When there is uncertainty, people naturally look for safe harbour. In the world of commercial real estate, that safe harbour has become multi-family assets, according to commercial real estate brokerage Avison Young.

"Purpose-built rental housing is attracting increased attention from investors to weather the economic uncertainty from the ongoing trade war," said Avison Young in their Spring 2025 multi-family market report. "Investors are drawn to multi-residential assets due to the prospect of owning a positive and stable cash flow asset on day one of acquisition, with a positive, long-term sentiment for rental rate upside."

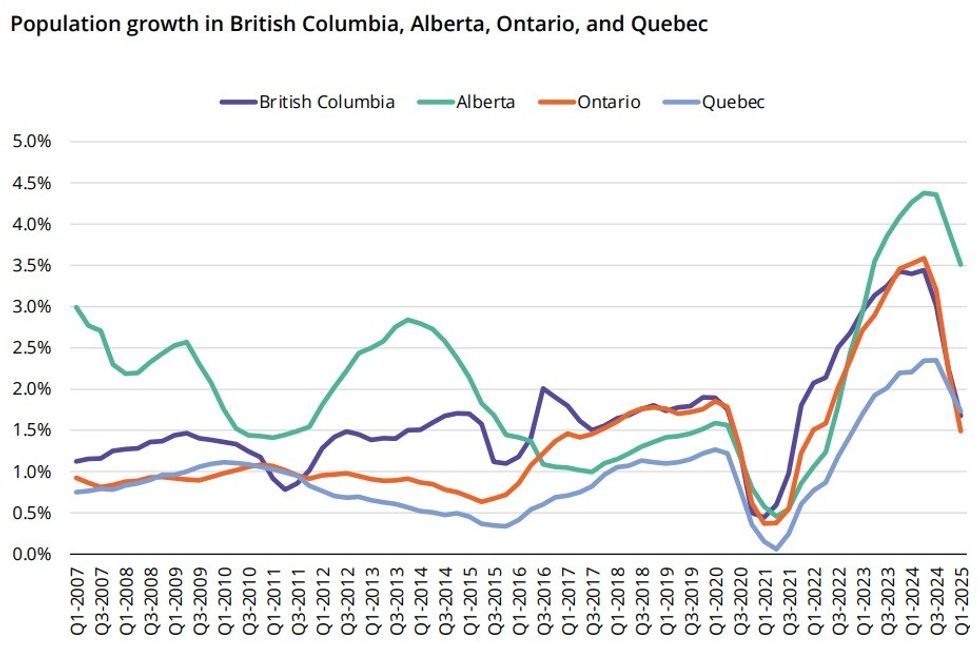

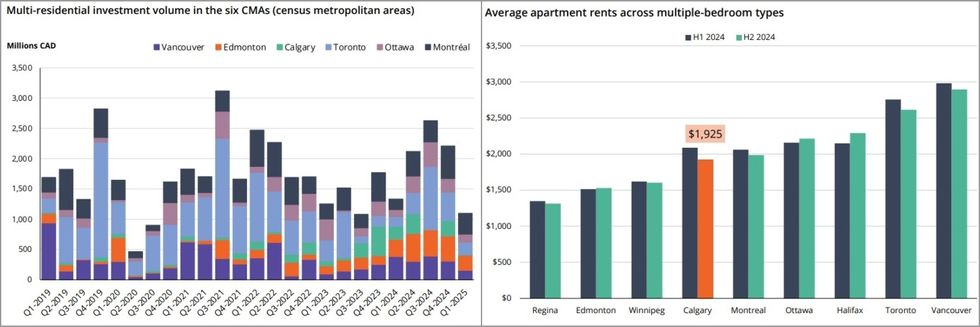

Across the country, investment in the multi-family market improved in all of the major markets from 2023 to 2024, in terms of sales volume, while the average price per unit has cooled from a peak of around $422,000 in 2023 down to $300,000, according to the report. Much of the recent activity has been driven by international immigration and interprovincial migration, the latter concentrated in Alberta and its two largest markets.

"The multi-family market, the story around it was really positive during COVID," said Jandip Deol of Avison Young's Edmonton Multi-Family team in an interview with STOREYS last week. "I think the general sense was that everybody needs a place to live and that was a huge value draw for a lot residents across the country. We saw the investors from BC and Ontario come into our market around COVID. That really spurred a lot of our transactions during COVID and post-COVID."

Deol says that Edmonton and Calgary started seeing a growth in rents over the last 24 months that they've been waiting more than 15 years for, which has really driven investment activity and transaction volume in both markets, as the multi-family markets in BC and Ontario both took a downturn. Although rents have made significant jumps, they generally remain more affordable than many other major markets across the country, and that combination has resulted in significant investor interest.

"Rents have moved more in the past 18 months than they have in the past decade," added Haig Basmadjian, an Associate Vice President at Avison Young Calgary. "Alberta, generally speaking, has been on the map now for investments for the first time since 2013. It's been very good for our market, with a lot of out-of-province interest driving that. What we're seeing is a large part of the absorption is coming from, of course immigration, but interprovincial migration."

Calgary vs. Edmonton

Some may be tempted to lump Calgary together with Edmonton, but there are some notable distinctions between Alberta's two largest markets.

"Edmonton is a much larger universe than Calgary when it comes to the amount of rental product they have," said Basmadjian. "Calgary did experience quite a run on rents. Those rents increased quite dramatically over a relatively short period of time. Edmonton experienced growth as well, but I think Calgary was leading the country in growth metrics when it comes to rents. But it also had an unprecedented number of housing completions in 2024. We had over 5,500 units in 2024 completed and we're scheduled to have more than that in 2025."

"I think the best way to break it down is just simple supply and demand," added Deol. "Calgary having less units means the rents move up quicker. There's more elasticity in the market, whereas Edmonton typically lags Calgary by nine to 18 months and the run-ups are a bit slower. We're still kind of in that run-up stage. Edmonton, in some areas, is still seeing some rental growth. Vacancy is still really tight — we're sub-5%, which is very healthy for our market. Specifically, with some of the newer assets, we're seeing that they're, depending on location, holding quite well in terms of occupancy. I spoke to an investor client of mine last week and he purchased 2,000 units in Edmonton and Calgary in the last 18 months and out of 2,000 units in Edmonton he only has three vacancies."

Basmadjian and Deol say some of the contributing factors behind Edmonton's much larger universe of multi-family product include the city's much longer history of building purpose-built rental, as well as the fact that it is a government city and is home to the University of Alberta (with its large demographic of renters). Meanwhile, Calgary has been more of a buyer city than a renter city, until recently, and is more white-collar while Edmonton is more blue-collar; although Calgary is seeing a shift with more young people renting as developers improve the array of amenities in their buildings.

In Calgary, Basmadjian says older product is still "tremendously popular" and there is a lot of interest in smaller, value-add multi-family properties, but newer assets are starting to transact as the bid-ask spread is tightening. For Edmonton, Deol says the market is generally "agnostic" when it comes to old versus new product and he and his team are seeing a healthy dose of attention in both.

Interest From Institutional Investors

According to the Avison Young team, much of the market in Alberta is currently being driven by private investors, with a majority of buyers right now having origins outside of the province. And that percentage of out-of-province buyers continues to increase, which hasn't happened in a long time, with large institutional players like REITs starting to follow and actively look at Alberta again.

"I'd say the top 10 is 50% private and 50% institutional, with institutional including the REIT players," said Deol. "Deals in the Alberta market are accretive, whereas they are not in BC and Ontario, and that's why you've seen attention diverted our way. You can still come in and get a healthy spread between your cap rate and your debt/cost of capital, which is why the entire country is looking at us right now. We've never seen investment from the Montreal contingent — there's 400,000-plus units in Montreal so there's enough horsetrading that goes on there — but we actually saw a huge contingent of Montreal players come to the Alberta market and essentially start up a buying frenzy here. It just shows you that these are unprecedented times in terms of demand, product delivery, and, as a result, transaction volumes."

"The pandemic was a complete reset and now we're well back over pre-pandemic levels," said Bradley Gingerich, Senior Managing Director of Marcus & Millichap's Edmonton-based Institutional Property Advisors (IPA) team. "The buyer pool has definitely changed. We lack large institutions, but we're getting a lot of private money and a lot of private money is doing institutional-sized deals."

"I think the large REITs and institutions are hesitant, as they've always been, towards Alberta," he added. "Generally, they come to Calgary first and then come to Edmonton second. It takes time to get markets heated up enough that they come in the sights of those institutions. It starts off with syndicators, then the wealthy families, and then some of the larger property owners. Boardwalk [REIT], Mainstreet [Equity], Avenue Living are staples in this province, but CAPREIT's becoming a pretty big staple."

Pricing

With all that buyer interest and rents also on an upwards trajectory, it's then reasonable to wonder how pricing has been affected.

"First and foremost, yes, there's been an increase in per-unit pricing throughout the market, in Calgary certainly, but it's a combination of two things," said Basmadjian. One: it is driven by the rent growth. But two: it's also driven by the competition. Competition drives pricing so when you have more groups that are coming, especially the ones from out of province, it's driving pricing upwards."

"There's been two distinct inflection points that have increased multi-family values, added Deol, speaking about Edmonton. "One was COVID and that was replacement cost. Obviously, we sell income-producing assets so it's always basically you keep your NOI, you divide it by cap rate, and you get your valuation. That really didn't hold true during COVID as rents came down, so we were selling based on replacement cost. Now that has changed back to NOI and cap rates, because rents have come up, the valuations are being pushed up by rent. In Edmonton, I would say that the valuations have not quite caught up to the rents, yet. I would say that by the end of this year, you're gonna see valuations kind of peak out."

Deol says that the average for new purpose-built suburban product, which is mostly what is being built in Edmonton, is around $240,000 a door today, but he expects the peak to be around $300,000 a door.

"The current MLI Select program that CMHC is offering has been really a blessing for Alberta, added Gingerich and his colleague Bradyn Arth, a Senior Vice President on the IPA team. "Metrics within that program work pretty well for Alberta and allowed a lot of the investors to get high leverage, like 95% loan-to-value, and that really drove the market. In Alberta, where there's no rent control, MLI Select brings that in and people do it willingly. It's a beneficial program for both sides."

"Because of that financing, you saw a lot of the private guys be able to reach upwards of $50 million and $100 million deals, because you're only putting 5% down," said Arth. "So you could buy a lot of real estate. It changed the game for a lot of those guys."

"Generally, the story is when Montreal, Toronto, and Vancouver are hot, Alberta is not," explained Gingerich. "When Alberta is hot, the rest of the country isn't. Alberta's been hot for the past... year-and-a-half and it looks like it will be this year as well."