After taking a breather during the height of the pandemic, it’s been full steam ahead for the Greater Toronto Area's condo market ever since.

Demand for condominium apartments -- both resale and new -- is up, with sales for both condo segments up notably year-over-year during the third quarter, according to industry leaders.

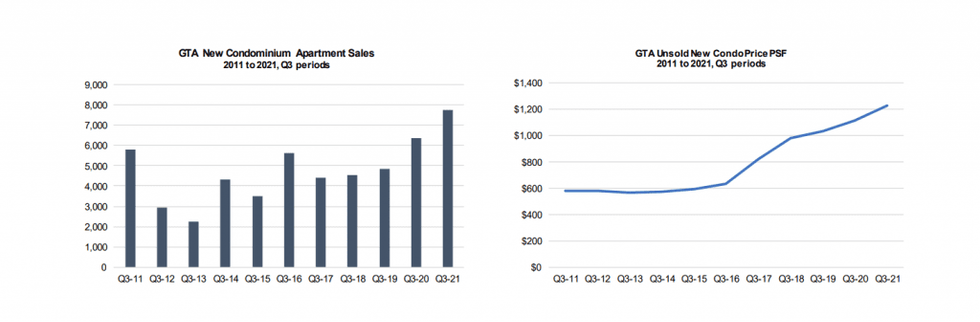

During Q3-2021, GTA realtors recorded 7,819 condominium apartment sales, a 10.6% year-over-year increase, according to the Toronto Regional Real Estate Board (TRREB). At the same time, Urbanation says new condominium apartment sales in the GTA totalled 7,773 units, increasing 22% year-over-year from the previous Q3 high in 2020 of 6,386.

However, as demand continues to pick up steam for both resale and new condos, buyers are eating up the available supply of listings, ultimately putting pressure on prices.

READ: Unattainable Detached Home Prices Bring the Canadian Condo Market Back to Life

Over the same period, TRREB said new listings were down by 31%, tightening conditions considerably over the past year, as competition increased between buyers. What's more, the board said the condo inventory that mounted during the initial phases of the pandemic has been more than absorbed, with listings down significantly compared to last year. As a result, the GTA condo market has returned to a seller's market.

Similarily, after fleeing the rental market, TRREB says renters have also returned, with the number of units leased increasing 15% while listings declined 30% during Q3-2021.

Kevin Crigger, TRREB president, says that the condo market has seen a "dramatic resurgence compared to a year ago."

“In 2020, first-time buyers sat on the sidelines due to economic uncertainty. This year, however, improving economic prospects have seen many of these buyers accelerate their searchfor a property. This trend will only continue as population growth resumes next year, and limited changes to supply are expected,” said Crigger.

Across the GTA new condominium market, unsold inventory also declined during the third quarter by 11% year-over-year to 11,955 units, and 16% below the 10-year average of 14,279 units.

When measured relative to the latest 12-month average sales, Urbanation says unsold inventory in Q3-2021 was equal to 5.4 months of supply, the lowest level since Q1-2018 and substantially below a balanced level of 10 months.

According to Urbanation, inventory was equal to 7.6 months in Toronto, compared to only 3.2 months in the 905 region of the GTA.

With demand strengthening and supply falling, prices rose. According to TRREB, the average selling price for Q3-2021 condominium apartment sales was $689,831 -- up 8.9% compared to the same quarter last year.

As for new condos, remaining new condominiums on the market in the GTA increased 10% year-over-year to a record high $1,231 psf, according to Urbanation. In Toronto prices were up 7% annually to $1,328 psf. Meanwhile, 905 region prices increased 17% from a year ago to $1,005 psf, marking the first time unsold average prices in the suburbs moved past the $1,000 psf threshold.

Rent prices are also seeing increases, with the price of a one-bedroom apartment averaging at $2,060 in the third quarter — a 2.4% increase over last year, while two-bedroom units rose 4% to $2,773.

Shaun Hildebrand, President of Urbanation, says presale condominium activity reached new highs during the summer as developers continued rolling out a large number of new launches to meet soaring demand.

However, with inventories declining further in the third quarter, Hildebrand expects that the momentum will likely sustain in the coming months.

"Although, high prices and greater prospects for interest rate increases may eventually start to weigh on demand, he added.

Looking ahead, TRREB Chief Market Analyst Jason Mercer says he expects that prices could increase more next year, especially if demand increases further due to the anticipated population growth.

“The condo market is catching up to the low-rise market segments in terms of market conditions. If demand continues to increase relative to supply, which is a distinct possibility assuming an acceleration in population growth over the next year, the annual rate of price growth could increase as we move into 2022,” said Mercer.

Mercer said he also believes that rental prices will accelerate as immigration resumes.