A wise man (Benjamin Franklin) once said that "in this world, nothing is certain but death and taxes." According to a Alberta property tax report published by Zoocasa on Wednesday, depending on where you live, death could very well be taxes.

Municipalities usually set their own property tax rate, charging homeowners a percentage of the assessed value of their home, annually, with a portion of it then going to the provincial government as well. With real estate having a tendency to only increase in value -- especially in the long-term -- this means that amount of property tax you pay will likely follow, even before governments increase the tax rate.

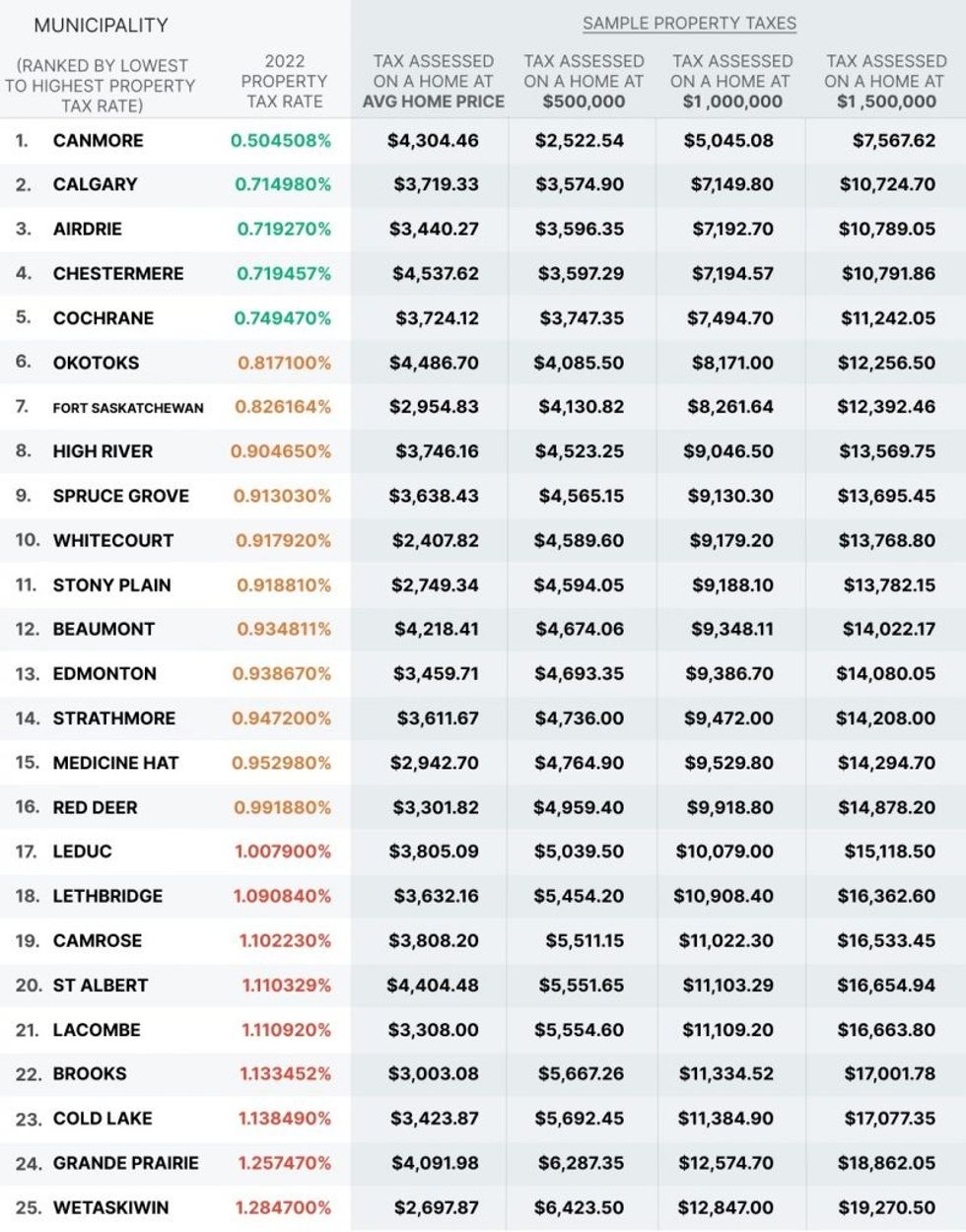

Zoocasa compiled the tax rates of 25 municipalities in Alberta, and at the top of list (or bottom, depending on how you look at it) is Wetaskiwin, which had a tax rate of 1.2847%. Second was Grande Prairie, which has a rate of 1.25747%.

There was then a significant drop-off to Cold Lake's 1.13849%. Brooks, Lacombe, St. Albert, Camrose, Lethbridge, and Leduc rounded out the rest of the municipalities with property tax rates over 1.0%.

On the other end of the list, the municipality with the lowest property tax rate was Canmore, at just 0.504508% -- less than half of Wetaskiwin's. There was then a sizeable gap between Canmore and the municipality with the second-lowest tax rate, Calgary, which has a rate of 0.714980% (but may be increasing by over 4% soon).

Airdrie, Chestermere, and Cochrane rounded out the municipalities with rates below 0.75%.

Here's the full list:

The rates themselves, however, are only half of the picture, with the more significant variable being property value, which can vary significantly from area to area. You can live in an area with a high property tax rate, but that may not mean too much if the property values in that area are low, for example.

Factoring in average home prices in the municipality, Whitecourt stands out as the municipality in Alberta that pays the least amount of dollars in property tax, at $2,407.82. Wetaskiwin, Stony Plain, Medicine Hat, and Fort Saskatchewan round out the list of municipalities that pay less than $3,000 in property tax.

READ: New Proposed Budget for Calgary Includes 4.4% Property Tax Increase

On the other end of the spectrum, the municipality that pays the highest average property tax is Chestermere, at $4,537.62, because despite having one of the lower tax rates in the province, Chestermere has one of the higher average property values, at $630,700.

The same goes for Canmore, which was one of six municipalities in Alberta with an average assessed tax of over $4,000, because while Canmore has the lowest tax rate in Alberta, it also has the highest average home price.

This article and the infographic above have been edited to address incorrect Zoocasa data regarding Lacombe.