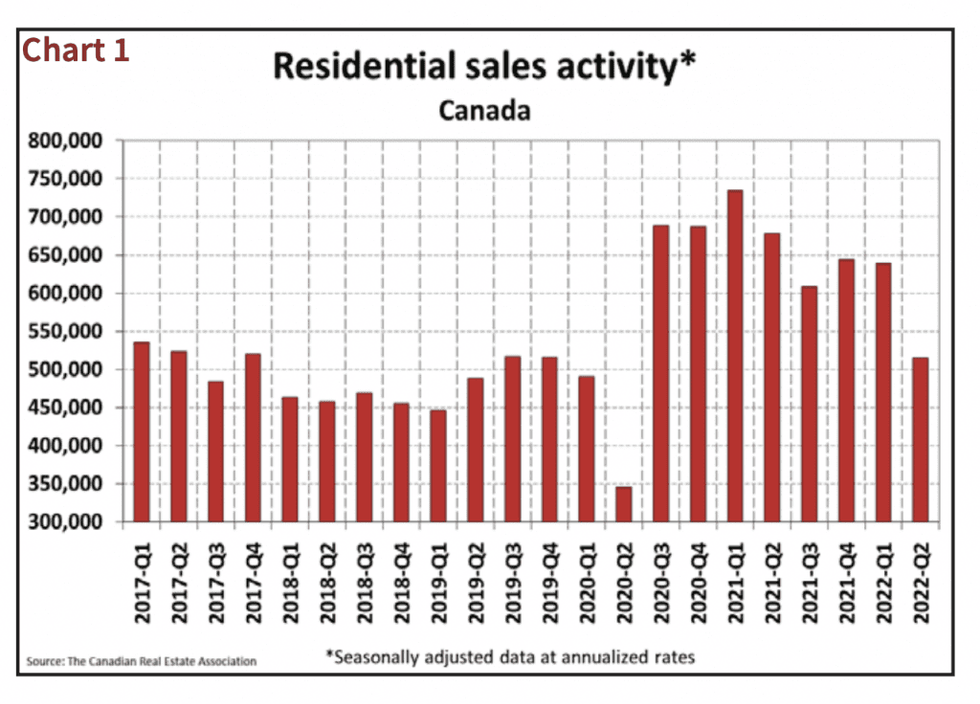

National real estate activity continued to slow in June in the face of rising interest rates, leading to a 23.9% annual plunge in sales from last year’s record, and the first year-over-year price decline seen since the early months of the pandemic.

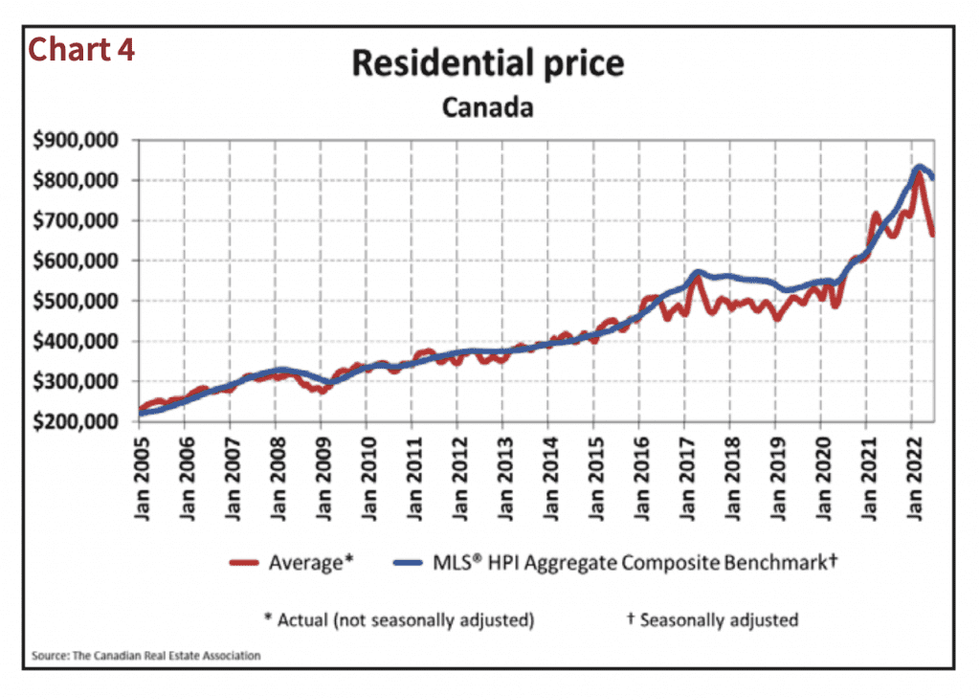

The Canadian Real Estate Association reports a total of 40,107 homes sold last month, marking a 5.6% dip from May, at an average seasonally-adjusted price of $665,850 -- down 1.8% annually, and by -4.3% month over month. That reflects a significant turnaround from price trends over the last two years, when searing year-over-year price growth became the norm; the last time home values dipped annually was in May of 2020, by 2.3%.

READ: This Is What the Interest Rate Hike Means for Canadians

Compared to the price peak recorded in February of this year, Canadian home prices have fallen 18.4%, a dollar amount of $150,870. The MLS® Home Price Index (HPI) edged down 1.9% month-over-month but was still up 14.9% year-over-year. However, that’s less than half of the 30% increases seen in January and February.

Sales were down in three-quarters of all local markets, especially in the nation’s largest cities including the Greater Toronto Area, Greater Vancouver, Calgary, Edmonton, Ottawa, and Hamilton-Burlington. That resulted in softer prices in those locales, CREA reports, especially in Ontario and parts of British Columbia (though Greater Vancouver remained largely stable). Prices remained flat across the prairies, and dipped slightly in Quebec, and “appear to have stalled” in Halifax-Dartmouth while rising in the rest of the Maritimes.

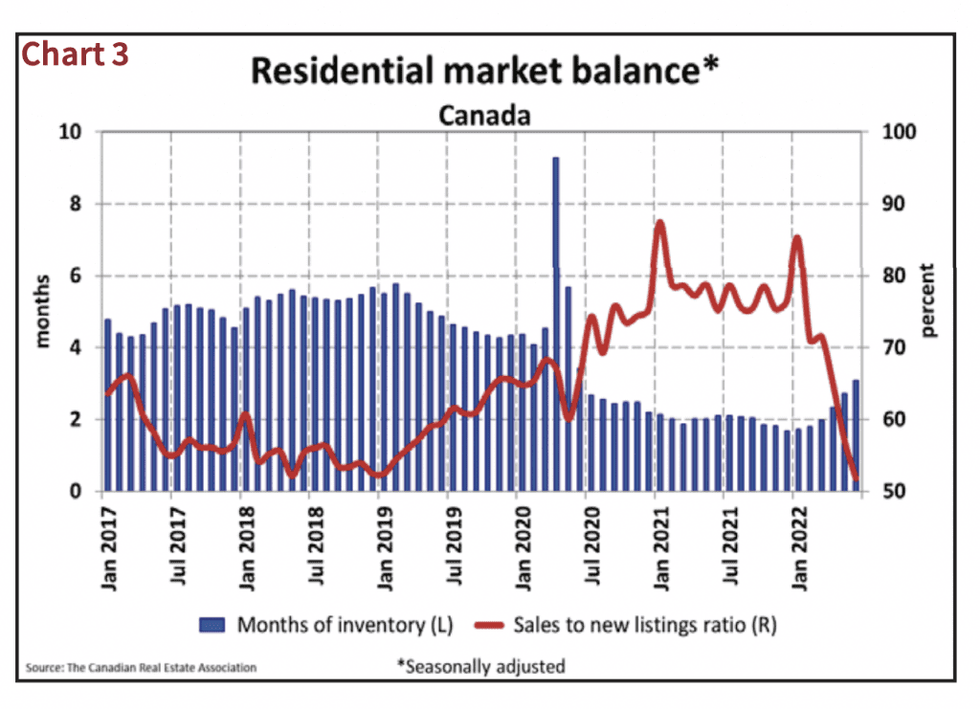

The number of newly listed properties continued to rise, up 4.1% from May and 10% from the same time in 2021, at 77,518.

“Sales activity continues to slow in the face of rising interest rates and uncertainty,” said Jill Oudil, Chair of CREA. “The cost of borrowing has overtaken supply as the dominant factor affecting housing markets at the moment, but the supply issue has not gone away. While some people may choose to wait on the sidelines as the dust settles in the wake of recent rate hikes, others will still engage in the market in these challenging times.”

Market balance continued to improve as the pace of new inventory grew more than sales, helping ease the sales-to-new-listings ratio to 51.7%, its lowest level since January 2015, and below the long-term average of 55.1%. This ratio, which gauges the level of buyer competition in the market, reflects a balanced market between a range of 40 - 60%, with above and below that threshold indicating sellers’ and buyers’ markets, respectively. According to CREA, three-quarters of all local markets could have been considered balanced in June.

The overall level of inventory on the market remains tight from a historical perspective, but is showing signs of recovery at 3.1 months; that’s up significantly from the lowest level ever seen just six months ago. The long term measure for this metric is slightly more than five months.

It’s clear the market continues to adjust to the tougher borrowing costs and qualification criteria that have occurred as a result of the Bank of Canada’s hiking cycle. The central bank has increased its trend-setting Overnight Lending Rate four times since March, the most recent being a surprise 1% hike on July 13. That supersized increase was a shock for borrowers and markets alike, as the Bank of Canada has made it clear it will aggressively tighten monetary policy in order to reign in runaway inflation.

That’s led to significant increases for both fixed and variable mortgage rates, the latter of which remain the most popular with homebuyers, says CREA’s Senior Economist Shawn Cathcart. He says that policymakers should take a second look at the current qualification thresholds in place for borrowers, such as the mortgage stress test.

“One important feature of the market right now that isn’t getting enough attention is the difference in mortgage qualification criteria between fixed and variable, because while variable rates adjust in real time, fixed rates have already priced in most of what the Bank of Canada is expected to do over the balance of 2022,” he says.

“As such, it’s no surprise to see people piling into variable rate mortgages at record levels, but probably not for the reasons they may have chosen them in the past. It’s because the 200 basis points plus the contract rate element of the stress test has, just since April, become much more difficult to pass if you want a fixed-rate mortgage. A strict stress test made sense when rates were at a record-low, but policymakers may want to assess if it continues to meet its policy objectives now that fixed mortgage rates are back at more normal levels.