The pace of inflation has chilled for the second month in a row, indicating that aggressive monetary policy measures may be having their intended effect.

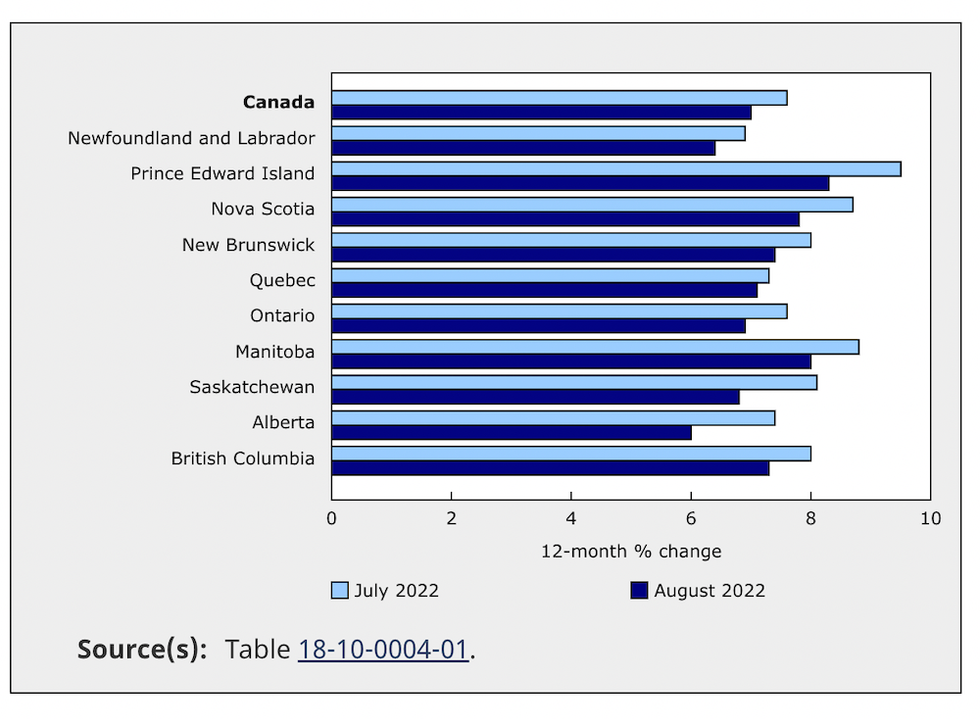

According to Statistics Canada (StatCan), the Consumer Price Index (CPI) rose 7% annually in August, down from 7.6% growth recorded in July. The slowdown was largely due to lower gas prices last month. However, even excluding cheaper prices at the pump, prices rose 6.3% year over year, down from their pace of 6.6% last month -- the first month since June 2021 that the YoY CPI excluding gasoline has slowed.

From a monthly perspective, the CPI inched down 0.2% in August from July -- the largest monthly decline seen since the early days of the pandemic.

Prices for transportation, which rose 10.3%, and shelter (+6.6%), drove the bulk of decelerating inflation; Canadians are still staring down high grocery bills, though, with prices for food purchased from stores up 10.8%, the fastest pace since August 1981.

However, steep inflation has yet to turn up in wage growth, with the hourly average rising 5.4% YoY. And, while prices increasing more than wages means Canadians are experiencing a decline in purchasing power, the gap was smaller than in the previous month, points out StatCan.

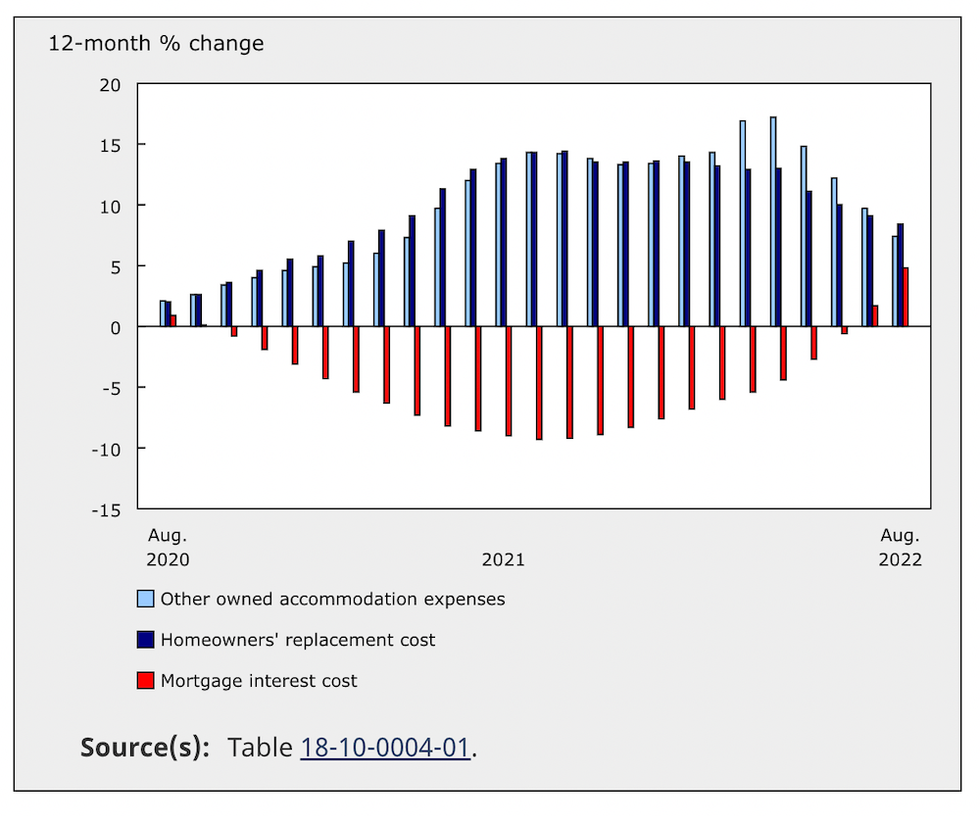

That higher interest rates are making their intended dent in inflation is evident in the slowing housing market; in addition to smaller annual growth in shelter prices, other “owned accommodation expenses”, such as the sale of real estate, fell to 7.4%, compared to 9.7% in July. The homeowner’s replacement cost index -- which captures the price of new home developments, was also down, with 8.4% growth. “These movements reflect a general cooling of the housing market,” StatCan writes.

In contrast, the mortgage interest cost index rose at a faster rate (+4.8%) than in July, when it grew just 1.7%. That's the fastest pace since January 2020, and is the direct result of the Bank of Canada’s rate recent rate increases, and elevated bond yields, which have pushed up prices for fixed-rate mortgage products.

The central bank has increased its trend-setting Overnight Lending Rate five times since March, bringing it from the pandemic-low of 0.25%, to 3.25% today. That’s materially increased debt servicing costs for homeowners, who are simultaneously juggling higher consumer prices from the very inflation the BoC has been raising rate to combat.

READ: Home Prices to Fall Another 14% by 2023: RBC

However, the BoC may have just been granted some breathing room by August’s lower reading, which could lead to a lighter touch on rates in their next announcement in October. However, interest rates are still set to rise further before the central bank is through.

“Policymakers will breathe a modest sigh of relief, though they're miles from being out of the woods with inflation still nowhere near target,” writes Benjamin Reitzes, BMO’s Managing Director of Canadian Rates and Macro Strategist of Fixed Income Strategy.

“This is about as good of an inflation report as we can hope for, especially after the strong US figures out last week. The slowdown in the headline and all three core inflation metrics is a clear positive. Unfortunately, inflation remains far too high, and the breadth of price increases hasn't backed off much, if at all. Nonetheless, the path to tamer inflation is going to be long and winding, and this is a step in that direction. While there's still plenty of data to go before the next Bank of Canada policy decision, today's number will, for now, limit how much further tightening the market prices.”