It wasn’t so long ago that the pandemic left the construction sector to grapple with a stalled supply chain and a shrunken labour force. Though much has improved since those fear-tinged days (generally speaking) residential construction in Canada is still remarkably downcast.

In fact, a recent report from the Canadian Centre for Policy Alternative (CCPA) says that developers today are investing less in new housing construction than they were during “the height of pandemic economy shutdown” in April 2020.

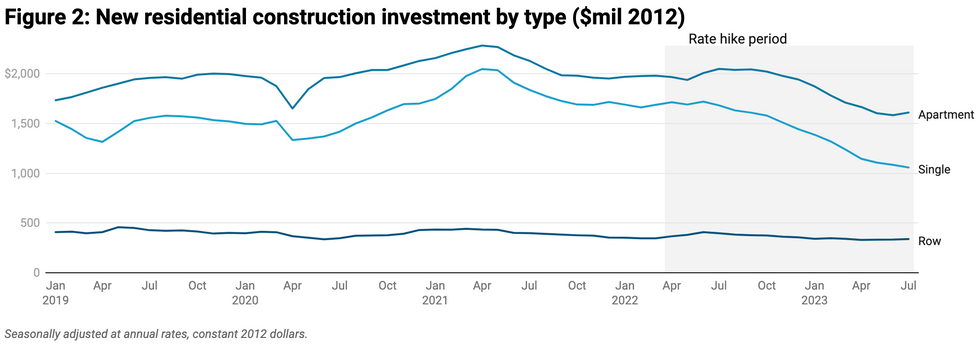

“Compared to the worst of the pandemic, investment in new single-family homes is down 21%, new row homes are down 8%, and new apartment construction is down 2%,” writes CCPA Senior Economist David Macdonald, who authored Wednesday’s report.

And then there’s the impact of interest rates, which have had a “devastating effect” on new residential construction, says Macdonald.

Since the Bank of Canada kicked off its hike cycle in the first quarter of 2022, investments in new single-family homes are down 36%, while investments in new semi-detached houses and new apartment construction have fallen 27% and 19%, respectively.

Meanwhile, other housing-related sectors are similarly downcast in the face of higher rates. Renovations are down 21%, while ownership transfer costs, such as real estate commissions, are down 28%

“Real GDP hasn’t grown at all between January and July 2023 and cratering residential investment is a key driver of that stagnation,” Macdonald also notes.

“The worst is yet to come”

The Bank of Canada began hiking interest rates last year in March, and Macdonald warns that the full impact of the hike cycle on new builds remains to be seen.

“The BoC estimates that the worst impacts of rate increases take two years to hit the housing sector and the housing sector is the main vehicle for rate hikes to hit the economy,” he says. “Right now, it has been 18 months since the first rate increases, but most of the bigger rate increases have occurred in the past 12 months — so the worst is yet to come.”

Macdonald also highlights that the private sector developers that we tend to rely on to build new housing are extremely rate-sensitive, as they often have to take on large amounts of debt for extended periods of time (and well before seeing a return).

This alone challenges the viability of privately funded housing projects, given today's rate realties, and renders many government-backed initiatives geared at boosting housing supply in Canada (think: the feds’ housing accelerator fund and the recent removal of GST on new rental builds) more or less moot.

“It's as if governments are bringing a nail to the construction site but the Bank of Canada is bringing a wrecking ball,” says Macdonald.