In an ever-dramatic real estate market, the great "buy or rent" debate remains on the lips of countless Canadians.

While rents had climbed to sky-high levels in the years leading up to the pandemic, especially in cities like Toronto and Vancouver, they took a nosedive when the collective realization set in that the COVID-19 would stick around for a while.

By the end of 2022, however, rents across the country had risen significantly. Not only have professionals returned from pandemic-inspired relocations to the city core and their physical offices -- at least, on a hybrid level -- a year of perpetually climbing interest rates, coupled with sky-high home prices, have kept would-be homeowners in the rental market.

For many, renting seems like the more affordable option -- if even just for the time being -- thanks to the cost of borrowing. But how much more affordable is it really? Some may argue that it’s actually easier on the bank account to buy -- that is, depending on where you live in the country (and countless other circumstantial factors).

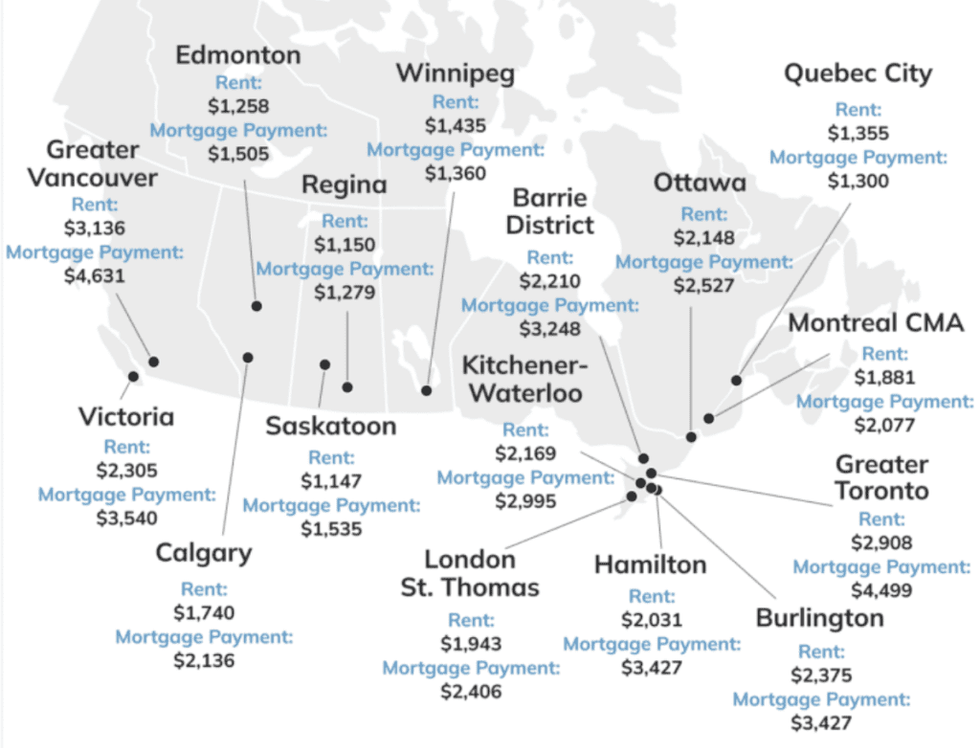

Recent data compiled by Zoocasa reveals that, despite climbing rents -- rentals were more affordable across most of Canada.

Zoocasa analyzed data for 21 different markets across the country and compared monthly rental prices and monthly mortgage payments for the average home in each. Additional costs for each were not considered, such as utilities or property taxes. Rental price numbers were sourced from Rentals.ca, while the monthly mortgage payments were calculated by assuming a 20% down payment at a mortgage rate of 4.69% amortized over 30 years on the average-priced home.

If you live in Winnipeg or Quebec City, however, mortgage payments are less expensive. The average rent in Winnipeg is $1,435, while the monthly mortgage payments for the average home would amount to $1,360 a month. In Quebec City, the mortgage payments each month would total $1,300, just shy of the average monthly rent of $1,355. On the east coast, Halifax-Dartmouth -- a region that saw high levels on intra-provincial migration in the thick of the pandemic -- is the next closest to having more affordable mortgage payments, with monthly mortgage payments costing just two dollars more than rents at $1,995.

Compared to mortgage prices, the rental markets that have the biggest price difference between rent prices and mortgage payments are in the cities with the most expensive home prices -- Vancouver, Toronto, Oakville-Milton, and Mississauga. Of these cities, rental prices are the most affordable in Mississauga at $2,395. Meanwhile, the most significant difference in rent and mortgage payments is in Oakville-Milton, with a difference of $2,626 between the two.

People in Regina pay the least amount for housing. Rental properties are at their cheapest here, with the average monthly rent of just $1,150, but as this is also the most affordable market in terms of housing price, this is to be expected.

There is some good news for renters, however (especially those who don’t live in Toronto). Rental prices have been on a very slow decline over the last few months, highlights Zoocasa. According to rentals.ca, Canadian rent prices have fallen by 2% over the last three months, indicating some softening in the market. “With the housing market kicking back into gear, the improvement in rental supply and the lack of affordability in the rental market, prices are adjusting slightly,” reads the Zoocasa report.

While the spring market is still a tricky one to predict, with the recent pause in interest rates, some experts believe that would-be buyers will emerge from the sidelines.

“As the Canadian population continues to outpace the rate at which new housing is being developed, it’s likely that housing affordability, whether renting or buying, will continue to be top of mind across the country,” reads the report.

In the meantime, the decision to rent or to buy is a highly personal one that’s dependent on many different life and financial circumstances. As cities like Toronto move more in the direction of Manhattan on the real estate and transit front, one thing is certain: there’s no shame in renting in this climate.

| City | Ave. Monthly Rent | Ave. House Price | Ave. Monthly Mortgage Payment |

| Vancouver | $3,136 | $1,123,400 | $4,631 |

| Toronto | $2,908 | $1,091,300 | $4,499 |

| Oakville-Milton | $2,595 | $1,266,500 | $5,221 |

| Burlington | $2,375 | $1,064,513 | $3,427 |

| Mississauga | $2,395 | $1,503,400 | $4,343 |

| Victoria | $2,305 | $858,600 | $3,540 |

| Kitchener-Waterloo | $2,169 | $726,500 | $2,995 |

| Ottawa | $2,148 | $613,000 | $2,527 |

| Barrie and District | $2,210 | $787,900 | $3,248 |

| Cambridge | $2,130 | $742,300 | $3,060 |

| Hamilton | $2,031 | $800,584 | $3,427 |

| London and St. Thomas | $1,943 | $583,500 | $2,406 |

| Halifax-Dartmouth | $1,993 | $484,000 | $1,995 |

| Kingston and Area | $1,896 | $540,900 | $2,230 |

| Montreal | $1,881 | $503,900 | $2,077 |

| Calgary | $1,740 | $518,100 | $2,136 |

| Winnipeg | $1,435 | $329,900 | $1,360 |

| Quebec City | $1,355 | $315,300 | $1,300 |

| Edmonton | $1,258 | $365,100 | $1,505 |

| Saskatchewan | $1,147 | $372,400 | $1,535 |

| Regina | $1,150 | $310,200 | $1,279 |