What's more Canadian than maple syrup? Taxes. So of course real estate taxes are very Canadian. But some cities have it better than others.

So it's not only home prices and borrowing costs that home buyers and homeowners have to worry about when it comes to housing affordability. It's also land transfer and property taxes.

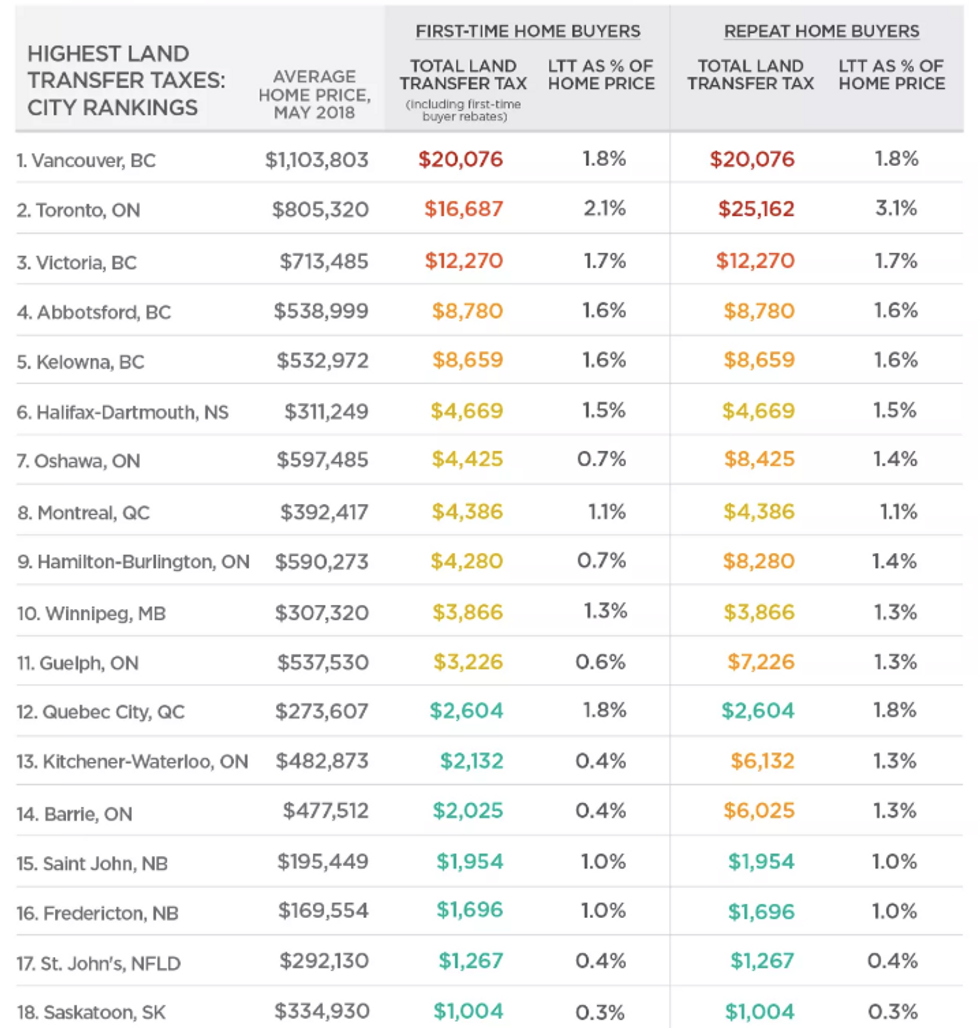

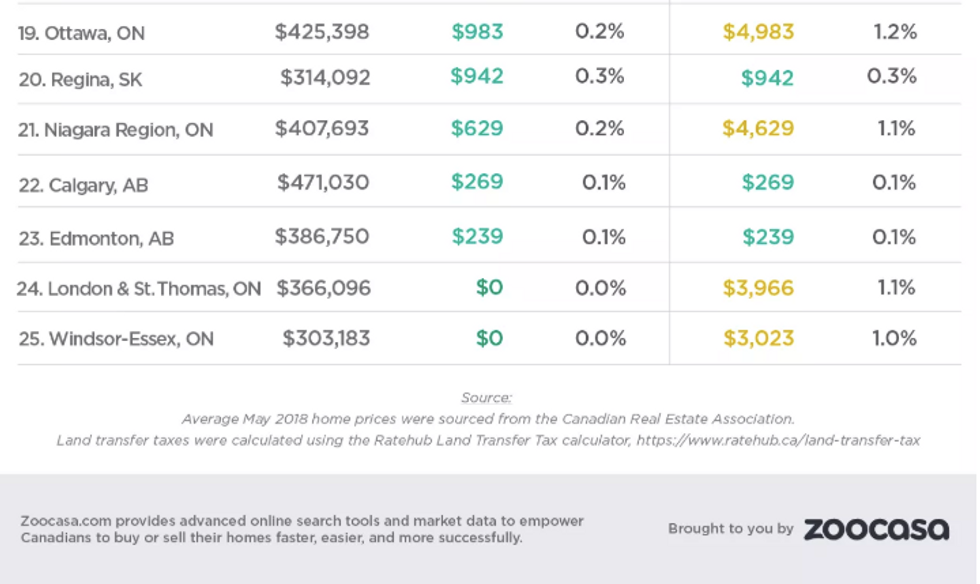

Depending on tax rates and local property values, some Canadians could pay as little as a few hundred dollars, while others can fork out tens of thousands of dollars.

To find out how taxes impact affordability across Canada, Zoocasa examined the land transfer tax structure, average home price, as well as any applicable first-time home buyer rebates, in 25 major Canadian cities.

In Toronto, home buyers contend with both a provincial and a municipal LTT. The tax tally is nearly $17,000, based on an average home price of just over $800,000. And, yes, that does factor in nearly $8,500 in rebates for first-time home buyers.

Repeat buyers are looking at tax bills in excess of $25,000.

Maybe this would make some home buyers consider moving to London or Windsor. Those Ontario cities average home prices are still below the threshold of $368,333, and first-time homebuyers don't have to worry about paying the LTT.

In Vancouver, housing affordability is at “crisis levels,” according to RBC. Add to that a $20,000 tax with the cost of buying an average-priced home worth $1.1 million.