Vendor Take-Back Mortgage

A vendor take-back mortgage is seller financing where the property seller provides a loan to the buyer, secured against the property.

September 30, 2025

What is a Vendor Take-Back Mortgage?

A vendor take-back mortgage (VTB) is a financing arrangement where the seller of a property provides a loan to the buyer, secured against the property being sold. Instead of—or in addition to—traditional bank financing, the buyer makes mortgage payments directly to the seller under agreed terms.

Why Vendor Take-Back Mortgages Matter in Real Estate

VTBs matter in real estate because they create financing opportunities when traditional lenders are unwilling or unable to finance a purchase. They can help sellers close deals faster, potentially at higher prices, while offering buyers more flexible terms. However, sellers take on risk if the buyer defaults, requiring careful structuring and legal documentation.

Example of Vendor Take-Back Mortgage in Action

A seller agrees to provide a $200,000 VTB for a buyer who cannot secure full bank financing. The buyer obtains $400,000 from a bank and pays the seller monthly installments for the $200,000 balance.

Key Takeaways

- A VTB is when the seller acts as the lender for part of the purchase price.

- Helps buyers with limited access to traditional financing.

- Sellers may secure faster deals or higher prices.

- Carries risk for sellers if buyers default.

- Requires legal documentation and registration on title.

Related Terms

- Seller Financing

- Private Mortgage

- Purchase Agreement

- Second Mortgage

- Promissory Note

205 Queen Street, Brampton/Hazelview

205 Queen Street, Brampton/Hazelview

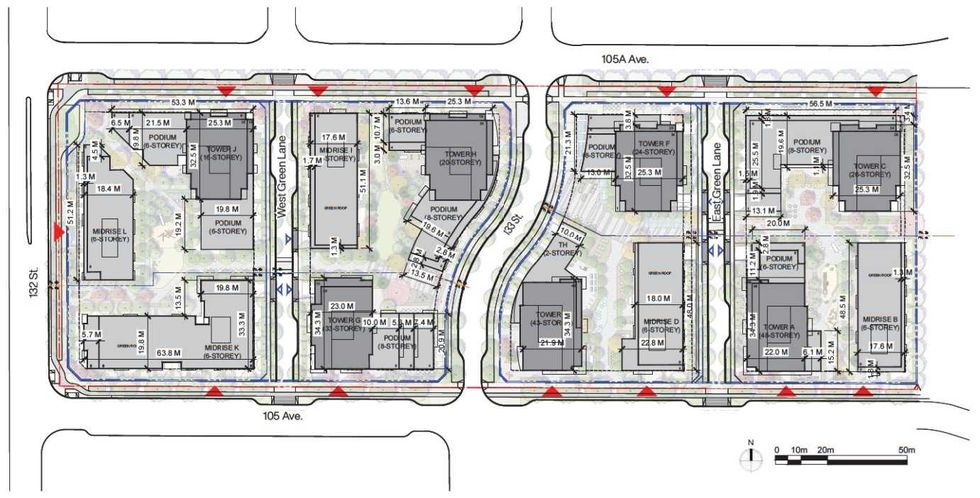

The layout of the Regency Garden redevelopment. (Arcadis, Onni Group)

The layout of the Regency Garden redevelopment. (Arcadis, Onni Group) An overview of the master plan for the Regency Gardens redevelopment. (Arcadis, Onni Group)

An overview of the master plan for the Regency Gardens redevelopment. (Arcadis, Onni Group) The phasing plan for the Regency Gardens redevelopment. (Arcadis, Onni Group)

The phasing plan for the Regency Gardens redevelopment. (Arcadis, Onni Group) A rendering of the project at full build out. (Arcadis, Onni Group)

A rendering of the project at full build out. (Arcadis, Onni Group)