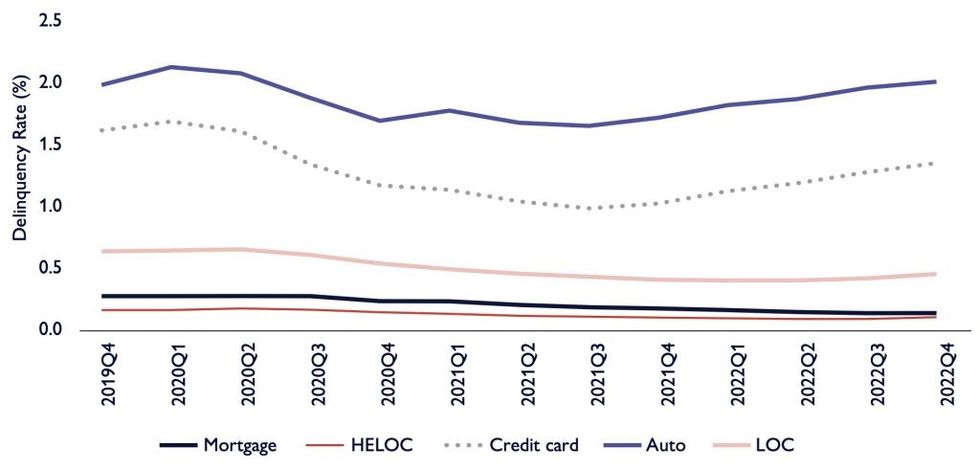

"Although mortgages in arrears remain low, they are a lagged indicator and in challenging financial situations, consumers will typically be delinquent on credit cards, lines of credit, or auto loans before mortgages. Increasing delinquencies for these credit products indicate a larger number of consumers are having difficulties with their debt payments."

The delinquency rates for credit cards and auto loans increased throughout 2022, with the latter now back to pre-pandemic levels at 2.02%. The former sat at 1.36% in Q4 2022. The delinquency rate for lines of credit had been declining since Q3 2020, but increased slightly in Q3 and Q4 2022 to 0.46%.

Delinquency rates for mortgages and home equity lines of credit (HELOCs) remain at or near historic lows, at 0.14% and 0.11%, respectively, but, as Bourassa-Ochoa cautioned, they tend to be lagged indicators.