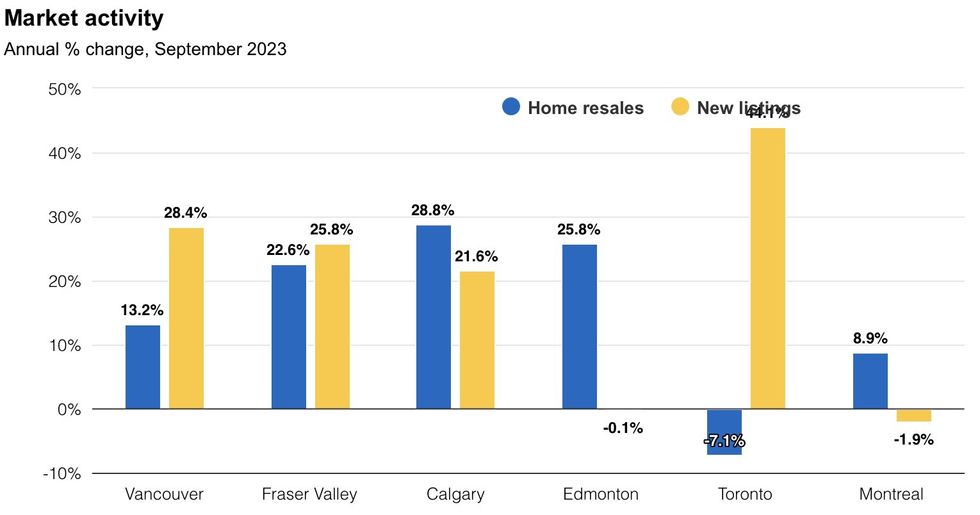

There has been a resurgence of sellers in Canada’s major real estate markets, but buyers aren’t biting.

Soaring interest rates are simultaneously forcing homeowners to sell — new listings rose across the country in September, including an 11% increase in Toronto — and dampening demand amongst buyers.

As Robert Hogue, Assistant Chief Economist at RBC, reports, weakening resales alongside growing supply have "significantly reduced" market tensions seen earlier this year. In several cities, including Toronto and Vancouver, conditions have swung in favour of buyers, and prices have started to edge down.

In the former, new listings have increased steadily for six straight months, but a troublesome trifecta of high interest rates, poor affordability, and growing economic uncertainty "pose serious obstacles" for buyers. Resales fell 1.8% month-over-month in September, while the MLS Home Price Index (HPI) edged down 0.8%. With buyers in a "stronger bargaining position," Hogue expects Toronto will see further price erosion in the near-term.

A similar situation is playing out in Vancouver — new listings have risen above pre-pandemic levels while interest rates and "crisis-level" affordability have kept buyers cautions. As in Toronto, the result is a dip in the MLS HPI. Down 0.4% month-over-month, slight declines should persist in the months ahead.

Montreal continues to recover from the sharp correction seen in 2022, but activity remains quiet as buyers face mounting affordability challenges. Demand-supply conditions have eased, keeping prices relatively level, but there has been some ebb and flow across segments; on a monthly basis, condo apartment prices rose 2.3% in September, while single-family home prices fell 2.1%. Hogue’s outlook calls for "more of the same" in the coming months.

Meanwhile, sales and prices are being driven to historic highs in Calgary, as buyers are drawn in by low ownership costs and relative affordability. Home resales rose for a sixth straight month in September — up an estimated 4% from August — while supply has started to lag. The market has become "highly competitive" for buyers, and the MLS HPI has seen the largest annual increase (8.7%) of Canada’s major markets. With Calgary holding strong as Canada’s “tightest and hottest” market, upward price pressures won’t let up anytime soon.

"We expect little change in this broad picture in the months ahead. We think buyers will stay on the defensive in many parts of Canada despite more choice becoming available to them," Hogue said.

"High interest rates, ongoing affordability issues, and a looming recession are poised to pose major obstacles. Any material acceleration in the market recovery will have to wait until interest rates come down in 2024."