The impact of rising interest rates on the housing market is more evident than ever, as Canadian housing prices just dropped by the largest degree on record, on a monthly basis.

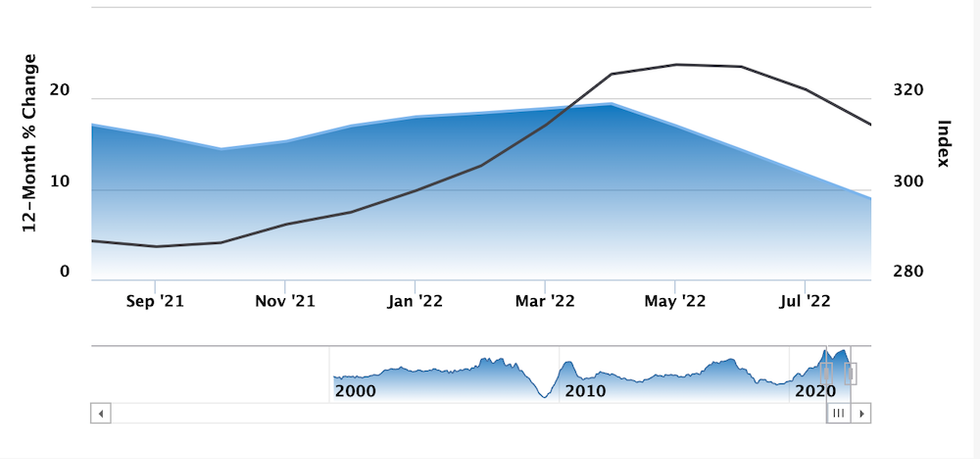

Data from the Teranet-National Bank Composite House Price Index, which compiles home prices in 11 CMAs around the country to independently determine average real estate price changes, fell 2.4% from July to August, the largest decline on record since the index was launched in 1999.

Accounting for seasonal adjustment, the drop came to 2.1%; that’s the fourth consecutive decline, with prices down in nine of the 11 markets tracked by Teranet with the largest drops recorded in Hamilton (-5.4%), Ottawa-Gatineau (-3.8%), Halifax (-3.6%), and Toronto (-3.5%). Alberta was a stronghold in terms of price stability with home values up in Calgary (+1.3%) and Edmonton (+2.8%). Teranet also notes steep declines in markets not included in its index, with Saint John (-7.8%), Brantford (-7.7%), Barrie (-6.7%), and Kitchener (-6.2%) feeling the heat.

While the index was still up on an annual basis by 8.9%, that also notes the fourth consecutive month of lower growth compared to the previous months. Year-over-year growth was strongest in Halifax, which rose 15.4%, followed by Victoria (+14.8%), and Calgary (+13.6%).

The Toronto price index fell 7.7% annually, and is also down 8.3% from what Teranet considers the city's market peak of May 2022. Vancouver prices are down 8.3% annually, and -4.06 from their market’s peak, which Teranet says occurred in April of this year.

READ: Home Prices to Fall Another 14% by 2023: RBC

The index’s record drop follows inflation data out this morning from Statistics Canada, revealing the housing market has cooled due to the Bank of Canada’s rate hikes, which it has aggressively implemented since March in efforts to calm inflation growth.

While the hikes seem to be having their intended effect, with inflation rising by just 7% in August, that in turn has pulled “owned accommodation expenses” in the real estate market down. The sale of real estate fell to 7.4%, compared to 9.7% in July, reports StatCan, while the homeowner’s replacement cost index, which reflects the price of new home developments, was also down, with 8.4% growth. “These movements reflect a general cooling of the housing market,” StatCan writes.

The latest report from the Canadian Real Estate Association also revealed a steep drop in homebuyer demand, with sales down for the sixth consecutive month in August, and the average national home price down nearly $180,000 from this past February.