Perhaps the biggest piece of news to come out of Budget 2024, unveiled last month, was that the provincial government will soon introduce the flipping tax first proposed by Premier David Eby during his 2022 campaign.

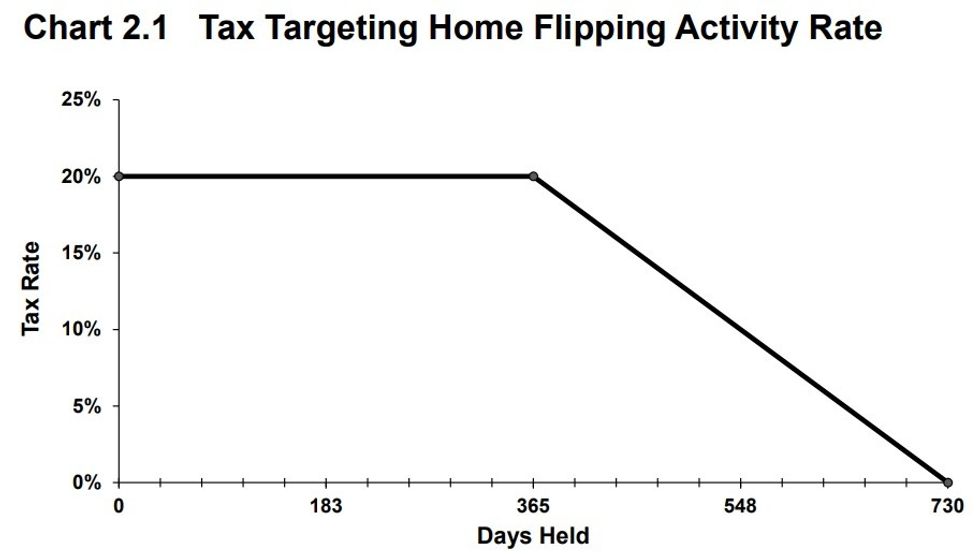

The new flipping tax will apply to the proceeds from the sale of residential real estate that has been held for less than two years, with rates varying depending on the period of time that has passed.

The tax rate will be 20% if the property has been held for 365 days or less and gradually decrease between 365 days and 730 days.

Legislation for the flipping tax has yet to be introduced, but the Province has said that it will come into effect beginning January 1, 2025 and that the flipping tax would apply to homes that were purchased before that date as well.

Accounting for unusual circumstances, the Province has also carved out a series of exemptions for life situations that could result in the sale of a property within two years. Those include divorce or separation, death, disability, illness, relocation for work, involuntary job loss, a change in household membership, personal safety, and insolvency.

Additionally, individuals who sell their homes within two years of buying it can exclude up to $20,000 when calculating their taxable income, which accounts for "flips" that may not be motivated by profit and are not captured by the exemptions. The Province says it will also make exemptions for "those who add to the housing supply or engage in construction and real estate development" and notes that these aforementioned exemptions is not an exhaustive list.

How Big Of A Problem Is Flipping?

The ongoing debate over the proposed flipping tax is both about whether flipping is really a negative for the housing market and whether it's a big enough problem to warrant a new tax.

House flippers are not unlike any other reseller of goods: they believe they are buying a commodity at a good enough price that they can quickly resell it to somebody else and make a profit. It's one thing to profit from reselling things like trading cards, and another to profit from reselling necessities — hoarding and reselling hand sanitizer and toilet paper during the early months of the COVID-19 pandemic, as one example.

The Province believes that flipping homes is closer to the latter, and David Eby has consistently made his ire for speculators known. Although the argument is that flippers hurt the market by inflating prices, the BC Real Estate Association (BCREA) argues in a recent analysis that "the extent to which flippers indeed cause home price appreciation remains theoretically and empirically ambiguous."

BCREA says its unclear whether flippers cause price appreciation or whether flipping is enticing to those people because of the market's existing natural price appreciation — whether the chicken came before the egg, in other words. BCREA also points out that an argument can be made that flippers facilitate the search process for long-term buyers by effectively staging and marketing their properties and also improve the quality of existing stock by renovating the homes before reselling them.

The Province recently said that between 2020 and 2022, approximately 7% of all home sales in British Columbia were resold within two years. Examining this statistic, BCREA found, via data from the Canadian Housing Survey, that a majority of these "flips" in BC arose from the life situations that the Province will be exempting from the flipping tax. It's conclusion: no more than one in 50 — 2% — of home sales are the kind of speculative flips that the Province is targeting.

What Impacts Could The Flipping Tax Have?

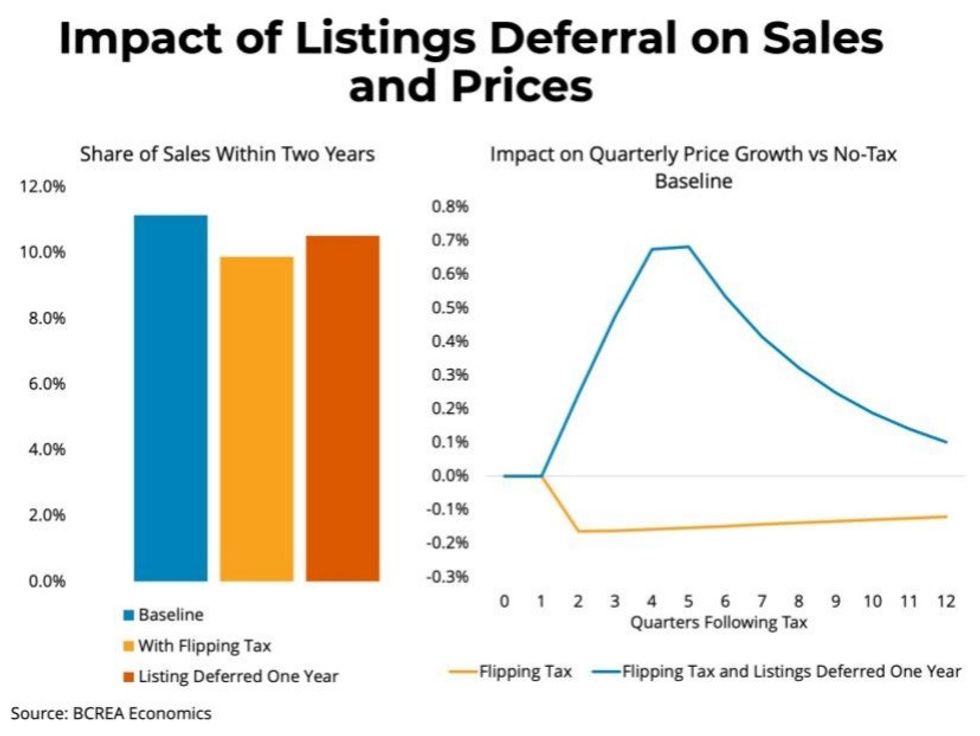

Using statistical modeling, BCREA concluded that the introduction of the flipping tax would result in about a 1.7% decrease in home sales over a three-year period. It also found that the tax could result in several unintended consequences.

The first pertains to the resale market.

"Because the government has now implemented a disincentive to sell within a two-year horizon of purchasing, some potential sellers will be prompted to delay listing," BCREA points out. The delay, which BCREA has hypothetically set at one year in their modeling but could potentially be more than that, would result in a drop in new listings in the short term and a drop in active listings in the long term, which itself can have several impacts.

"Accounting for these supply-side effects, the decline in active listings prompts markets to tighten, which results in higher price growth and price expectations," says BCREA. "As a result, some of the dampening effects of the tax are offset as more investors are attracted to the market by rising prices."

BCREA concludes that even a decrease in new listings of between 5% and 10% would negate any positive impacts on affordability that the proposed flipping tax would have — assuming it would have one at all.

The second unintended consequence is at it relates to the presale market, the sales of which are referred to as "contract assignments."

Explaining how the proposed flipping tax would apply to the presale market, sales and marketing firm MLA Canada notes that the tax's two-year window starts from the date a presale contract is signed, not upon construction completing and the transaction closing. They also note that the two-year window does not then reset upon the latter.

"This approach encourages early investment in presale projects and seeks to minimize contract assignments, where contracts are transferred before project completion, often at a higher price," says MLA Canada. "If a presale contract is assigned to another buyer, the acquisition date for the assignee is the date of assignment, potentially subjecting them to the tax on profits. When a person assigns the presale contract to another person before the two-year mark, the tax would apply on any profit and the tax rate will be based on the time between when they entered into the contract and when they assigned it."

MLA Canada concludes that the proposed flipping tax would have "little" impact on the presale market. An increased amount of assignment flipping could potentially be seen towards the tail-end of the 2024, ahead of the tax coming into effect on January 1, but a typical presale project sees just about only 2% and 5% of units involved in third-party assignments, they said. Furthermore, as construction timelines often exceed two years, the flipping window is largely irrelevant and assignment flipping can still occur without triggering the tax.

What the proposed flipping tax could have a bigger impact on, both the MLA Canada and the BCREA say, is deterring investment in new housing construction.

MLA Canada says that "Taxing these buyers could deter investment out of fear and thereby reduce the amount of new housing being developed overall" and BCREA says that it "could also reduce liquidity in the presale housing market and therefore impair financing for new housing projects." Both say that this could result in reduced housing supply in the long run.

Flipping Tax Legislation

Another aspect of the debate about whether British Columbia needs a flipping tax is that there is already a relevant measure in place.

With Budget 2022, the Government of Canada introduced its own residential flipping rule. Before the rule came into effect in 2023, profits from the sales of homes that were not a person's principal residence were taxed as ordinary capital gains, meaning 50% of the profits were treated as taxable income. With the new rule in place, that profit is now treated as business income, meaning 100% of the profits are treated as taxable income.

Examining the federal flipping measure, BCREA says that there remains no conclusive data that this measure has discouraged flipping or improved affordability, and it "does not appear that we saw a meaningful decline in the small proportion of sales of properties that were purchased within 12 months."

BCREA also pointed to other jurisdictions around the world that have similar anti-flipping measures — United States, Australia, New Zealand, Singapore — and concluded that those measures have also not resulted in any noticeable changes.

Regardless of the effect, flips are already subject to the federal flipping tax — which has a window of just one year — and the flipping tax BC is proposing would be in addition to that.

The Province has said that the proposed flipping tax "complements" other existing measures it has taken against speculation, such as the speculation and vacancy tax, which the Province says has brought over 20,000 homes back into the market. They have acknowledged that a flipping tax is not a silver bullet, but believe it's still needed to dissuade speculators.

"Families shouldn't have to compete with house-flipping investors when they're trying to buy a home," said Premier David Eby. "This tax will deter speculators and give families looking for a place to live an advantage in our housing market."

Legislation regarding the flipping tax is expected to be introduced this spring, but only time will tell whether that advantage for families will extend to their wallets and what other impacts the tax may have.