Title Search

Understand what a title search involves in Canadian real estate, why it's required before closing, and how it protects buyers from legal complications.

May 22, 2025

What is a Title Search?

A title search is the process of examining public records to verify the legal ownership of a property and identify any liens, claims, or encumbrances.

Why Do Title Searches Matter in Real Estate

In Canadian real estate, title searches are performed by lawyers or notaries as part of the closing process. They ensure the buyer receives clear title and that the seller has the legal right to transfer ownership.

A title search checks for:

- Registered property owners

- Outstanding mortgages or liens

- Easements or rights-of-way

- Court judgments or encumbrances

If any issues are found, they must be resolved before the property can be legally transferred. In many provinces, buyers also purchase title insurance as added protection.

A title search is critical for protecting the buyer from future legal disputes or financial loss related to hidden ownership issues.

Example of a Title Search

A title search reveals that a previous owner failed to discharge a mortgage. The seller resolves the issue before closing, ensuring the buyer receives clear title.

Key Takeaways

- Verifies ownership and property status.

- Identifies legal claims or debts.

- Required before property transfer.

- Conducted by lawyer or notary.

- Ensures buyer receives clear title.

Related Terms

- Title Insurance

- Real Estate Lawyer

- Lien

- Encumbrance

- Closing Process

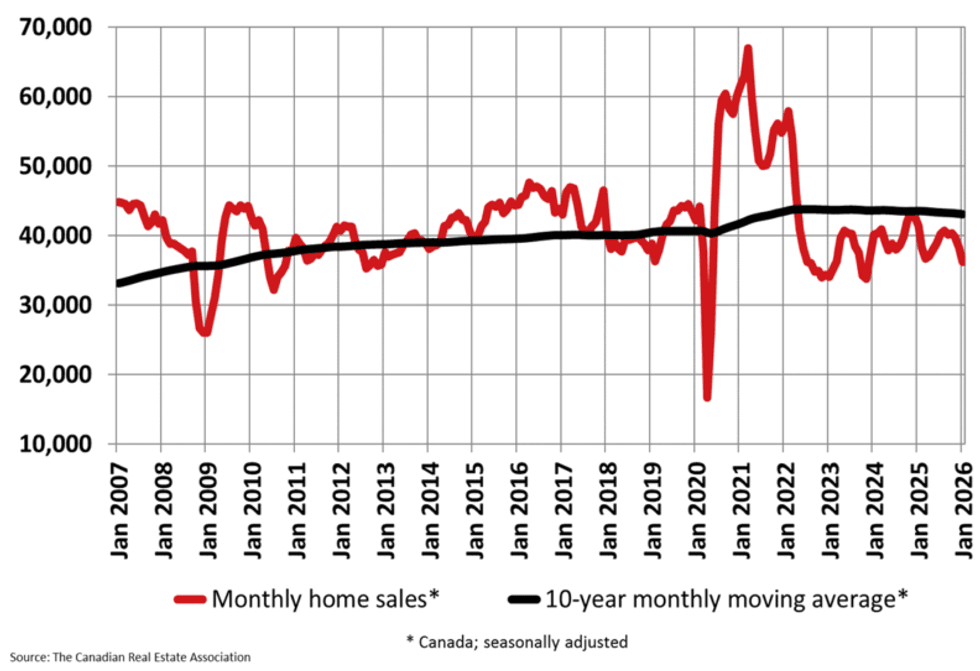

CREA

CREA

Liam Gill is a lawyer and tech entrepreneur who consults with Torontonians looking to convert under-densified properties. (More Neighbours Toronto)

Liam Gill is a lawyer and tech entrepreneur who consults with Torontonians looking to convert under-densified properties. (More Neighbours Toronto)

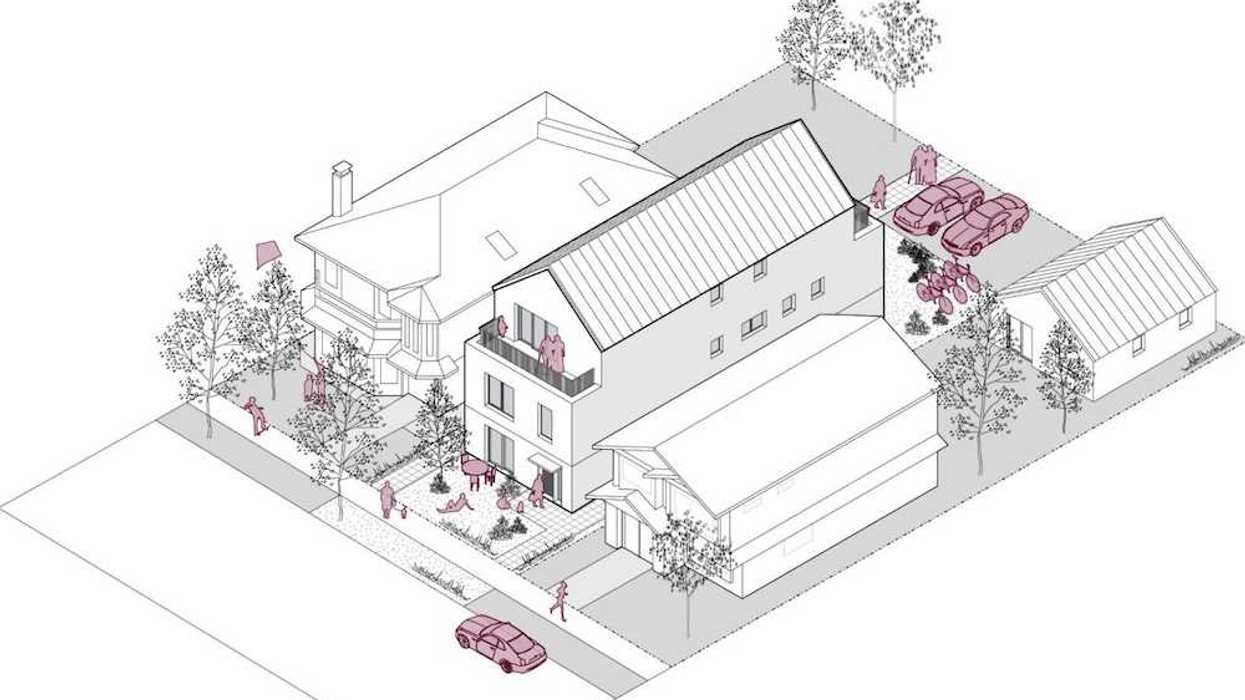

A rendering of the “BC Fourplex 01” concept from the Housing Design Catalogue. (CMHC)

A rendering of the “BC Fourplex 01” concept from the Housing Design Catalogue. (CMHC)

Rendering of 9 Shortt Street/CreateTO, Montgomery Sisam

Rendering of 9 Shortt Street/CreateTO, Montgomery Sisam Rendering of 1631 Queen Street/CreateTO, SVN Architects & Planners, Two Row Architect

Rendering of 1631 Queen Street/CreateTO, SVN Architects & Planners, Two Row Architect Rendering of 405 Sherbourne Street/Toronto Community Housing, Alison Brooks Architects, architectsAlliance

Rendering of 405 Sherbourne Street/Toronto Community Housing, Alison Brooks Architects, architectsAlliance