[Editor's Note: The changes outlined in this article were approved by Vancouver City Council on June 17.]

As the real estate market continues its downward turn, local governments across Metro Vancouver (and beyond) have shown a strong willingness to tweak their policies in an effort to provide some relief to homebuilders and to get shovels in the ground. The latest municipality to do so is the City of Vancouver.

"Development viability is under increasing strain due to a wide range of factors, such as construction cost escalation, impending tariff implications, an elevated interest rate environment, and recent changes to immigration policy, all of which have created greater uncertainty and dampened consumer and investor confidence," said the City in a report that will be considered by Council next week. "At the same time, the cost basis for construction – including land, labour, regulatory requirements, and government charges – has dramatically outpaced inflation since 2019, while home prices have approached affordability ceilings."

"The investor pool is shrinking, driven by the end of foreign investment, stagnating rent yields, and diminished expectations of future appreciation," added GM of Planning Josh White, who authored the report and hinted at the changes in an interview with STOREYS last month. "This shift has left both purpose-built rental and strata development financially challenging, particularly at the scale, price points, and speed required to meet the city’s housing needs. Without intervention, supply will continue to lag behind demand, exacerbating affordability pressures and excluding key market segments – especially families and middle-income earners – from viable housing options."

In response to the aforementioned challenges, the City is proposing a series of changes to support the financial viability of development projects. Most of the changes relate to when and how the City collects development fees. How much the City collects is not changing, as no changes to rates have been proposed.

Development Cost Levies (DCLs)

The first change is pertaining to development cost levies (DCLs), which are known as development cost charges (DCCs) in other municipalities.

Under existing policy — dictated by the Province's Local Government Act — developers are required to make their DCL payments upon issuance of the building permit (BP) for their project, which is one of the last steps before construction. Many developers — such as those involved in the letter-writing campaign in September 2024 — have said that paying it all upfront is a burden because they are often financing the payment with debt for the duration of construction, as Wesgroup's Brad Jones previously told STOREYS.

Thus, the City has proposed a policy change to allow DCLs to be paid in three equal installments: a third upon building permit issuance, a third 12 months after BP issuance, and the remaining third 24 months after BP issuance. This change would apply to all projects with DCLs — inclusive of City-wide DCLs, area-specific DCLs, and Utilities DCLs — totalling $500,000 or more. The DCL rate will be locked in upon BP issuance, will not be subject to rate increases that occur afterwards, and will not accrue interest. As assurance for the City, the developer will be required to provide a "pay-on-demand" Surety Bond or Letter of Credit and default on any of the installments will result in the full remaining balance becoming due.

"While deferral of DCLs could pose a sizeable one-time impact on funding for infrastructure and amenities to support growth in the next capital plan (2027-2030), collections are expected to stabilize thereafter," the report states. "To mitigate such impact, staff recommend using interim financing, repayable over 10 years, to bridge the funding gap."

Community Amenity Contributions (CACs)

The second big change is pertaining to community amenity contributions (CACs), which the City levies on projects that require rezoning.

"Currently, the City's CAC policy for rezonings provides discretion to allow for deferral for the portion of cash CACs exceeding $20 million, with interest at Prime + 3% applicable to the deferred payment and payment due by the earlier of 24 months of rezoning enactment or prior to issuance of the first building permit," according to the report. "Up to 50% of the deferred CAC may be secured by 'pay-on-demand' Surety Bond and the remainder by Letter of Credit."

"Under the proposed amendments, the City may, at its discretion, allow for deferral for the portion of cash CACs exceeding $5 million, with interest at Prime + 1% applicable to the deferred payment and payment due by the earlier of 24 months of rezoning enactment or prior to issuance of the first building permit. The first $10 million of the deferred CAC may be secured, at the City’s discretion, by 'pay-on-demand' Surety Bond and the balance over $10 million may be secured by a combination of 'pay-on-demand' Surety Bond (up to 50%) and Letter of Credit."

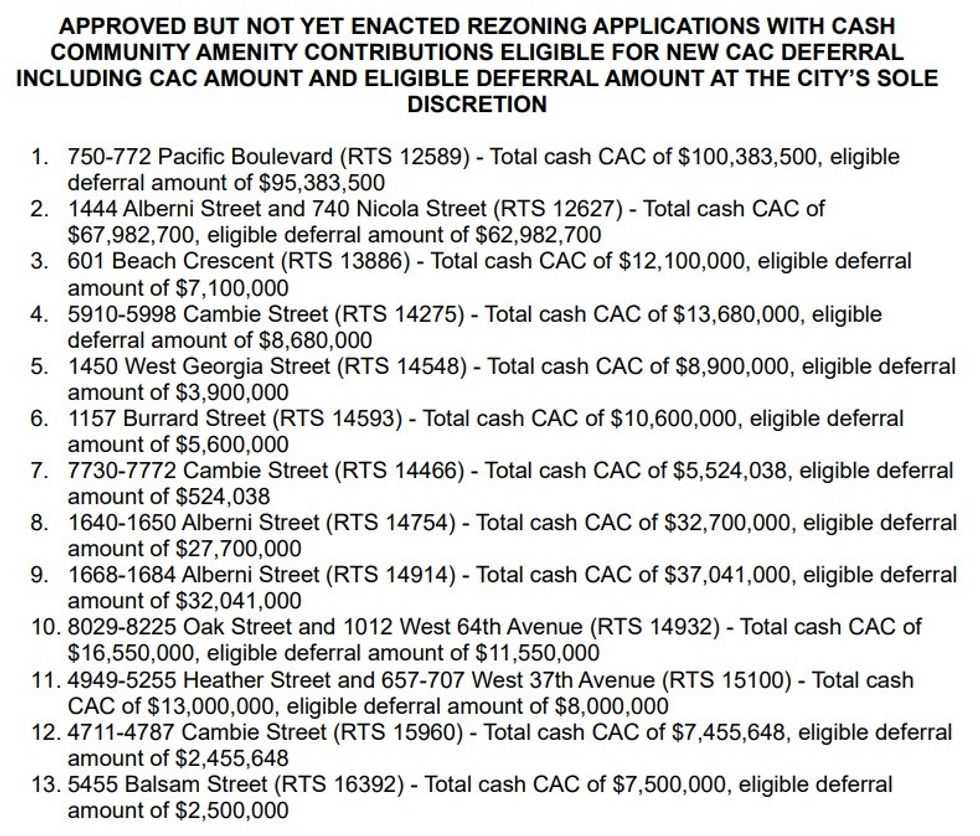

The effect of this change is similar to that of the DCLs change, which is to reduce the upfront financial burden, and the City says this CAC change would apply to new, in-stream, as well as approved rezonings that have not been enacted yet. (In the City of Vancouver, rezoning approvals like what was granted this week for the Commercial-Broadway Safeway redevelopment are only in principle and the applicant must then meet various conditions for the rezoning to be officially enacted.)

Annual Inflationary Adjustments To Development Fees

Like other municipalities, the City of Vancouver conducts regular reviews of its rate schedules for DCLs, CACs, and density bonus contributions (DBZs), oftentimes adjusting — increasing — rates to account for inflation.

In recent years, Council has already approved deferring this rate adjustment in both 2023 and 2024, and is proposing that the adjustment for 2025 — an increase of 3.2% — again be deferred.

The deferral means that when the rates are next adjusted, they will jump substantially to reflect the inflation that has occurred over several years, not just one year.

"Forgoing the 2025 inflationary adjustment to DCLs, CAC Targets and DBZs will reduce development contributions in the following year by ~$4 million based on recent historical collections," the report states. "Foregoing the implementation of the deferred 2024 inflationary adjustment to CAC Targets and DBZs will reduce development contributions by an additional ~$2 million in the following year."

"Pay-on-Demand" Surety Bonds

Another change is as it relates to the aforementioned "pay-on-demand" Surety Bonds.

"The City has traditionally relied on Letters of Credit to secure infrastructure and amenity obligations as part of development," according to the report. "In recent years, the City has started to accept 'pay-on-demand' Surety Bonds on a limited basis to secure delivery of turnkey amenities above $20 million and cash CAC payment deferral. Surety Bonds are a financial instrument where the surety guarantees the obligation of the developer to the City. 'Pay-on-demand' Surety Bonds are intended to function like Letters of Credit in that the City is intended to have the right to demand payment or fulfillment of an obligation of the developer from the surety, by providing a notice of default and the surety contracts that it will fulfill the obligation. However, there are key differences between Letters of Credit and 'pay-on-demand' Surety Bonds, which creates the potential for greater collection risk."

The risk is increased because, while letters of credit are issued by chartered banks and those banks generally require that the developer has the funds in their account, surety bonds are instead issued by insurance companies that are not holding the funds. In the event of a default and the City demands payment, the insurance company is nonetheless required to fulfill the obligations of the developer, but the collection procedure is different and usually entails more time compared to letters of credit.

Nonetheless, the City has proposed that the eligibility threshold for the use of such Surety Bonds be reduced from $20 million to $5 million, as well as that Surety Bonds also be allowed on infrastructure and amenity obligations with an aggregate value per project of over $5 million (with a minimum of $3 million pertaining to infrastructure).

Floorplates

The final significant change is pertaining to floorplates, which is the size of a single floor, measured in square footage.

Currently, the City has a floorplate "guideline" of 6,500 sq. ft, but believes this has "become outdated due to evolving building codes, energy requirements, and rising construction costs."

"To better support project viability, a shift towards a more flexible, principles-based framework is necessary. Smaller sites will still require tighter limits to achieve urban design goals like tower separation and sunlight access, while larger or less constrained sites – especially those for mass timber or social housing – may accommodate up to 8,000 sq. ft. floorplates. Additionally, taller buildings and larger sites offer opportunities for additional flexibility rooted in sound urban design principles. However, this flexibility requires stricter tower separation standards to maintain livability. Floorplate sizes should be flexible, allowing professional discretion to achieve high-quality, context-sensitive urban design."

The City has published a bulletin outlining the changes that indicates the floorplate guideline of 8,000 sq. ft will apply not just to mass timber towers and social housing projects, but also towers that exceed 40 storeys. The floorplate guideline for all other towers ranges from 4,000 sq. ft to 7,200 sq. ft, depending on whether the site is one that can accommodate a tower, whether it is a corner or mid-block site, and the site frontage.

This particular change is under the authority of the Director of Planning (Josh White), does not require Council approval, and already came into effect on June 3.

All of the above changes, except for the floorplate change, are up for Council approval on Tuesday, June 17, and the report states that the City will continue to look for changes.

"Staff are continually reviewing policies and process improvements to ensure they are appropriately applied and streamlined to support development viability. This ongoing work aims to enhance clarity and efficiency while balancing the need for timely project delivery with the City’s commitment to building complete communities and delivering essential amenities for residents."

Additionally, on June 18, Councillor Rebecca Bligh will be introducing a motion called "Jumpstarting Rental Housing: Bold Action to Boost Rental Housing Construction in Tough Economic Times," which asks staff to "report back on options to design a program of tax abatement for projects that prioritize rental and below market rental units while deferring increases in property taxes for properties redeveloped for rental housing, holding the tax rate based on the assessed value prior to redevelopment, for a determined period."