Bank of Canada Rate

Learn what the Bank of Canada rate is, how it affects mortgage rates and real estate affordability, and why it's crucial for homebuyers and investors in Canada.

May 22, 2025

What is the Bank of Canada Rate?

The Bank of Canada rate, also known as the overnight rate, is the interest rate at which major financial institutions borrow and lend one-day (or overnight) funds among themselves. It serves as the country’s key monetary policy tool.

Why the Bank of Canada Rate Matters in Real Estate

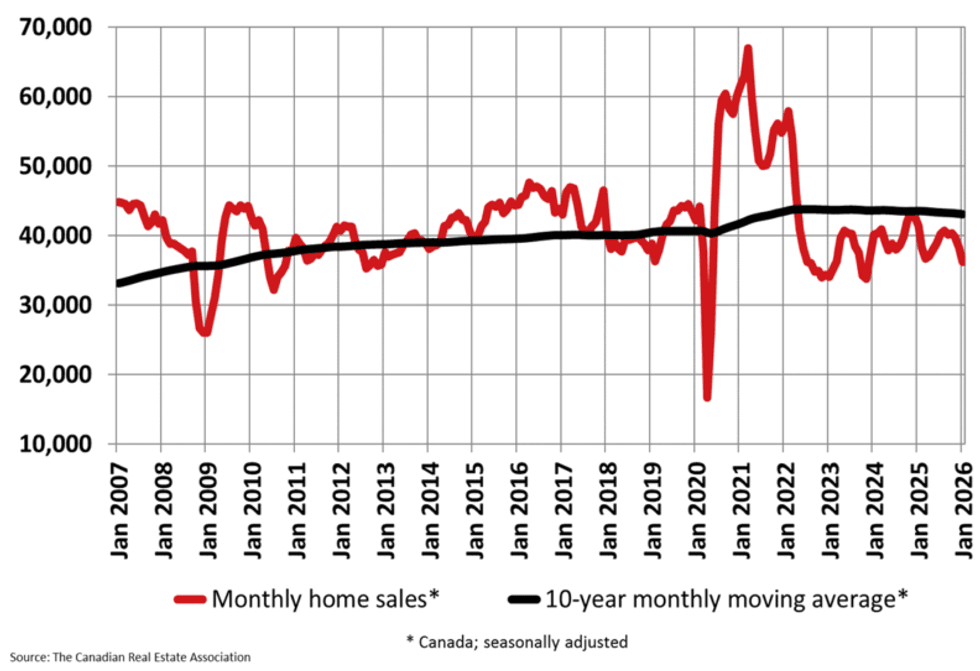

The Bank of Canada rate directly influences borrowing costs across the Canadian economy, including mortgage rates, lines of credit, and other lending products. When the central bank raises or lowers this rate, it signals a shift in monetary policy aimed at controlling inflation, encouraging spending, or stabilizing economic growth.

In real estate, changes to the Bank of Canada rate have a significant impact on both fixed and variable mortgage rates. Lenders use the overnight rate as a benchmark to determine the prime rate, which then affects variable-rate mortgages and home equity lines of credit (HELOCs). Even fixed-rate mortgages are influenced indirectly, as bond yields respond to monetary policy changes.

A low Bank of Canada rate typically results in cheaper borrowing, stimulating home buying and increasing real estate activity. Conversely, when the rate rises, mortgage payments become more expensive, which can cool housing demand and reduce affordability.

Understanding how the Bank of Canada rate functions allows buyers, investors, and homeowners to better time their real estate decisions, anticipate mortgage rate changes, and adjust their budgets accordingly. It also helps explain broader market trends, including shifts in property values and demand across the country.

Example of the Bank of Canada Rate

In an effort to curb inflation, the Bank of Canada raises its overnight rate by 0.50%. As a result, several banks increase their prime rates, which raises the interest on variable-rate mortgages and lines of credit.

Key Takeaways

- The Bank of Canada rate sets the tone for national interest rates.

- Influences mortgage rates, especially variable ones.

- Used to control inflation and guide economic growth.

- Impacts affordability and demand in real estate.

- Understanding it helps buyers and investors make informed timing decisions.

Related Terms

- Interest Rate

- Fixed Rate Mortgage

- Variable Rate Mortgage

- Mortgage Stress Test

- HELOC

Christine Boyle and Gregor Robertson. (Government of British Columbia)

Christine Boyle and Gregor Robertson. (Government of British Columbia)

CREA

CREA

Liam Gill is a lawyer and tech entrepreneur who consults with Torontonians looking to convert under-densified properties. (More Neighbours Toronto)

Liam Gill is a lawyer and tech entrepreneur who consults with Torontonians looking to convert under-densified properties. (More Neighbours Toronto)

Eric Lombardi at an event for Build Toronto, which is the first municipal project of Build Canada. Lombardi became chair of Build Toronto in September 2025.

Eric Lombardi at an event for Build Toronto, which is the first municipal project of Build Canada. Lombardi became chair of Build Toronto in September 2025.

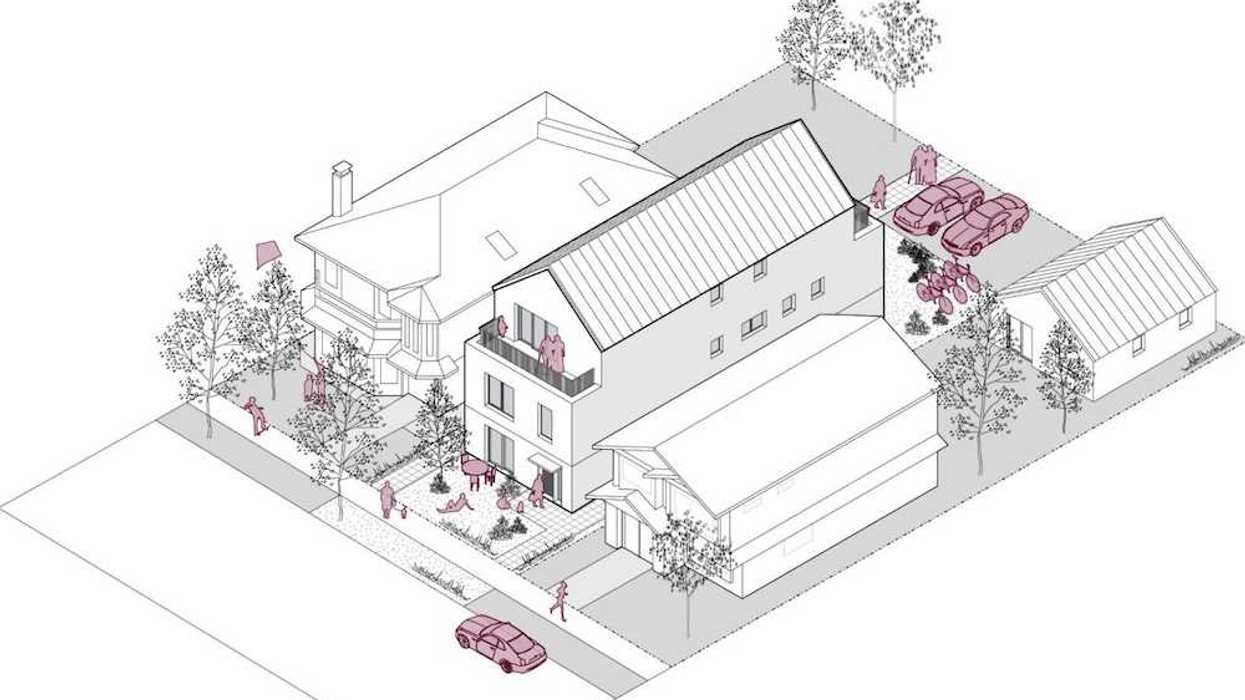

A rendering of the “BC Fourplex 01” concept from the Housing Design Catalogue. (CMHC)

A rendering of the “BC Fourplex 01” concept from the Housing Design Catalogue. (CMHC)

Rendering of 9 Shortt Street/CreateTO, Montgomery Sisam

Rendering of 9 Shortt Street/CreateTO, Montgomery Sisam Rendering of 1631 Queen Street/CreateTO, SVN Architects & Planners, Two Row Architect

Rendering of 1631 Queen Street/CreateTO, SVN Architects & Planners, Two Row Architect Rendering of 405 Sherbourne Street/Toronto Community Housing, Alison Brooks Architects, architectsAlliance

Rendering of 405 Sherbourne Street/Toronto Community Housing, Alison Brooks Architects, architectsAlliance