Last week, on National Housing Day, the Province of British Columbia and the Ministry of Finance released the latest batch of revenue data regarding the Speculation and Vacancy Tax (SVT), for the 2021 tax year, the fourth year since BC implemented the tax in 2018.

The Province created the tax to encourage owners to actually use the homes they purchase, rather than just hold on to them as an asset while living elsewhere, amidst a housing crisis defined in-part by a housing supply shortage. Revenue from the tax -- separate from the City of Vancouver's Empty Homes Tax -- also gets redirected towards the Province's Homes for BC plan to address housing affordability.

According to the Province's annual reports, it collected $88M in 2019, $81M in 2020, and $78M in 2021. Less tax revenue may appear to be a bad thing, but in the case of the Speculation and Vacancy Tax, it can rightfully be a positive as it's likely a subtle indication that the amount of vacant homes in the Province is decreasing.

"Analysis of the 2021 data shows the tax continues to encourage people to use their residential properties as their home or as rentals for people," the Province said. "As a result, between 2020 and 2021, nearly 26,000 additional property owners claimed the principal residence exemption because the unit was no longer vacant. This number suggests the SVT is changing property-owner behaviour and increasing long-term housing."

The Province says that 99.8% of British Columbians remain exempt from the tax, but when there's that much tax revenue coming in, it's useful to know exactly where it's coming from and where it's going.

BC Speculation and Vacancy Tax Revenue Data

Of the $78.4M -- $78,428,393, to be exact -- collected in 2021, "satellite families" accounted for the largest portion, at $24.1M. The Province defines satellite families as those with a majority of their income coming from outside of Canada. Foreign owners -- defined as a property owner that isn't a citizen or permanent resident of Canada -- paid a total of $20.3M in SVT. BC residents accounted for $12.7M, undeclared owners accounted for $8.7M, non-BC-based-Canadians accounted for $6.7M, and those classified as none of the above accounted for $6.0M.

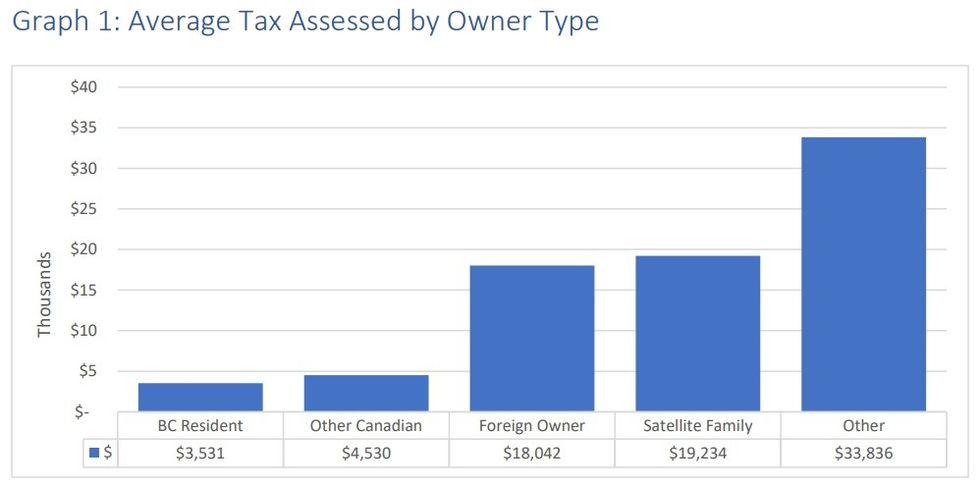

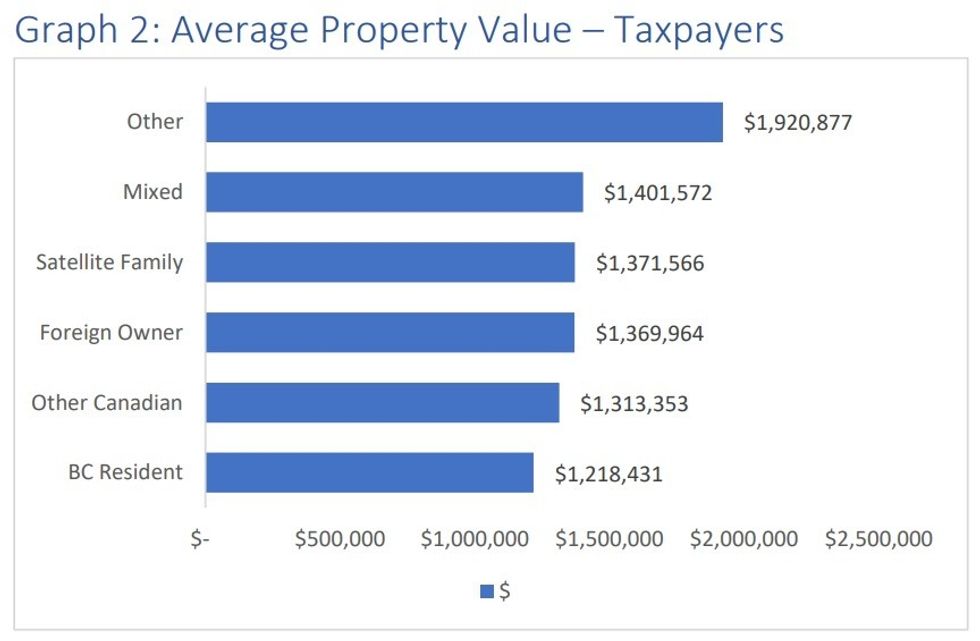

Satellite families and foreign owners are taxed at 2.0% of their property value, and these owner types paid an average of $19,234 and $18,042, respectively. BC residents and other Canadians are taxed at 0.5% and paid an average of $3,531 and $4,530. Those who paid the highest average SVT were corporations, trusts, and partnerships with interest holders that include more than one owner type, classified as "Other", which also includes those who are undeclared. The rankings of how high the average tax amount different kinds of owners paid also aligns with the average values of their properties.

By region, Metro Vancouver accounted for a large majority of the tax revenue, with $55,036,707, or 70.2%. Second-highest were those from the undeclared group, at $8,702,293 (11.1%), third was the Capital region at $6,613,428 (8.4%), followed by the Central Okanagan area at $4,883,414 (6.2%), the Fraser Valley at $2,337,699 (2.9%), and Nanaimo at $854,852 (1.1%). Notable is that tax revenue for nearly all the regions increased just slightly from 2020 to 2021, except for Metro Vancouver, where SVT revenue dropped from $59.1M to $55.0M.

In July, the Ministry of Finance also announced that the Province would be expanding the tax to the municipalities of North Cowichan, Duncan, Ladysmith, Lake Cowichan, Lions Bay, and Squamish. The Province has also said it will continue looking at potential further expansions in the future.

BC Housing Expenditures

The Special Accounts Appropriation and Control Act mandates that all SVT revenue the government collects goes into a Housing Priority Initiatives (HPI) Special Account, which then primarily goes to BC Housing, and must be used to fund housing, shelters, or rental initiatives where the tax applies.

According to the Province, $3.9B has been invested towards housing since the Homes for BC plan began in 2018, in areas subject to the SVT, including $1,054,300,000 between 2021 and 2022, which is up from the $827,600,000 invested between 2020 and 2021.

By region, while less SVT revenue was collected in Metro Vancouver, BC Housing expenditures in Metro Vancouver increased from $686,400,000 to $749,400,000, a 9.2% increase. Investment in the Fraser Valley also increased from $68.4M to $78.0M, as well as in Nanaimo, from $42.1M to $52.1M.

However, BC Housing expenditures in the Capital region and Central Okanagan region decreased, despite tax revenues from both regions increasing in the same period. This would indicate that SVT revenue from those regions are being used to other regions such as Metro Vancouver and the Fraser Valley -- not unreasonable given the severity of the housing crisis in those regions.

BC Housing is, of course, currently embroiled in several controversies, after Opposition and BC Liberals Leader Kevin Falcon publicized a leaked report that "outlines severe financial and organization mismanagement" at BC Housing and Atira Women's Resources Society. Falcon has accused now-Premier David Eby of burying the report while he was acting as the Minister of Housing.

"There is no way Eby was unaware of the situation at BC Housing and Atira, and yet he chose to bury the report and hide that information from the public — all while pouring hundreds of millions of public dollars into an organization that not only couldn’t be trusted to manage money, but was also failing to look after vulnerable British Columbians," Falcon said in a press release on November 22.

RELATED: David Eby Targets Housing Crisis Profiteers in New Sweeping Housing Plan

Former CEO of BC Housing Shayne Ramsay has also come under fire after leaked text messages seemed to indicate that Ramsay was involved in directing funding to Atira, whose CEO is Ramsay's spouse, Janice Abbott, despite conflict of interest measures previously put in place after they married in 2010. Ramsay abruptly resigned in early August, saying he was "retiring" and wanted to spend more time with his children and family.

However, less than three months prior, an Ernst and Young review of BC Housing identified issues with how BC Housing chose supportive housing projects, concluding that -- among other things -- "project administration processes are largely undocumented and do not apply a risk-based approach. In some instances, subjective evaluation can be better documented."

In late September, Ramsay then resurfaced in late September as the new Executive Vice President of Real Estate and Development for Nch’ḵay̓ Development Corporation, the Squamish Nation’s economic development arm.