Assignment of Rents

An assignment of rents lets lenders collect tenant income directly if a borrower defaults, providing extra loan security.

September 30, 2025

What is an Assignment of Rents?

An assignment of rents is a legal provision in a mortgage or loan agreement that gives the lender the right to collect rental income directly from tenants if the borrower defaults. It serves as additional security for lenders.

Why an Assignment of Rents Matters in Real Estate

Assignments of rents matter in real estate because they protect lenders by ensuring income from investment properties can be redirected to cover loan payments in the event of borrower default.

Example of an Assignment of Rents in Action

A landlord defaults on their mortgage for an apartment building. The lender enforces the assignment of rents clause, collecting tenant rents directly to apply toward the mortgage balance.

Key Takeaways

- Gives lender rights to collect tenant rents on default.

- Provides additional security for mortgage lenders.

- Common in commercial and investment property loans.

- Triggered when borrower defaults on obligations.

- Helps lenders recover loan payments through rental income.

Related Terms

- Mortgage Default

- Foreclosure

- Receivership

- Security Interest

- Commercial Mortgage

The LJM Tower at 2782 Barton Street East in Hamilton in June 2025. (Google Maps)

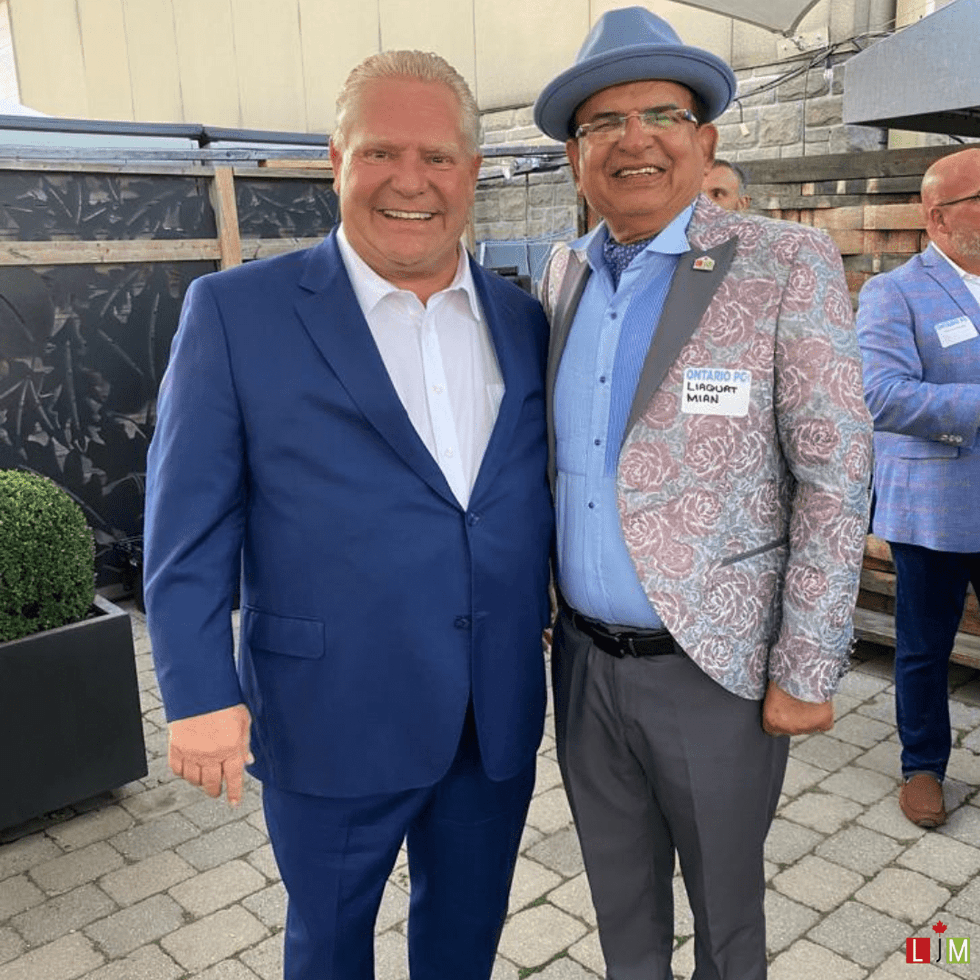

The LJM Tower at 2782 Barton Street East in Hamilton in June 2025. (Google Maps) Ontario Premier Doug Ford and LJM Developments President Liaquat Mian. (LJM Developments)

Ontario Premier Doug Ford and LJM Developments President Liaquat Mian. (LJM Developments)

CREA

CREA

Liam Gill is a lawyer and tech entrepreneur who consults with Torontonians looking to convert under-densified properties. (More Neighbours Toronto)

Liam Gill is a lawyer and tech entrepreneur who consults with Torontonians looking to convert under-densified properties. (More Neighbours Toronto)

Eric Lombardi at an event for Build Toronto, which is the first municipal project of Build Canada. Lombardi became chair of Build Toronto in September 2025.

Eric Lombardi at an event for Build Toronto, which is the first municipal project of Build Canada. Lombardi became chair of Build Toronto in September 2025.

A rendering of the “BC Fourplex 01” concept from the Housing Design Catalogue. (CMHC)

A rendering of the “BC Fourplex 01” concept from the Housing Design Catalogue. (CMHC)