The National Bank of Canada has released its latest quarterly snapshot into housing affordability, and it shows ‘continued improvement’ — not only from a national vantage point, but in 80% of major local markets as well. But, as anyone experiencing the housing market in real-time can attest to, it doesn’t really feel like affordability is improving.

But first, the data.

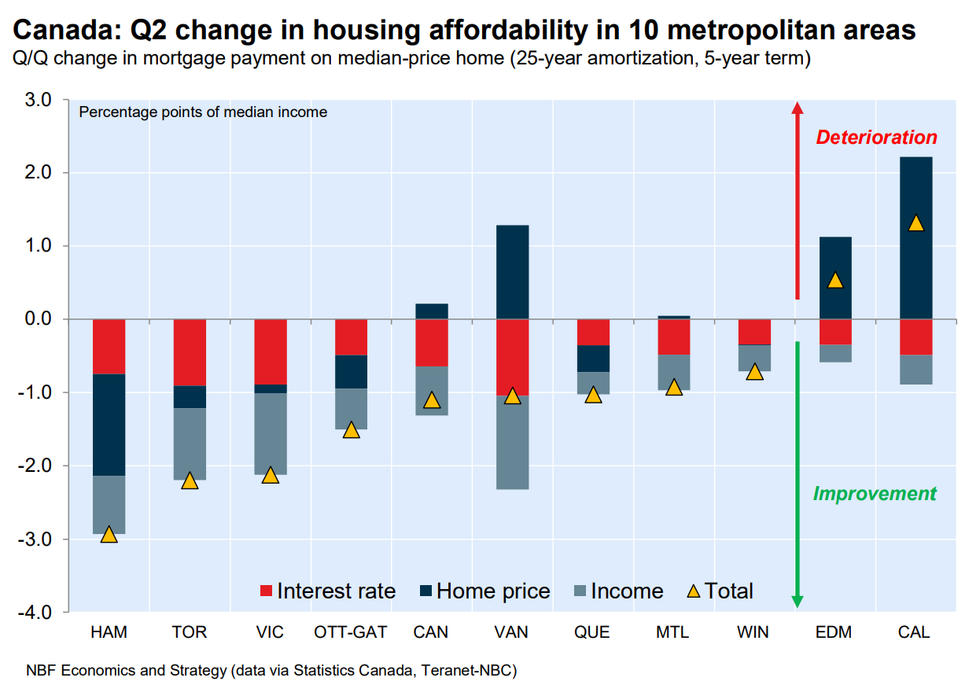

A report put out by National Bank economists Kyle Dahms and Alexandra Ducharme on Thursday shows that Canadian housing affordability improved in the second quarter of 2024 despite the fact that seasonally adjusted home prices ticked up 0.4% from the quarter prior. According to the report, the benchmark mortgage rate (for a five-year term) fell 11 basis points in the quarter, while median household income rose 1.2%, which helped to prop up affordability.

As such, “mortgage payment as a percentage of income,” or MPPI, dipped 1.1 percentage points to 57.9% between the first and second quarters of the year.

National Bank also highlights that “the amelioration was relatively widespread,” as eight out of ten major markets included in the report saw a decline in MPPI in the second quarter.

Of course, from market to market, the declines were of varying degrees, the report says. “On a sliding scale of markets from best progression to least: Hamilton, Toronto, Victoria, Ottawa-Gatineau, Vancouver, Quebec, Montreal, Winnipeg.” Conversely, housing affordability “deteriorated” in Calgary and Edmonton.

More Affordable Vs. Actually Affordable

While there are some particulars to National Bank’s methodology to note — for instance, the benchmark mortgage rate assumes a five-year term and 25-year amortization, while income needed to purchase the median property assumes that a household devotes 32% of its pre-tax income for a mortgage payment at the posted rate — the headline takeaway is that housing affordability is on the mend.

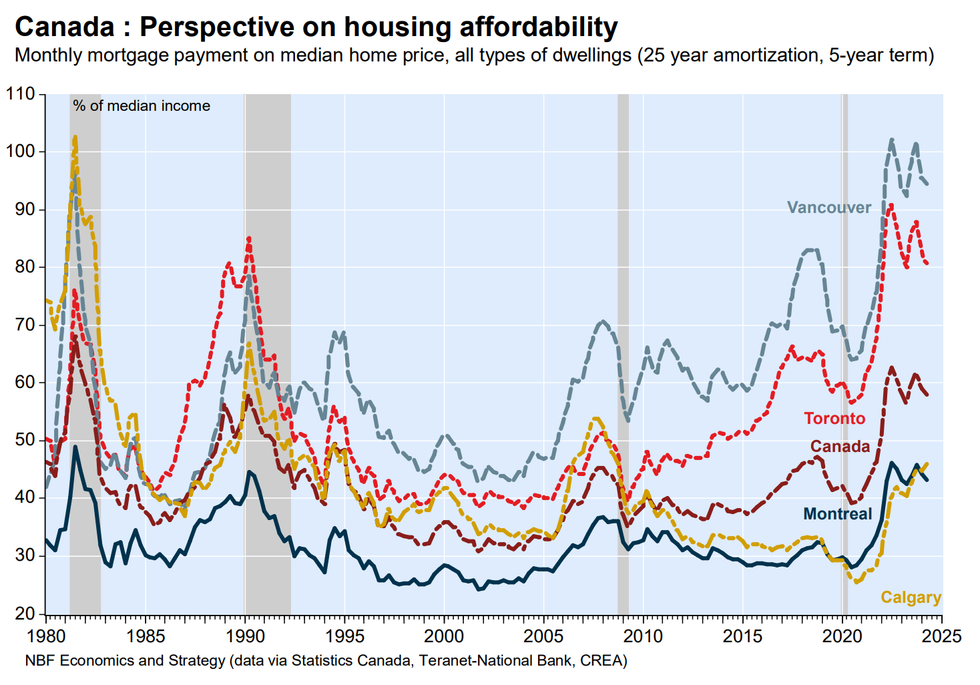

Even so, it’s important to consider the baseline here; we’re coming off of a period where housing affordability has been trampled amid high mortgage rates and home prices, and some experts have gone as far as to say that affordability, amid high interest rates and high home prices, has already plunged to its worse-ever level across major Canadian markets like Toronto, Victoria, Ottawa, and Montreal. As such, ‘more affordable’ doesn’t necessarily equate to actually affordable, as far as your average consumer is concerned.

With respect to the national MPPI, which was just shy of 58% last quarter, Ducharme tells STOREYS that it “remains well above pre-pandemic levels,” the quarter-over-quarter improvement notwithstanding. “Consumers comparing today's situation with that of a few years ago would rightly feel that current circumstances are worse,” she adds.

And it's the same story locally, with mortgage payment as a proportion of income remaining unequivocally high. Hamilton, for example, saw the “most significant improvement” in housing affordability last quarter, with MPPI edging up 2.9 percentage points to 65.5%. That figure may have improved from the quarter prior, but it's still well above the metric’s “long run average” of 41% — and it's also just a really high in its own right. Breaking down home purchases into condo and non-condo, it appears those mortgage payments would eat into 47.5% and 69.4%, respectively, of income.

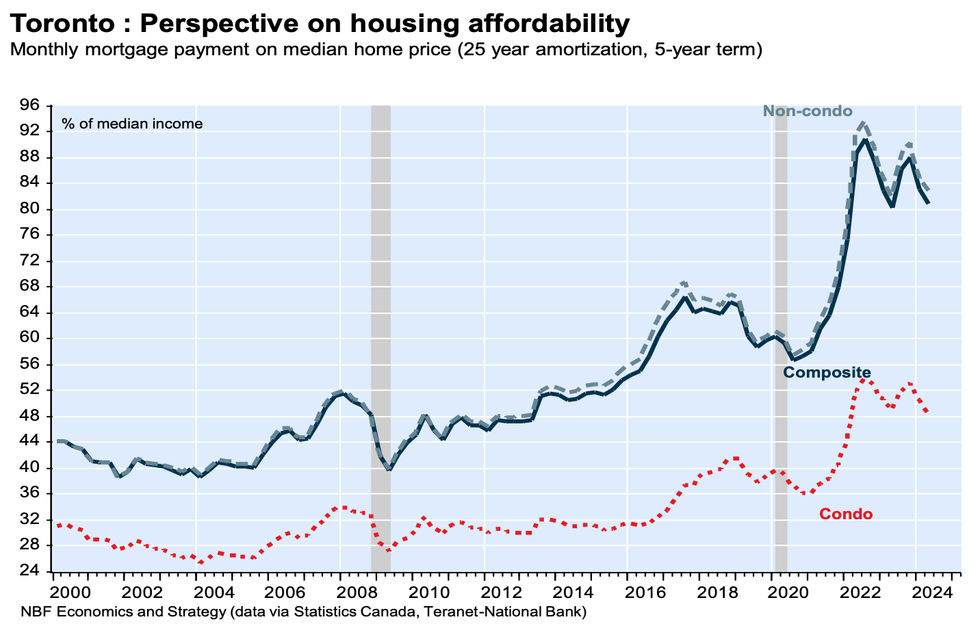

Greater Toronto saw the second-best improvement in housing affordability behind Hamilton, with MPPI dipping 2.2 percentage points to 80.7%. Though that is the lowest the metric has been since the second quarter of 2023, it remains well above the historical average of 52.9% for the city. For condo and non-condo, MPPI was 48.5% and 82.8%, respectively.

In Greater Vancouver, MPPI came down 1.1 percentage points, but the metric remained at a sky-high 94.5%. The quarterly improvement was attributed to “lower interest rates and an increase in income that together more than offset a 1.3% increase in home prices,” National Bank says. “Vancouver remains the least affordable Canadian city in which to buy a home.” MPPI for condo and non-condo purchases was 56.1% and 126.4%, respectively.

For the seven other markets featured in National Bank's report, MPPI clocked in 79.8% for Victoria (47% for condo and 89.2% non-condo), 46% in Calgary (27.2% for condo and 504.4% for non-condo), 43.3% for Ottawa/Gatineau (26.5% for condo and 47.6% for non-condo), 43.2% in Montreal (34.6% for condo and 47% for non-condo), 32.6% in Edmonton (19.2% for condo and 34.2% for non-condo), 31.6% for Quebec City (23.6% for condo and 31.7% for non-condo), and 31% for Winnipeg (21.7% for condo and 31.1% for non-condo.

These numbers are “indicative of an unaffordable market,” says Ducharme. “Meanwhile, low vacancy rates on the rental market have led to a sharp rise in rental prices, meaning that consumers currently living in rented accommodation may find it harder to save enough to become homeowners.”

The Interest Rate Factor

There are other factors to consider when talking about housing affordability, including things like insurance and property tax costs, both of which have risen rapidly in recent years. But if we’re just looking at housing affordability based on home prices and financing conditions, it stands to reason that conditions will improve as interest rates continue to come down, and the cost of borrowing comes down with it.

However, as Thursday's report points out, the two — the policy rate and mortgage rates — don’t necessarily move “in lockstep.”

Nonetheless, economists with the National Bank of Canada are currently forecasting that the Bank of Canada will ease its policy rate by 150 basis points over the next 12 months, bringing the rate down to 3%. By the third quarter of 2025, the expectation is for the policy rate to be at 2.75%. “This development would provide a significant alleviation of the financing burden,” the report says. “At current income and home price levels, it would bring affordability halfway back to pre-pandemic levels.”

There are, of course, risks to that forecast, Ducharme warns. “Lower interest rates could mean higher prices, but we expect the economy and labour market to remain soft in the months to come, which should provide little support for home prices.“ According to Thursday's report, payment shock from upcoming renewals should also help to keep a lid on price growth moving forward.