The Ontario Superior Court of Justice has granted a receivership order over a series of development land parcels in North York, the likes of which were set to accommodate a 10-storey mid-rise and a 32-storey flatiron tower with a shared six- to eight-storey base.

The June 18 appointment order stems from an application made in April, which refers to around two dozen entities as the collective “lender,” and an indebtedness of around $28,450,456 as of March 31, 2025, “with interest, legal fees and disbursements continuing to accrue.”

According to the application, the debtor is Grmada Holdings Inc., an Ontario corporation with a registered head office in Richmond Hill whose sole officer and director is Roman Zhardanovsky. The properties that are subject to the receivership order include 3750 Bathurst Street, 3748 Bathurst Street, and 3742 Bathurst Street.

Grmada Holdings doesn’t appear to have a large development presence in the Greater Toronto Area, however, it is the firm behind a pair of 60-storey towers proposed in the City of Markham in late 2023. However, a report that went to city staff in early 2024 contested the development, and it was ultimately refused.

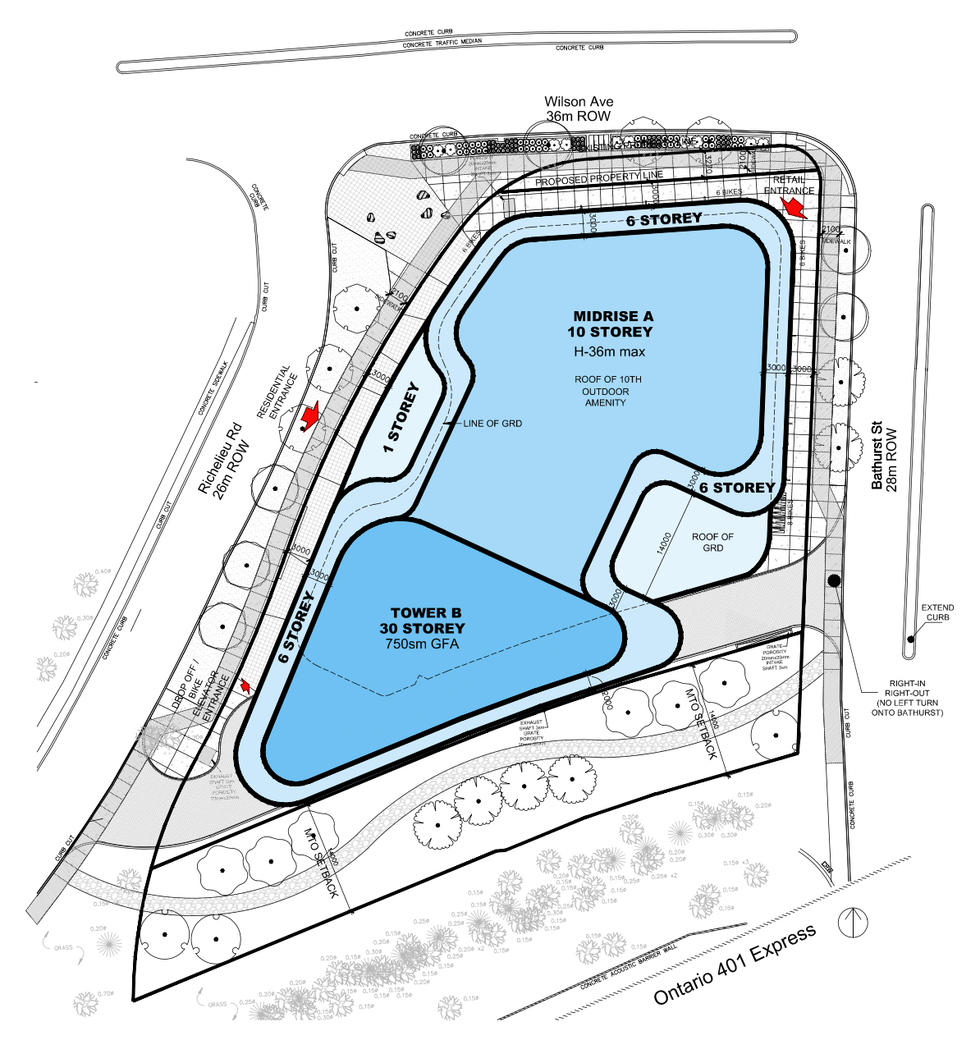

Meanwhile, the 10- and 32-storey development slated for Bathurst Street, at the southwest corner of Bathurst Street and Wilson Avenue, was approved without amendments or debate by City Council at its February 2024 session.

The report that went to Toronto City Council in February 2024 notes that a mixed-use development consisting of an 11-storey mid-rise and 30-storey tower was proposed for the site in September 2024. The tower element was increased in height in response to community consultation, in which some of the participants expressed that additional floors would help to meet more housing need.

Timeline Snapshot

- February 1, 2024 — Original loan maturity date

- May 1, 2024 — Interest payment missed

- July 25, 2024 — Demand letter issued

- October 1, 2024 — Forbearance deadline

- March 31, 2025 — Indebtedness calculated at ~$28.4M

- June 8, 2025 — Fire incident reported

- June 18, 2025 — Receivership granted by court

The most recent rendition of the plans call for building heights of around 112 and 330 feet and a total gross floor area (GFA) of around 404,077 sq. ft. Of the total GFA, around 9,181 sq. ft would be non-residential, and the remainder, at around 394,896 sq. ft, would be residential, with 479 condo units planned. The development would replace a former gas station, a former retail store, a coffee shop, and two single-detached houses.

By the time the redevelopment plans received City Council’s approval, Grmada had already made the arrangements for a loan, with a Commitments Letter dated July 10, 2023, cited in the application for receivership. The loan advanced was in the principal amount of $25,383,000. As security, the debtor put up the development property, personal property, and a general assignment of rents.

Although the loan matured on February 1, 2024, an amendment was made to the initial Commitments Letter extending the term to July 31, 2024. In the meantime, however, the debtor failed to pay interest due on May 1, 2024, putting it in automatic default. A demand letter was issued on July 25, 2024, and on September 1, 2024, and the debtor agreed to forbear on receivership proceedings until October 1, 2024. To date, the debtor has failed to repay the loan or make further interest payments, according to the court filings.

In addition, according to an endorsement of Justice J. Dietrich from last month, an active fire was reported to the City of Toronto Fire Services on June 8, at which time Zhardanovsky was informed and was reportedly unwilling to deal with the matter.

TDB Restructuring Limited was appointed as receiver over the properties at 3750 Bathurst Street, 3748 Bathurst Street, and 3742 Bathurst Street shortly after that, on June 18. STOREYS reached out to Zhardanovsky for comment on the proceedings on Tuesday morning, but did not hear back by the time of publication.