Once upon a time, Canada’s housing market had a very predictable annual cycle. Home sales were slow through the winter months, bottoming out in January, then would jump in the spring, hitting a peak in May and staying strong through the summer months, until they began a descent in the fall, back into the winter doldrums.

But for the past three years, that’s not how it’s been. When the Covid-19 pandemic lockdowns began in March 2020, home sales dropped off a cliff. The spring home-buying circuit was essentially canceled. But very soon, as people became accustomed to life in a pandemic, home sales roared back to life, hitting unusually high levels in the summer and fall of 2020.

And while the pandemic has since subsided and life has returned (mostly) back to normal, the housing market has continued to behave in bizarre and unpredictable ways.

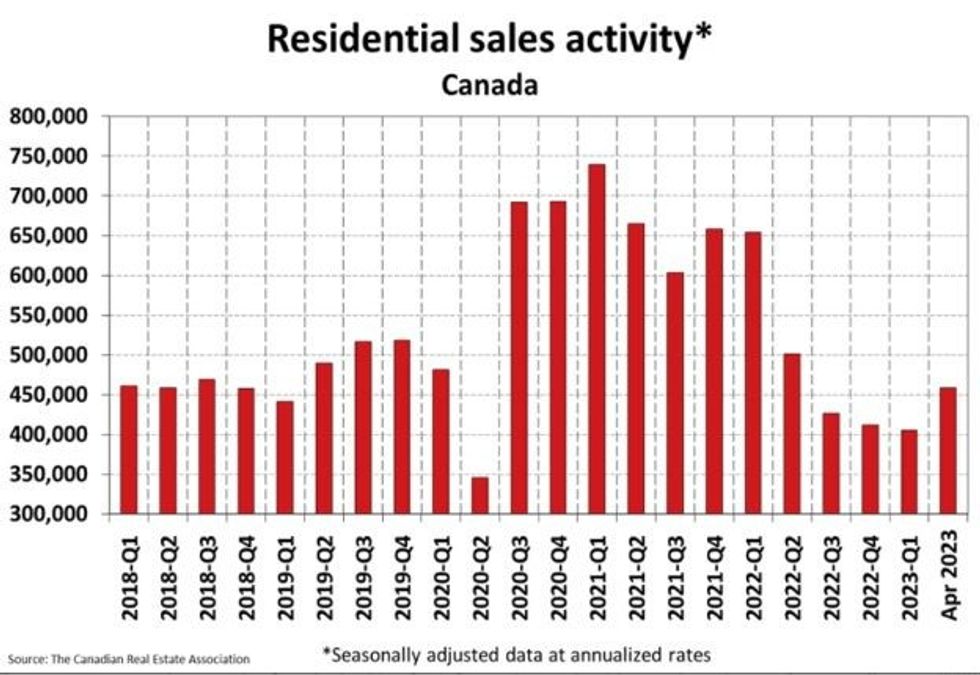

The Canadian Real Estate Association’s data on existing home sales paints the picture: Seasonally-adjusted home sales peaked in the January-March period of 2021, then fell through the spring and summer, before bouncing back in the final months of the year. They stayed strong through the January-March quarter of 2022, and then cratered as spring arrived, falling to below pre-pandemic levels.

Hot winter sales seasons, cool(er) spring and summer sales seasons. What gives?

The answer, in simplest terms, is that over the past three years Canada has been in a very unusual place, economically, and that has been reflected in the housing market’s behaviour. Extremely low mortgage rates during 2020 and 2021 -- spurred by the Bank of Canada’s measures to stimulate the economy amid pandemic shutdowns -- pulled forward a lot of housing demand.

Then, in 2021, inflation began to rise, and the Bank of Canada reversed course. The lowest interest rates ever turned into some of the highest interest rates in years, and mortgage costs followed suit. Affordability collapsed, taking the wind out of the housing market’s sails in 2022.

Last year’s interest rate hikes “dominated” the seasonal patterns normally seen in the housing market, says Doug Porter, Chief Economist at BMO Financial Group -- in much the same way that the pandemic’s closings and re-openings erased the seasonal pattern back in 2020.

Porter predicts that once mortgage rates stabilize, the market’s traditional seasonal pattern will re-emerge.

“I do believe there is a cycle at play especially in Canada, where weather plays such a big role, and the school year as well,” he says.

But he adds an interesting caveat: Some things have changed in the housing market that may mean the seasonal pattern going forward won’t be as strong as it was in the past.

Chief among those is the role of investors in the housing market. Porter points to data from Statistics Canada, released earlier this year, showing that a substantial chunk of housing in Canada -- including single-family homes -- is now owned by investors.

As of 2020, 20.2% of Ontario’s housing stock was investor-owned, while in British Columbia, that proportion was 23.3%. The share of detached houses used as an investment was 15% in Ontario, and 16.5% in British Columbia.

Investor buyers are “less driven by seasonal factors,” Porter says, meaning that going forward, the typical annual pattern might be more muted. It might just be the new normal that there will be stronger sales in December, and relatively weaker sales in the spring.

But that assumes that investors are a growing part of the market -- which is hard to discern in the StatCan data, Porter notes, since this is something the statistical agency only recently turned its attention to. There are no historical data sets to compare with.

Farah Omran, an economist at Scotiabank who tracks the housing market, sees other reasons why the seasonal pattern may not be what it was going forward.

“Potential nonseasonal triggers of demand looking ahead may be strong population growth through immigration, first-time homebuyers that have amassed enough savings for a down payment during the housing market downturn, and normalization of rates as expected next year,” she wrote in an email to STOREYS.

But Omran cautions against making too much of the breakdown of the pattern -- because that pattern is still intact, at least partly.

CREA’s headline home sales numbers are seasonally adjusted -- meaning they’re not the raw sales numbers, but are adjusted upwards or downwards to erase the effect of the seasonal patterns.

Many statistics are adjusted this way in order to avoid drawing the wrong conclusions from the data. If CREA were to report, for instance, that home sales doubled from January to May, people might conclude there’s a sudden huge boom in the housing market, when in fact they’re seeing the typical pattern seen in any given year. Seasonally-adjusted numbers offer a way of cutting through that noise, to see the underlying patterns in the market.

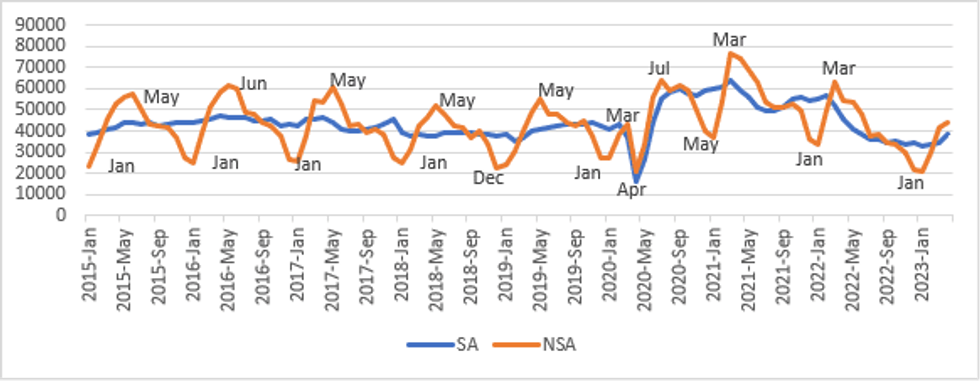

Omran produced a chart comparing the seasonally adjusted numbers with the non-seasonally adjusted numbers, and indeed, the annual cycle is still there -- though with some notable changes.

“Looking at the [non-seasonally adjusted data], indeed you do see that over the past couple of years, the typical seasonal cycle, while still partly maintained, is distorted,” Omran wrote.

Nonetheless, something has changed in the seasonal pattern of recent years: In 2021 and 2022, the peak of the housing market arrived earlier than usual. In pre-pandemic times, home sales peaked in May, but in these years, the peak came in March instead.

Omran says the reasons for that may have differed from year to year.

“Historically low rates and the resulting FOMO [fear of missing out] energy in the market … brought demand forward in 2021 and, with it, the peak of the market forward from May to March. In addition, the erosion of affordability leading up to that point is one of the potential reasons for the market to have taken a turn after March,” Omran wrote.

In 2022, the market’s peak may have been brought forward “by a strong economic recovery, an incredibly strong labour market recovery and an acceleration in immigration, not to mention the widely-expected incoming rate hikes, pushing buyers to the market again before rates [went] up. At that point the deteriorating sentiment and increasing uncertainty from the war [in Ukraine] and inflation and even more unaffordable prices, combined with the rate hike cycle… forced the market to slow down as early as March.”

All of which is to say, there’s no guarantee that this is the new normal. Just as this year’s housing market rebound -- with high mortgages rates in place -- came as a surprise to many, so too could next year bring fresh surprises.

“Radically changing times create radically different market cycles,” Ron Butler of Ontario-based Butler Mortgage wrote in an email.

“From 2009 to 2020, Canada experienced 11 years of very low and stable mortgage rates. Spring and fall real estate cycles followed their very long-established patterns. Covid and the lockdowns of early 2020 totally disrupted that cycle.

“The wild work-from-home wave of 2021, with unheard-of increases in house prices, disrupted it again. And in 2022 the fastest, highest percentage increase in mortgage rates [and the Bank of Canada’s key lending rate] in Canada's history disrupted normal cycles again.

“In all likelihood, these unusual times will continue until a steady mortgage rate pattern emerges and wild economic gyrations subside.”

Steve Saretsky, Vancouver-area real estate agent and prominent commentator on the housing market, meanwhile, sees this spring’s housing market rebound as a sign that this return to normal is already happening.

“Yes, the cyclicality of the housing market has been disrupted in recent years due to the incredible amount of volatility,” he wrote in an email to STOREYS. “However, I think we are seeing a return to more normal now. The winter market was slow, spring rebounded, and I think we are starting to see demand drop off a bit as we head into the summer months.”