Short-Term Financing

Explore short-term financing in Canadian real estate, how it works, who uses it, and why it's critical for bridging timing or funding gaps.

May 22, 2025

What is Short-Term Financing?

Short-term financing refers to temporary loans or credit with repayment periods under 12 months, used to address immediate real estate funding needs.

Why does Short-Term Financing Matter in Real Estate?

In Canadian real estate, short-term financing is used when buyers face timing gaps — such as needing a down payment before selling a current home, or funding renovations prior to refinancing.Common types include:

- Bridge loans

- Private lending arrangements

- Construction loans

Short-term financing is useful in competitive markets and for investors or developers who need flexibility and speed to close deals.

Understanding this tool helps buyers take advantage of time-sensitive opportunities without long-term financial commitment.

Example of Short-Term Financing in Action

A developer uses a six-month private loan to fund renovations before applying for a mortgage refinance.

Key Takeaways

- Loans repaid in less than 12 months.

- Used for bridging, renovations, or fast closes.

- Higher cost, faster access.

- Often repaid after sale or refinance.

- Valuable in competitive or time-sensitive situations.

Related Terms

- Bridge Financing

- Bridge Loan

- Private Lending

- Down Payment

- Refinance

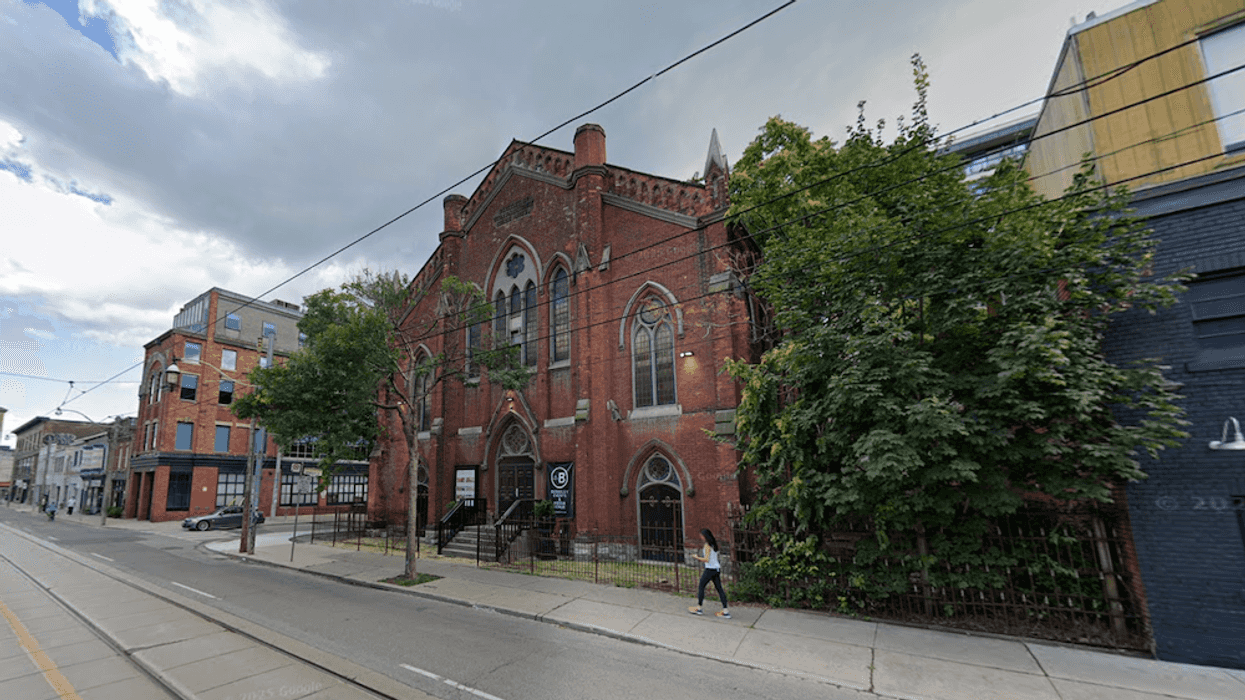

205 Queen Street, Brampton/Hazelview

205 Queen Street, Brampton/Hazelview

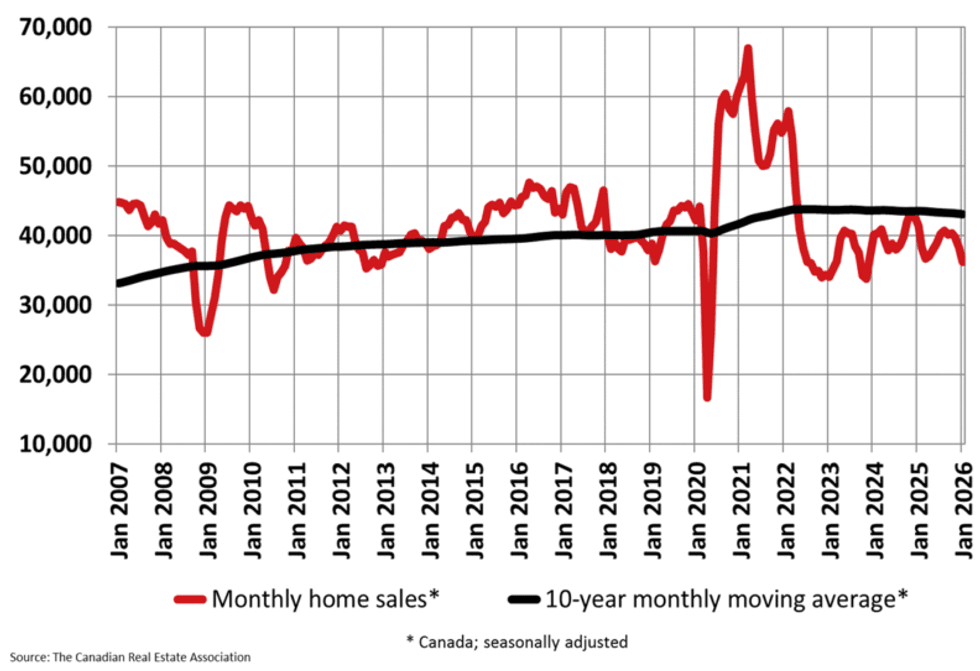

CREA

CREA

Liam Gill is a lawyer and tech entrepreneur who consults with Torontonians looking to convert under-densified properties. (More Neighbours Toronto)

Liam Gill is a lawyer and tech entrepreneur who consults with Torontonians looking to convert under-densified properties. (More Neighbours Toronto)

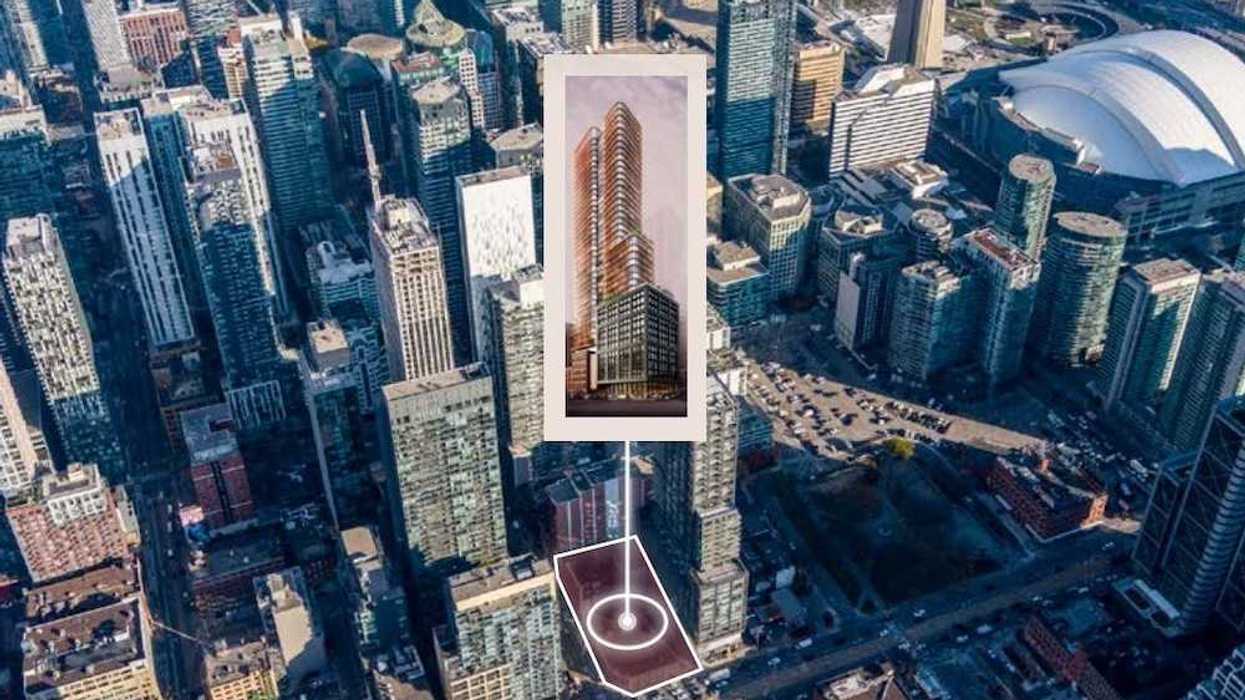

401-415 King Street West. (JLL)

401-415 King Street West. (JLL)

Eric Lombardi at an event for Build Toronto, which is the first municipal project of Build Canada. Lombardi became chair of Build Toronto in September 2025.

Eric Lombardi at an event for Build Toronto, which is the first municipal project of Build Canada. Lombardi became chair of Build Toronto in September 2025.