Housing starts edged up slightly in several major cities during the first half of the year, but the growth will not be nearly enough to address Canada’s significant supply crisis.

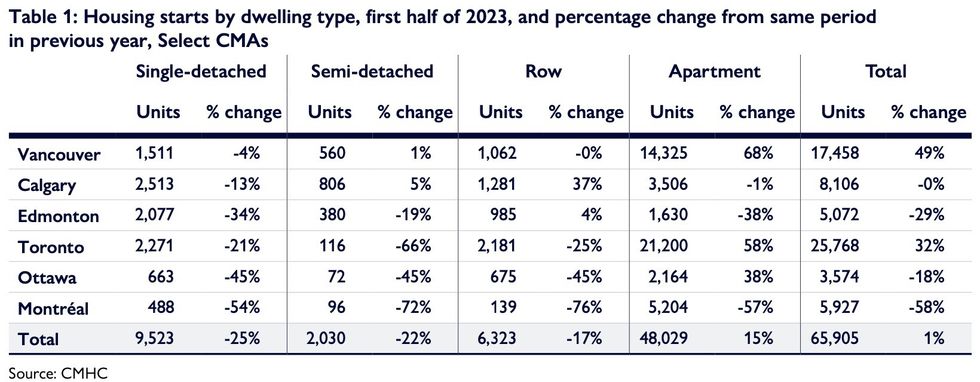

Over the first six months of 2023, total housing starts in the country’s six largest census metropolitan areas (CMAs) increased 1% compared to the same timeframe in 2022, according to new data from the Canada Mortgage and Housing Corporation (CMHC).

The growth was entirely led by apartment construction, which rose 15%, while starts of single-detached, semi-detached, and row houses fell 25%, 22%, and 17%, respectively.

As well, construction was largely concentrated in Toronto and Vancouver — apartment starts in the former jumped 58%, with rental starts reaching a multi-decade high, pushing total starts to rise 32%. In the latter, a 49% increase in apartment construction led total starts to rise 68% compared to 2022.

While Ottawa also experienced an increase in apartment construction during the first half of the year, with starts rising 38%, Calgary, Edmonton, and Montreal all posted declines.

But Calgary registered growth elsewhere, with semi-detached starts rising 5% and row home construction increasing 37%, leading total starts to stay flat compared to a year ago. Although Edmonton saw row home starts rise 4%, total starts fell 29%.

In Montreal, declines were "particularly notable," and registered across all dwelling types. The city’s 58% drop in total housing starts was enough to offset much of Toronto and Vancouver’s growth at the six-CMA level.

High interest rates are to blame for the "generalized weakness" in starts for single-detached, semi-detached, and row houses, as prospective buyers shy away from the pricey property types. This demand has instead been refocused on apartments, driving up starts in Toronto and Vancouver’s expensive real estate markets.

But the flurry of starts seen in the first half of 2023 will not endure, with the CMHC predicting that economic challenges, and high interest rates, will slow the pace of apartment construction in Toronto and Vancouver throughout the latter half of the year. One "major challenge" is the cost of construction, which remains elevated in the cities.

CMHC data from July and August already reflects this outlook, with the seasonally adjusted annual rate of housing starts declining significantly in both cities.

As well, there are indications that faltering demand for new construction on the ownership front isn't keeping pace with new supply. Across Canada, the inventory of completed and unsold homes increased 48.7% between the first half of 2022 and the first half of 2023. The biggest increase was seen in apartments, at 57.0%.

“Despite increases in some centres, the overall level of new construction activity remains too low to address the country’s affordability and housing supply crisis over the longer term,” the CMHC said.

“Significant increases in the construction industry’s productivity will be critical to ensuring supply can be increased to address this crisis over the longer term.”